PHOTO

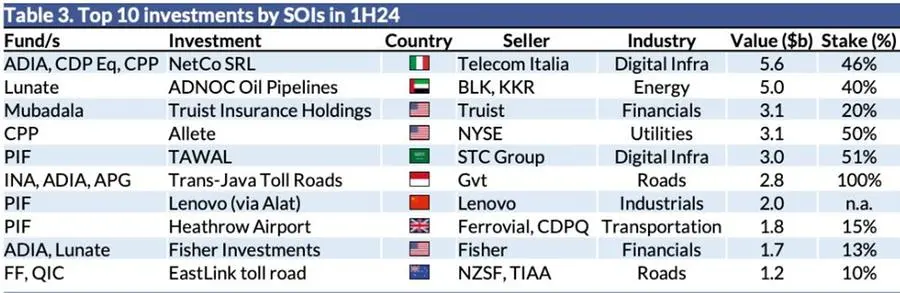

The first six months of 2024 saw 27 mega-deals, which are deals of more than $1 billion in value invested or divested by sovereign investors.

Investments in H1 2024 are led by the top sovereign wealth funds in the Middle East, which invested $ 38.2 billion in 58 different deals, according to industry tracker Global SWF.

The amount invested by the ‘Oil Five’ - Saudi’s PIF, Abu Dhabi’s ADIA, Mubadala and ADQ, and Qatar’s QIA - is more than double of what the ‘Maple Eight’ (largest Canadian funds) deployed and almost eight times what the Singaporean funds spent, data from Global SWF’s Governance, Sustainability and Resilience (GSR) scorecard revealed.

Watch the Zawya video here.

While the market uncertainty has invited global funds to be cautious, Gulf-based and particularly, Abu Dhabi-based funds, have received significant windfall from oil and are more active than ever.

The pressure of sustainability goals at organization level is impacting the preferences of state-owned investors (SOIs).

"In 2021, we saw for the first-time investments in green assets, mostly renewable energy beating investments in black assets mostly, oil and gas and mining. This trend has persisted during 2022, 2023, and the first half of 2024," said, Diego López, Founder and Managing Director of Global SWF.

"The buy-back of 40% of ADNOC Oil Pipelines by ADQ-backed Lunate was important and could have reversed the trend, but we saw significant activity in green investments, too," he added.

The latter included Mubadala’s investments in Australian, Indian and Japanese renewable energy, NBIM’s investments in British and Spanish wind and solar farms, and ISIF’s commitments into various regional funds and entities focused on impact and sustainability.

China focus

During the first half of 2024, sovereign investors have continued to debate geopolitical considerations and their exposure to China, with two opposite views: most Western funds are bearish, while Eastern funds are bullish.

Gulf SWFs are still interested in China: Mubadala re-opened its Beijing office in 2023 to manage its $10 billion JV with SAFE and CDB, and ADQ helped finance CYVN (ADDoF)’s $3.3 billion investment in EV NIO.

But they also see the value of the USA in their portfolios and may start conceding in sensitive sectors such as AI.

The GSR Scoreboard analyses practices and efforts of the world’s major State-Owned Investors (SOIs), including Sovereign Wealth Funds (SWFs) and Public Pension Funds (PPFs).

(Reporting by Seban Scaria; editing by Daniel Luiz)

(seban.scaria@lseg.com)