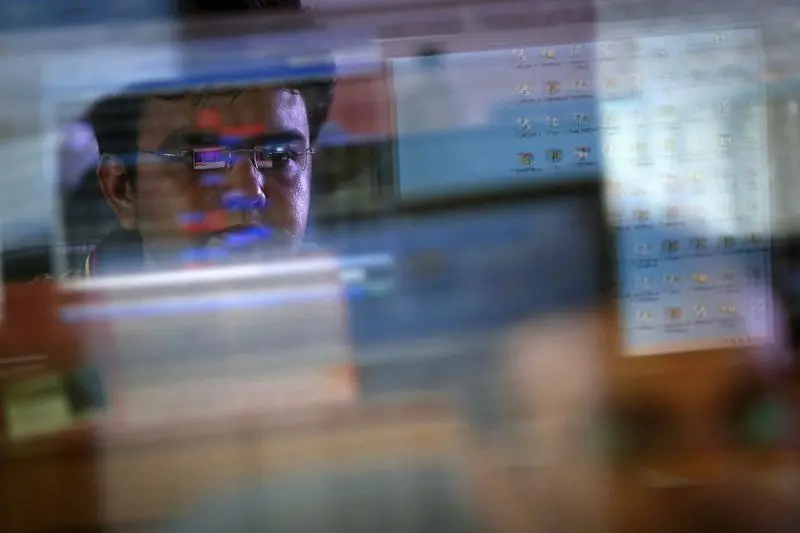

PHOTO

Indian shares advanced on Thursday after the U.S. Federal Reserve's rate pause and policy commentary led to hopes of an end to further rate hikes and spurred a rally across global markets.

The NSE Nifty 50 index was up 0.73% at 19,127.50 as of 10:12 a.m. IST, while the S&P BSE Sensex rose 0.74% to 64,060.88.

All 13 sectoral indexes advanced, with high weightage banks, financials, information technology (IT) climbing more than 1%.

The more domestically focussed small- and mid-caps also gained 1% each.

The Fed held policy rates steady in the 5.25%-5.50% range on Wednesday, with Chair Jerome Powell saying that inflation had been coming down.

Wall Street equities rallied overnight, with S&P 500 and Nasdaq Composite adding more than 1% and 1.5%, respectively.

U.S. 10-year bond yields, which hovered around 16-year highs over the last few weeks, fell to a two-week low after the Fed decision.

Asian markets advanced, with the MSCI Asia ex-Japan index gaining 1.5%.

"The Fed's decision to keep rates unchanged for the second consecutive time has raised hopes of a pivot on rates by market participants," said Dhawal Ghanshyam Dhanani, fund manager at SAMCO Mutual Fund.

Forty-seven of the Nifty 50 stocks logged gains. Britannia Industries gained 3.5% and was the top Nifty 50 gainer. The biscuit maker topped profit estimates, but missed revenue expectations in the September quarter.

The sharp rise in gross margin indicated that Britannia's cost efficiencies have made a comeback in the September quarter, said analysts at JM Financial.

Steel maker Tata Steel lost 1% after reporting a loss in the second quarter, hurt by lower sales and charges due to restructuring in the UK.

Tyre maker JK Tyre & Industries jumped 10% after posting a nearly five-fold rise in quarterly net profit.

(Reporting by Bharath Rajeswaran in Bengaluru; Editing by Janane Venkatraman and Eileen Soreng)