PHOTO

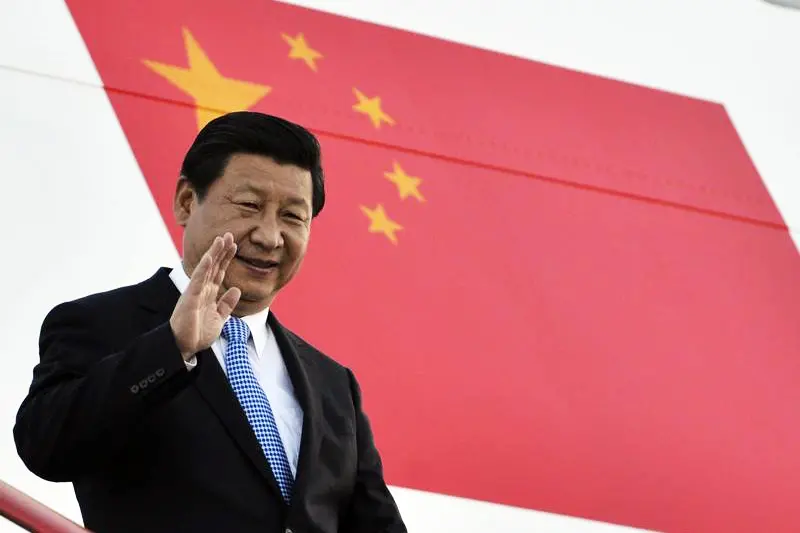

In 2013, Chinese President Xi Jinping unveiled the Silk Road Economic Belt and the 21st-century Maritime Silk Road initiative now known as One Belt One Road, (OBOR) in order to actively develop connectivity and economic cooperation with countries mainly between China and Eurasia. The initiative aims to build a community of shared interests, destiny and responsibility with mutual political trust, economic integration and cultural inclusiveness. Initiating investment and developing economic trade communications with Islamic countries is one of important components of the OBOR strategy and this is detailed in the "Vision and Actions on jointly building the Silk Road Economic Belt and 21st-century Maritime Silk Road" published by the government on 28th March, 2015 ("Vision and Actions").

Compared to traditional financial products, Islamic finance has developed significantly due to its high flexibility of business, low risk, low debt requirements and the need to use real estate as collateral. In 2014, Sharia compliant financial institutions represented approximately 1% of total world assets, at around US$2 trillion. The latest study shows that, by 2020, the value of the global Islamic financial market will rise to US$3.25 trillion.

Financial integration is one of the key areas of cooperation set out in the Vision and Actions. The Chinese government emphasises that financial integration is a crucial element in the construction of the OBOR and has decided to speed up the incorporation and operation of the Silk Road fund. Proposals to strengthen the practical cooperation of China-ASEAN Interbank Association and to carry out multilateral financial cooperation in the form of syndicated loans and bank credit has also been completed. Qualified Chinese financial institutions and companies are encouraged to issue bonds in both Renminbi and foreign currencies outside China, and use the funds raised to invest in countries along the OBOR.

As background to the strategic execution of the OBOR, State Owned and private enterprises in China are also trying to make use of Islamic finance, as against traditional finance, to serve their own overseas development. Chinese banks are strengthening their cooperation with Muslim countries, and are busy developing their overseas business and outbound investment. Islamic finance is rapidly becoming an established channel for China to enlarge its overseas economic influence.

Issuing Islamic securities is an important mechanism for Chinese enterprises to raise funds and expand in Muslim countries. Although Islamic finance does not offer interest, there are still opportunities to ensure financial benefits and remuneration primarily through issuing Islamic securities (Sukuk). Investors who purchase such securities would not obtain interest as an income; however, they could be given remuneration in terms of investment gains.

It has been reported that a High Speed Rail project in China is considering using Islamic securities to raise a fund for almost 30 billion Chinese yuan (US$4.7billion). If successful, this would be one of the largest Islamic securities fund ever raised.

In addition, Hainan Airlines Group is planning to raise US$150 million for ship purchasing, and this could be the first such deal to be approved by the Islamic finance authorities. Hainan is also planning to raise offshore Islamic securities. Some large banks in China have been raising their influence in the Gulf countries indeed, three of these banks issued traditional securities on NASDAQ Dubai, while others are in the planning stages.

Country Garden, the Chinese mainland real estate agents announced their intention in October 2015 to issue Islamic medium-term notes with a nominal value of MYR1.5 billion (US$340million) through their wholly-owned subsidiary in Malaysia. This is the first case of the Chinese real estate sector raising funds offshore through Islamic finance mechanisms.

Apart from issuing Islamic securities, local Chinese government authorities and enterprises who need to raise funds will do so in Islamic countries with substantial oil capital, fundamental infrastructure and energy projects such as coal, chemicals, wind power and solar generation. These are in compliance with the investment preference of the Islamic finance system on projects with long term, low risk, steady income and the "Go Abroad" strategy of Islamic countries as part of their financial globalization. This has highlighted efforts through the promotion of local development of China to absorb foreign investment and maintain local stability.

However, we must also note that due to the characteristic of Islamic finance, and how it differs from traditional finance, there are numerous difficulties and challenges Chinese enterprises would have to face when using this structure. Unfamiliarity with the Islamic finance process is the prime issue for Chinese enterprises compared with traditional finance. Islamic finance, as a special financing system, has to follow the teachings of Islam, and as such certain areas are forbidden including the payment of interest, speculation, investments in alcohol and gambling, and both risk and interest share. In order to fully use Islamic finance, Chinese enterprises must learn the fundamental system and regulation that govern this financing mechanism and understand it business practices

Constraints on current policies and systems also have an impact on China's development of Islamic finance. In 2009, the Bank of Ningxia was approved as a trial centre for Islamic banking business, and is the first bank in China to do so. There was a further suggestion that Ningxia could be developed as a pilot region of financial cooperation between China and the Gulf states, becoming the Islamic finance centre of China, like Dubai in the Gulf and Kuala Lumpur in Malaysia, however, this has not yet been finalised by the government. One likely reason for this is the unique nature of Islamic finance which makes it very difficult to merge into the current financing management system in China. Under the OBOR, China is considering using Islamic finance as a breakthrough to initiate extensive business communication and project cooperation in many areas with Middle East and South East Asian countries. It is considering opening outbound Islamic financing institutions, and participating in the investment in these regions or developing enterprises which operate through Islamic financing products. This is not only safer for funds and better for comprehensive income, but also improves the long term benefits.

Following the initiation of the OBOR it is now developing the practical stages, and there will be a significant increase in the use of Islamic financing tools and investment in major construction projects. If the Chinese government could enhance its cooperation with Muslim countries through Islamic finance, that it will significantly progress the development of the Silk Road project.

About Mr Du, Baozhong

Mr. Du is a senior legal counsel in the Beijing office of Yingke Law Firm. After graduating from China University of Political Science and Law with a master degree, he had been working for the Department of Treaty and Law in China's Ministry of Commerce for 13 years, and was engaged in legal consulting work in a large-scaled state-owned enterprise. Mr. Du, as the delegation member of Chinese Government, has participated in the working group meetings held by the Commission on International Trade of the United Nations several times, and addressed as the Chinese representative on meetings of OECD and APEC. He is specialized in foreign direct investment, outbound investment, international trade, private equity, venture capital, mergers and acquisitions, foreign-related arbitration, labor law, etc.

About Ms. Li, Xuan

Ms. Li is working as a trainee in the International Legal Affairs Department of the Beijing office of Yingke Law Firm, and also acts as the coordinator of Yingke Brussels Office. After graduating from Dalian Maritime University with a bachelor degree in Maritime Law, and a LLM Maritime Law degree at Bentham House, Faculty of Laws, University College London. She used to work in-house in an international shipping company, responsible for marine insurance and admiralty laws. While working in the UK, she served as the assistant analyst for hedge funds at Thomson Reuters London. Her specialisations are maritime law, international trade law and international arbitration.

© Business Islamica 2016