PHOTO

The region’s biggest smartphone seller, Samsung, is losing its market share, as more consumers are opting for affordable handsets, according to a new report on Monday.

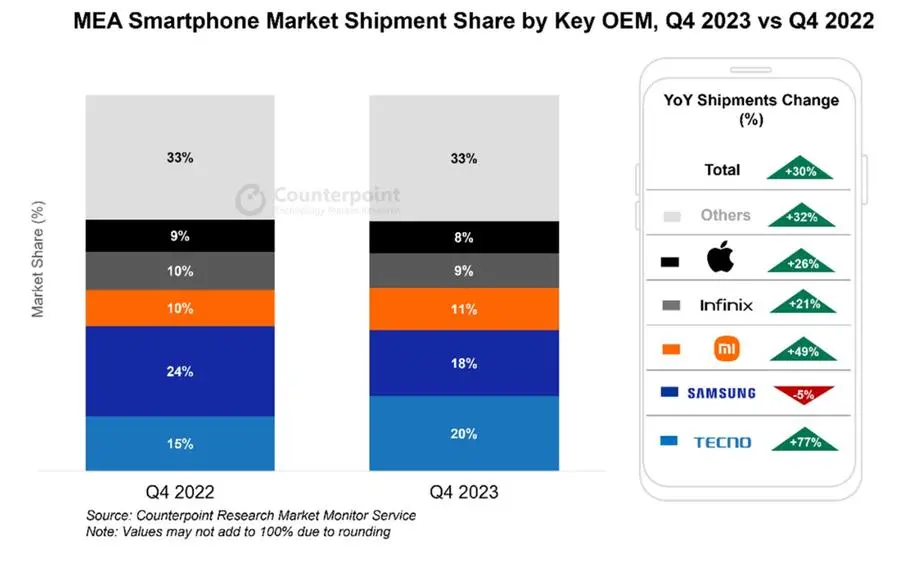

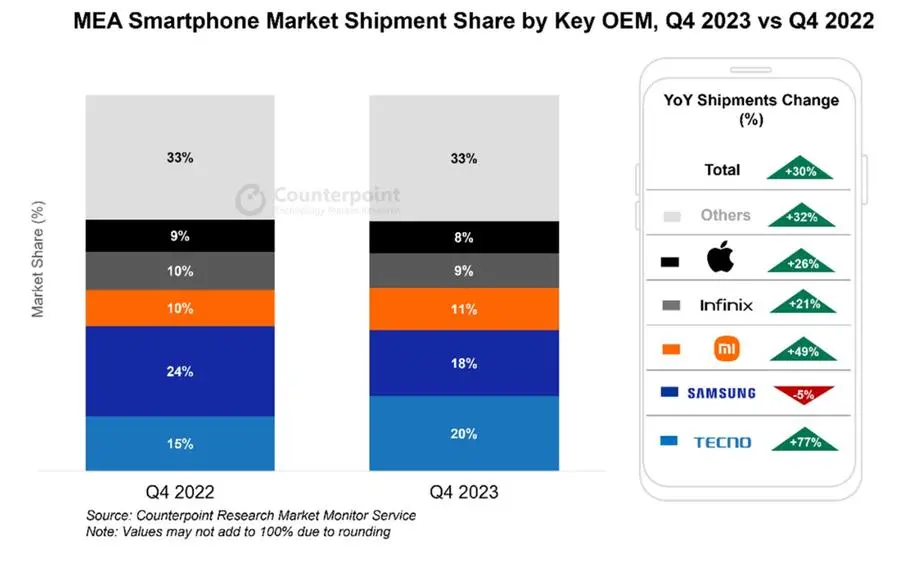

As of the fourth quarter of 2024, Chinese firm Transsion Group’s Tecno-branded phones dominated the growth in gadget sales in the Middle East and Africa (MEA) market, with an increase of more than three quarters in smartphone shipments, surpassing Samsung for the first time, the latest data from Counterpoint’s Market Monitor Service showed.

“Tecno grew 77% YoY in Q4, surpassing Samsung to lead the market for the first time,” the report said.

“This lead was mainly driven by the $150 price band, which grew by 68% YoY for Tecno, with models like Tecno Pop7 and Camon 20 Pro receiving good response from consumers,” the report said.

In terms of market share during the fourth quarter, Tecno led the table with 20%, up from the previous year’s 15%. Samsung came second with an 18% share, down from 24% in the fourth quarter of 2022, followed by Xiaomi (11%) and Apple (9%).

Overall, mobile phone sales in the Middle East and Africa (MEA) grew, supported by strong demand for 5G technology.

Total smartphone shipments in the region went up by 30% year-on-year in the fourth quarter of 2023. During the period, 5G shipments surged by 60%, mainly driven by Samsung and Apple gadgets.

For the full year 2023, smartphone shipments grew by 11% year-on-year, reflecting a steady improvement in consumer sentiment throughout the year amid easing inflation and stabilising local currencies, the report said.

“MEA experienced remarkable growth, outpacing other regions due to the strong momentum since Q2 2023, as economies steadily recovered,” said Yang Wang, Senior Analyst at Counterpoint Research.

“The popularity of smartphones, proliferation of digital services like mobile money and social media, big infrastructure projects and the expansion of services sectors also proved to be key catalysts.”

The report noted that there has been a rapid growth in the adoption of 5G technology over the past few years.

It attributed the 60% growth in 5G shipments during the fourth quarter to “broader availability” and falling prices of components, as well as narrowing of the price gap between 4G and 5G chipsets.

(Writing by Cleofe Maceda; editing by Daniel Luiz)