PHOTO

Saudi Arabia is on track to hit a target of increasing its Public Investment Fund (PIF) in size to $400 billion in 2020, with the Institute of International Finance (IIF) estimating that it currently has about $300 billion worth of assets.

In a note published on Thursday, IIF said that a key part of Saudi Arabia's Vision 2030 economic diversification plan involved “the transformation of the PIF from a state holding company into one of the world’s largest sovereign investment vehicles”, with a proposal to grow assets to $400 billion by 2020 and $2 trillion by 2030.

“We now estimate PIF’s assets at about $300 billion, of which one-fourth are invested abroad,” it said, citing stakes the fund has taken in Softbank's Vision Fund, electric car maker Tesla, ride hailing firm Uber, Blackstone's infrastructure funds and investment funds in Russia and Egypt.

“Proceeds from privatisation (a target of about $200 billion) and the eventual 5 percent sale of Aramco (a target of $100 billion) will further boost the PIF’s assets,” IIF's note said.

The initial public offering (IPO) of a 5 percent stake in state-owned oil giant Saudi Aramco was meant to be the first major step towards boosting PIF's coffers, but it was delayed as the Saudi government instead sought to have the state-owned oil firm acquire PIF's 70 percent stake in petrochemicals giant Saudi Basic Industries, creating an enlarged upstream and downstream energy giant before a proposed listing. Read more here

Saudi Aramco also launched its debut bond offer in April this year to help finance the $69 billion deal, which the IIF said should complete before mid-2020. Read more here

However, it added that "several regulatory procedures need to be addressed before proceeding with the 5 percent sale of Aramco". It also said that the kingdom's privatisation efforts have thus far been delayed as a result of “legal impediments and concerns about implications for the labour market”.

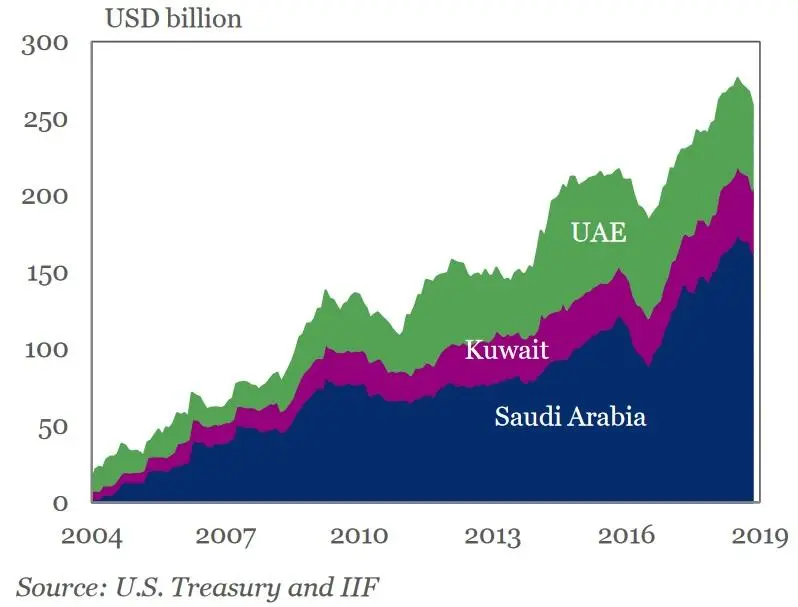

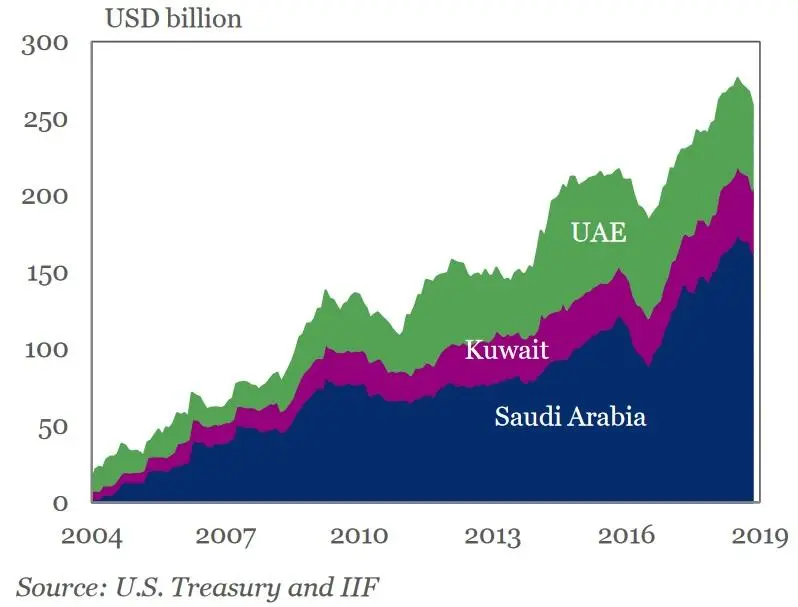

GCC countries’ ownership of US treasuries

PIF's transformation towards a sovereign wealth fund has contributed towards continued capital outflows in the kingdom, IIF's note said, as it seeks higher returns from riskier assets. Both PIF and the General Organization for Social Insurance have reduced holdings in euros and UK pounds, the note said, in favour of investment in higher-yielding United States treasuries.

“While Saudi Arabia’s official reserves have declined since 2014, the kingdom’s holdings of U.S. government bonds climbed to a peak of $170 billion in March 2019,” it said.

A report published by Riyadh-based Jadwa Investment last month stated that foreign reserves held by the kingdom's central bank, the Saudi Arabian Monetary Authority, increased by $5.5 billion in April, hitting a total of $505 billion.

(Writing by Michael Fahy; Editing by Mily Chakrabarty)

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2019