Abu Dhabi Commercial Bank (ADCB), the emirate’s second largest bank, and Union National Bank surged in early trading on the Abu Dhabi stock market, following confirmation the lenders were in talks to merge.

ADCB announced in a statement issued to the Abu Dhabi Securities Exchange late on Monday it had started “exploratory talks regarding a potential merger with Union National Bank”.

The bank added that “similar and separate discussions have also commenced with the shareholders of Al Hilal Bank.”

Union National Bank (UNB) confirmed in another statement to the exchange the preliminary merger talks.

National Bank of Abu Dhabi (NBAD) and First Gulf Bank (FGB) merged in 2017 to create First Abu Dhabi Bank, which paved the way for further consolidation in the banking sector, according to analysts.

“When NBAD and FGB were merging we anticipated that we would see other mergers taking place in the UAE [United Arab Emirates],” Marie Salem, head of capital markets at FFA Private Bank (Dubai) Limited, told Zawya.

“Over the past 10 years, there had been similar rumours, twice to be precise, which were both categorically denied by the management. However this time both ADCB and UNB have confirmed the news of exploratory talks about the merger in their press release. We believe the fairly smooth transition of FGB-NBAD merger has given confidence to the shareholders to now closely explore this deal,” SICO bank told its clients in a note seen by Zawya.

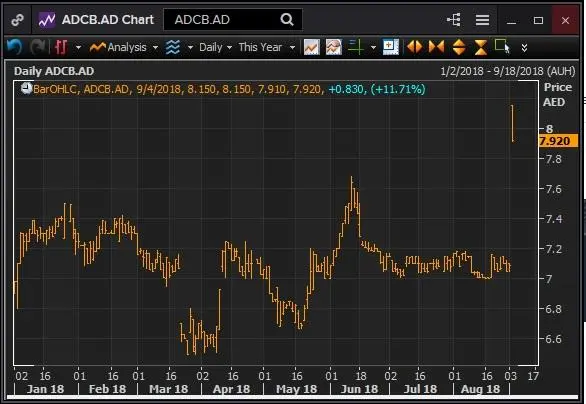

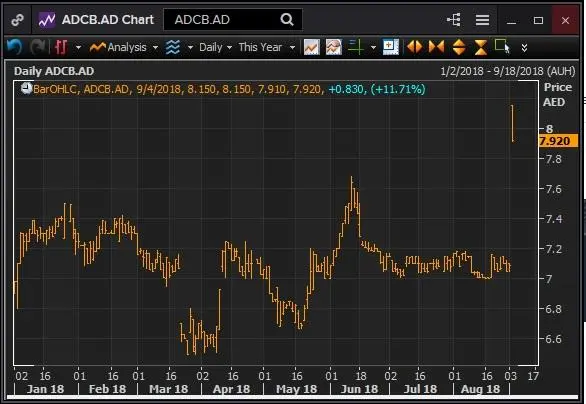

ADCB was trading 12.83 percent higher on Tuesday by 12:55 pm UAE time, while the bank is up 17.65 percent so far this year. UNB was trading at 14.78 percent high on Tuesday, while it is up 16.58 percent so far this year.

Abu Dhabi’s market index was trading near 1.09 percent at 12:55 pm UAE time, boosted by the surge in the share prices of ADCB and UNB.

The Abu Dhabi government fully owns unlisted Al Hilal Bank and owns a majority in both ADCB and UNB.

“Considering it is a 3-way deal with the same primary owner, it is likely to be a share-swap with both UNB and Al Hilal getting shares of ADCB. As Al Hilal Bank is not listed, we expect the banks to be individually valued and the swap price decided accordingly,” according to the SICO note.

“Although it is difficult to forecast the swap ratio, our preliminary analysis suggests: 0.6/shares of ADCB for every share of UNB,” the note adds.

“The primary concern on the deal would revolve around the asset quality of the entities. As per the latest reported financials (2017), Al Hilal has a NPL ratio of 9.7 percent and similar amount of past due loans. We believe that will be taken into consideration to arrive at the swap ratio. UNB in 2Q18 reported improvement in asset quality.”

ADCB had reported a 12 percent rise in its 2018 second-quarter net profit (click here for the full story), while UNB’s second quarter net profit slid 18 percent. Al Hilal Bank had reported Q2 net profit had increased 32.6 percent.

“I think with the current low volumes and liquidity in the markets the effect of the news will be very quick and it will not have the impact that such a big announcement is expected to have in the markets,” Salem said.

“UNB is currently trading below its book value whereas ADCB is trading above its book value. Given that, it is clear that the shareholders of UNB are most likely to benefit from that merger in case it happens,” she added.

(Reporting by Gerard Aoun; Editing by Shane McGinley)

(gerard.aoun@thomsonreuters.com)

© ZAWYA 2018