PHOTO

Business activity remains tepid and exports have fallen.

Egypt's economy has yet to fire on all cylinders, but should gather steam in the second half of the year as investments pick up, according to analysts.

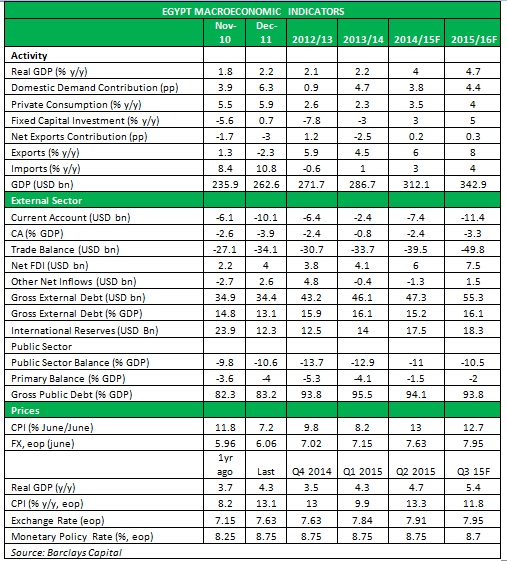

Egypt's economy grew only 3% in the first quarter of 2015 due to weaker exports and the stock market is down nearly 12% this year, recording sharp losses in the last week on foreign exchange and energy shortages as well as a string of attacks by Islamist militants in the Sinai Peninsula.

The Egyptian economy had grown 4.3% in the fourth quarter of 2014 and 6.8% in the third quarter, according to official data. The government has said it expects the economy to grow 5% in 2016, but that could prove difficult given that economic indicators are flagging.

The services sector enjoyed a USD 4.2 billion surplus during the first nine months of the fiscal year that ended on June 30, 2015, led by tourism receipts, but exports continue to retreat, falling 22.7% year-on-year during the same period. Petroleum exports also contracted for a fifth consecutive quarter.

"The drag from falling exports that is affecting GDP growth is also weighing on Egypt's external balances," Barclays Capital said in a report. "Recent balance of payment data also reveals a mixed picture."

The country's central bank recently allowed the Egyptian pound to depreciate in its official foreign exchange auctions in the hopes of boosting exports and attracting further investment.

Although public investment spending rose 30% in the first 10 months of the 2014/2015 fiscal year, business activity has been contracting. The Purchasing Managers' Index, excluding oil, grew slightly in June for the first time in five months, rising to 50.2 from 49.9 the previous month.

Barclays said the disbursement of about USD 6 billion of Gulf Arab financial support from April should bring the current account deficit for the fiscal year ending 30 June 2014, to about USD 7.4 billion -- or -2.4 percent of GDP, higher than its previous deficit forecast of 0.8 percent.

POLICY "SLIPPAGE"

Foreign direct investment flows, which doubled to USD 5.5 billion during the first nine months of the 2014/15 fiscal year, have helped prop up finances. Other multilateral and bilateral disbursements and a newly issued Eurobond for USD 1.5 billion in early June is also expected to help bridge external financing needs and maintain foreign currency reserves.

Egypt's central bank said on Tuesday that foreign currency reserves rose to USD 20.08 billion at the end of June from USD 19.56 billion the previous month. It said domestic debt reached EGP 2.016 trillion (USD 261 billion) in the third quarter while external debt stood at USD 39.9 billion.

The World Bank has warned that the country's budget deficit and debt aggregates remain "high and unsustainable".

The Egyptian government has been trying to cuts its deficit, while moving to restore the country's economy. The state's revised draft budget for the 2015/2016 fiscal year that started on July 1 cut the projected deficit to 8.9% of gross domestic product, from a previously forecast 9.9%.

The new draft projects public expenditure at EGP 864 billion, of which EGP 429 billion was allocated for social programs, according to a Reuters report. Projected tax revenue was revised slightly upwards to EGP 422.3 billion.

As part of its reform program, the government plans to boost revenues through taxation, including introducing value-added taxes, and to cut expenditure by reducing subsidies on energy and petroleum products.

But analysts expect the authorities to wait for parliamentary elections before implementing unpopular reforms.

"The opportunity of having a new parliament and a new government by year-end to help shoulder responsibility, along with the president, for the difficult policy reforms to come may be another motivation for the delays, in our view," Barclays said.

The World Bank has warned of a risk of "policy slippage" since the details and exact timing of some announced policies were still missing and there was also concern on whether Egypt had the capacity to implement them.

"Egypt's main risk and priority is to sustain and enhance the economic recovery, which requires improved security conditions and steadfast reform implementation," said the World Bank in a recent report.

"Sustaining the reform pace requires efficient and well-targeted safety nets, which might take time to build. Finally, there is significant uncertainty regarding the financing of the announced mega-projects, and the potential contingent liabilities that may arise."

The feature was produced by alifarabia.com exclusively for zawya.com.

Zawya 2015