PHOTO

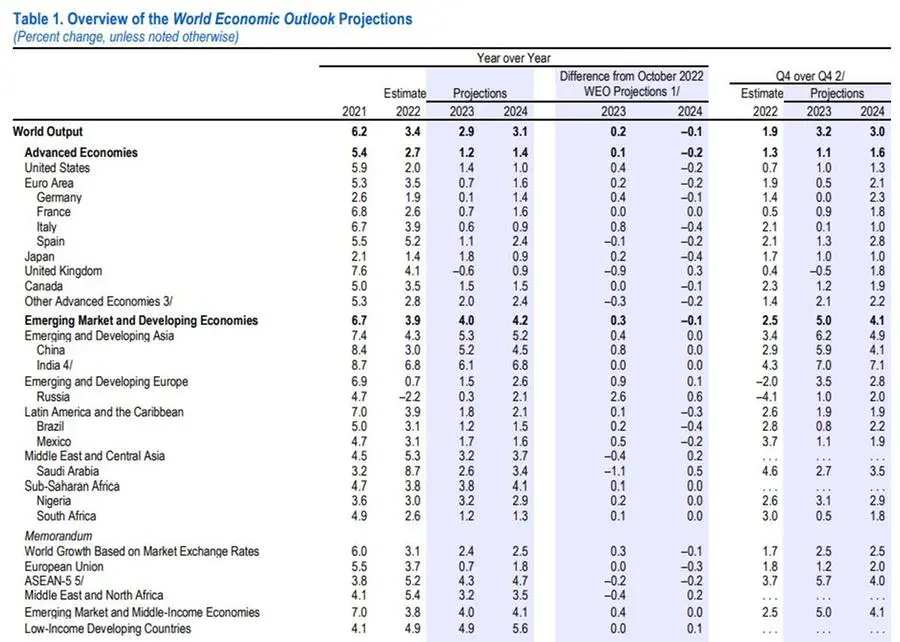

Economic growth in the Middle East and North Africa (MENA) will slow to 3.2% this year from 5.4% in 2022, before rising to 3.5% next year, the International Monetary Fund (IMF) said in its latest World Economic Outlook update.

The growth projection for the region mirrors the global slowdown caused by higher interest rates and Russia’s war in Ukraine and is mainly attributable to a “steeper-than-expected” growth slowdown in Saudi Arabia. It is also lower than the estimated 3.6% growth projection that the IMF released in October last year.

Growth in the kingdom will fall significantly to 2.6% from the estimated 8.7% in 2022, reflecting mainly lower oil production in line with an agreement through OPEC + (Organisation of the Petroleum Exporting Countries, including Russia and other non-OEC oil exporters).

However, the Washington-based lender said that non-oil growth in Saudi Arabia will remain robust.

Last October, the IMF said that worsening global conditions weighed on the outlook for MENA countries, citing that the region is “facing exceptional uncertainties and downside risks. However, it said that economic activity in MENA has been resilient so far.

Forecast for other markets

In its latest forecast released on Monday, the IMF said that the increase in central bank rates to stem inflation and the Russia-Ukraine conflict continue to weigh on global economic activity. Overall, global growth is expected to fall from an estimated 3.4% in 2022 to 2.9% in 2023, then rise to 3.1% next year.

The growth in MENA is lower than in other regions, including emerging market and developing economies, which are expected to post 4% growth, China (5.2%), India (6.1%), Sub-Saharan Africa (3.8%).

With the cost-of-living crisis, the IMF said the priority in most economies is achieving sustained disinflation.

“With tighter monetary conditions and lower growth potentially affecting financial and debt stability, it is necessary to deploy macroprudential tools and strengthen debt restructuring frameworks,” the lender said.

The IMF said fiscal support should also be better targeted at those most affected by high food and energy prices.

(Reporting by Cleofe Maceda; editing by Daniel Luiz )