PHOTO

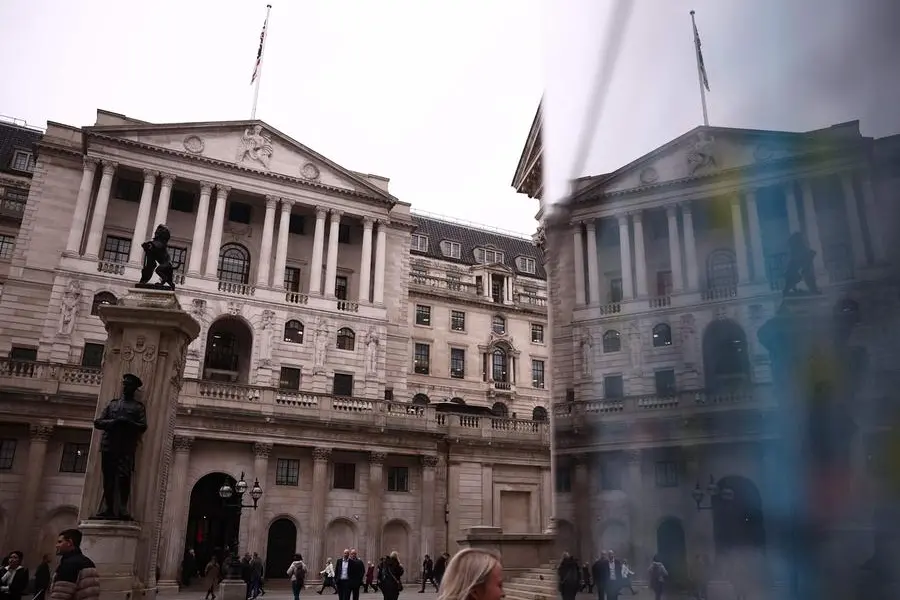

The Bank of England today reduced interest rates by 25bps to 4.75% saying UK inflation is now close to the 2% target. It marks the apex bank’s second such reduction in 2024, after it began its easing cycle in August.

Despite bond market volatility following new Labour Chancellor Rachel Reeves’ first budget last week, which included £40 billion ($52 billion) in tax increases, the bank went ahead with a widely anticipated cut.

Interest rates will continue to fall gradually if things evolve as expected, the bank said, adding that inflation is likely to rise to around 2.75% over the next year as household energy prices provide less of a drag than in recent months. It is expected to fall back to 2% after that.

“We can’t rule out more global shocks that keep inflation high. For example, developments in the Middle East could increase inflation by causing oil prices to rise.” Bank of England said in a statement.

Neal Keane, head of global sales trading at ADSS, said the bank faced the dilemma of two opposing trends - falling inflation supporting rate cuts, and last week's budget signaling higher government spending, with the office of budget responsibility (OBR) expecting policy changes to boost demand by 0.6%.

The BoE may therefore elect to leave rates unchanged in December unless there is a significant fall off in data over the next month, Keane said.

(Writing by Imogen Lillywhite; editing by Seban Scaria)