PHOTO

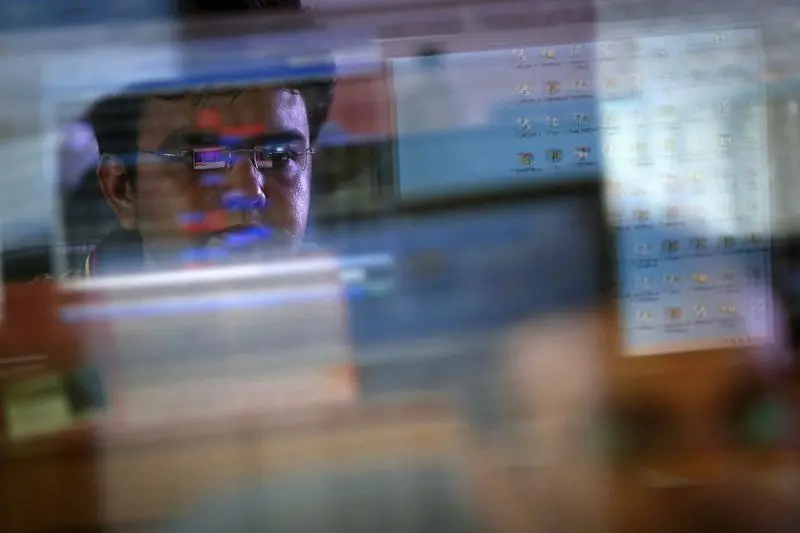

Indian shares ended higher on Wednesday as domestic IT firms advanced with an eye on rate cut clues from the upcoming Federal Reserve minutes, while consumer stocks and heavyweight Reliance Industries supported gains.

The blue-chip NSE Nifty 50 rose 0.31% to 22,597.8 points, while the S&P BSE Sensex advanced 0.36% to 74,221.06, as of 3:30 p.m. IST.

Six out of the 13 major sub-indexes closed in the green, with the U.S. rate-sensitive IT stocks, which earn the bulk of their revenue from U.S. clients, adding 0.7%.

Later in the day, minutes from the Fed's latest policy meeting will offer clues about the rate cut trajectory in the world's largest economy.

India's fast-moving consumer goods - seen as "defensive" against volatility - also helped the positive sentiment of the day, adding 1.43%.

Hindustan Unilever and Tata Consumer Products were among the top percentage gainers on the sub-index as well as the benchmark Nifty.

Among individual stocks, heavyweight Reliance Industries rose 1.71%. The stock was among the top gainers in the energy sector, which rose 0.88% as crude prices slipped for the third straight session.

Drugmaker Cipla also added 2.8% after receiving the U.S. FDA's nod to its hormonal disorder injection and was the top percentage gainer on the benchmark.

Meanwhile, foreign selling pressure and worries about the results of the national elections continued to weigh on investor sentiment.

The volatility index - a key gauge for measuring market unease - softened but closed around 19-month high levels on Wednesday. "Market participants, taking political cues from the domestic front, are not seeing anything decisive on the horizon. But sustained buying on behalf of domestic investors and upbeat sentiment in global markets are lending some comfort," said Religare Broking's Ajit Mishra. The results of the elections are due on June 4. (Reporting by Hritam Mukherjee in Bengaluru; Editing by Mrigank Dhaniwala, Eileen Soreng and Janane Venkatraman)