PHOTO

Japanese stocks on Wednesday retreated from the one-week highs hit in the previous session, weighed down by an overnight drop in global semiconductor shares and lingering worries over China's COVID-19 situation.

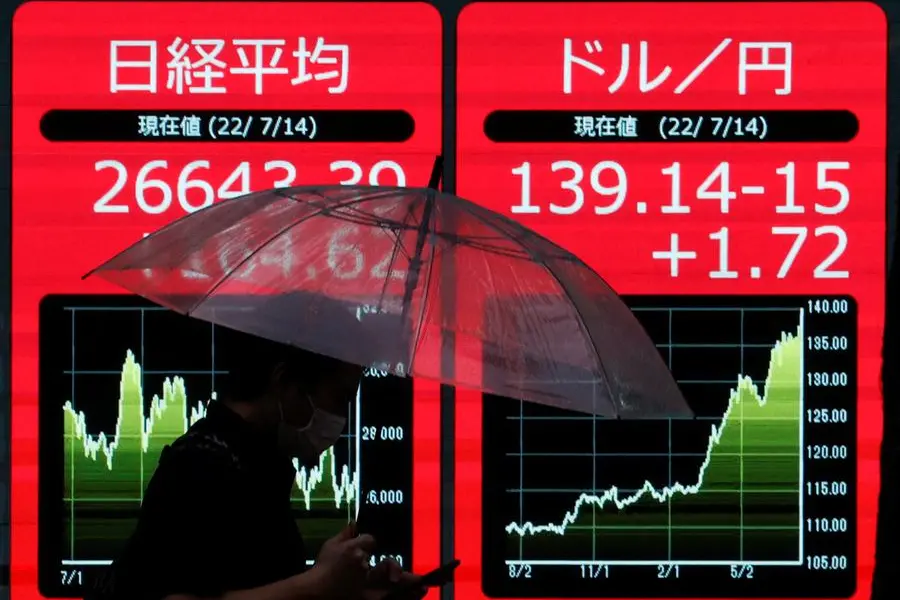

By mid-day, in thin year-end trading, the Nikkei Average was down 156.91 points, or 0.6%, at 26,290.96. Losses for the year so far are around 8.7%.

Traders said there was early selling of stocks after the Nasdaq Composite and the Philadelphia Semiconductor Index (SOX), which have a high proportion of high-tech stocks, fell on Tuesday.

Of the 33 industries on the Tokyo Stock Exchange, six sectors rose, including electricity and gas as well as insurance, while prices fell in 26 industries, including real estate and air transportation.

The declines in stocks of Fast Retailing and SoftBank Group Corp weighed the most on the Nikkei. Softbank shares hit their lowest in five days.

Earlier in the day, the Bank of Japan released the minutes of its December 19-20 monetary policy meeting, in which the central bank kept its ultra-easy policy but shocked markets with a surprise tweak to its bond yield control, so that long-term interest rates can rise more.

Norihiro Fujito, chief investment strategist at Mitsubishi UFJ Morgan Stanley Securities, said those minutes, showing BOJ board members discussed growing prospects that higher wages could finally eradicate the risk of a return to deflation, was "not being considered as a factor in the market so far".

The policy tweak has pushed yields higher, stoked expectations of wage rises and inflation and also pushed the yen up, creating a conflicting mix of drivers for stocks.

The dollar traded at 134.04 yen, up 0.42% during the session.

Naka Matsuzawa, chief Japan macro strategist at Nomura, said this week could see the after-effects of the BOJ's policy surprise linger, "with this primarily appearing as speculation that the Bank will raise short-term policy rates (lift negative rates)."

"...this speculation is the main driver behind unexpected JPY appreciation and weakening in the stock market."

The largest percentage gainers on Wednesday were Hitachi Zosen Corp, up 2.09%, followed by IHI Corp.

The volume of shares traded on the Tokyo Stock Exchange's main board was 0.56 billion, compared to the average of 1.2 billion in the past 30 days.

The broader Topix was down 0.28 %, while the Mothers Index of start-up firm shares lost 1.07% . (Reporting by Tokyo markets team; Editing by Krishna Chandra Eluri)