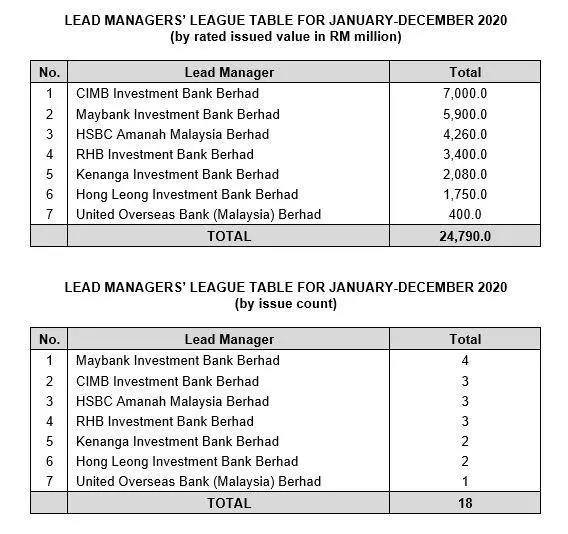

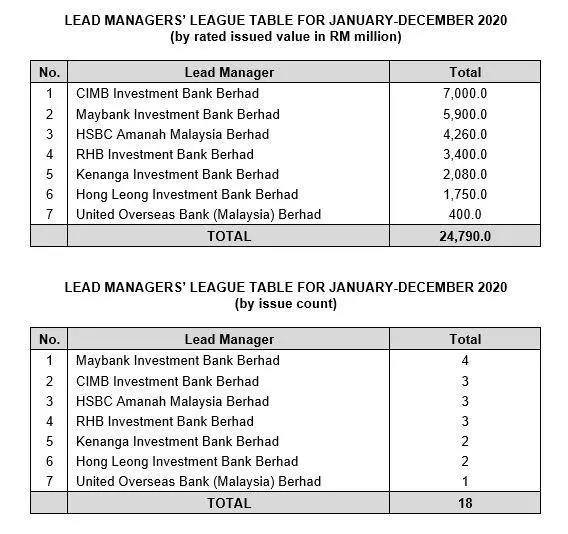

Malaysian Rating Corporation Berhad (MARC) has published its 2020 Lead Managers’ League Tables. Published annually, the league tables rank the lead managers by volume and number of lead-arranged MARC-rated issuances in any given year. MARC’s Lead Managers’ League Tables provide a meaningful measure of domestic bond issuances rated by MARC given that only issuances which have attained financial close are included.

CIMB Investment Bank Berhad topped the issued value league table of MARC-rated debt and sukuk programmes/issuances, with Maybank Investment Bank Berhad coming in second and HSBC Amanah Malaysia Berhad in third place.

The issue count league table of MARC-rated debt and sukuk programmes/issuances was headed by Maybank Investment Bank Berhad. Coming in second were CIMB Investment Bank Berhad, HSBC Amanah Malaysia Berhad and RHB Investment Bank Berhad.

Details of MARC’s 2020 League Tables are as follows:

Note:

Rated issued value credit is given to lead managers based on the programme-specific arrangements between lead arrangers for jointly arranged programmes. Equal issue count credit is given to lead managers for jointly arranged programmes.

Notable corporates which were involved in deals rated by MARC were recognised in separate categories. Sime Darby Property Berhad was honoured with MARC’s Sustainability Award 2020 in recognition of its effective sustainability governance structure and processes for measuring, managing and reporting of its sustainability impact. Meanwhile, National Cancer Council Malaysia was the winner of MARC’s Transparency Award 2020 for its contribution to promoting transparency among non-profit organisations.

The Project Financing Award 2020 was awarded to Pengerang LNG (Two) Sdn Bhd given its critical role in the development of the country’s gas industry whereas Leader Energy Sdn Bhd was the recipient of the Green Project Finance Award 2020 in view of its commitment towards providing clean energy by way of its power plants.

Noteworthy deals rated by MARC in 2020 included Malaysian Resources Corporation Berhad’s Sukuk Murabahah Programme of up to RM5.0 billion, Bank Pembangunan Malaysia Berhad’s RM5.0 billion Islamic Medium-Term Notes and OSK Rated Bond Sdn Bhd’s Sukuk Murabahah Programme with a combined limit of up to RM2.0 billion. MARC also rated the RM1.9 billion Sukuk Murabahah Programme by Pelabuhan Tanjung Pelepas Sdn Bhd.

Contacts:

Lalitha Sivanesan, +603-2717 2953/ lalitha@marc.com.my

Nurfarain Mohd Dom, +603-2717 2925/ farah@marc.com.my

© Press Release 2021

Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.