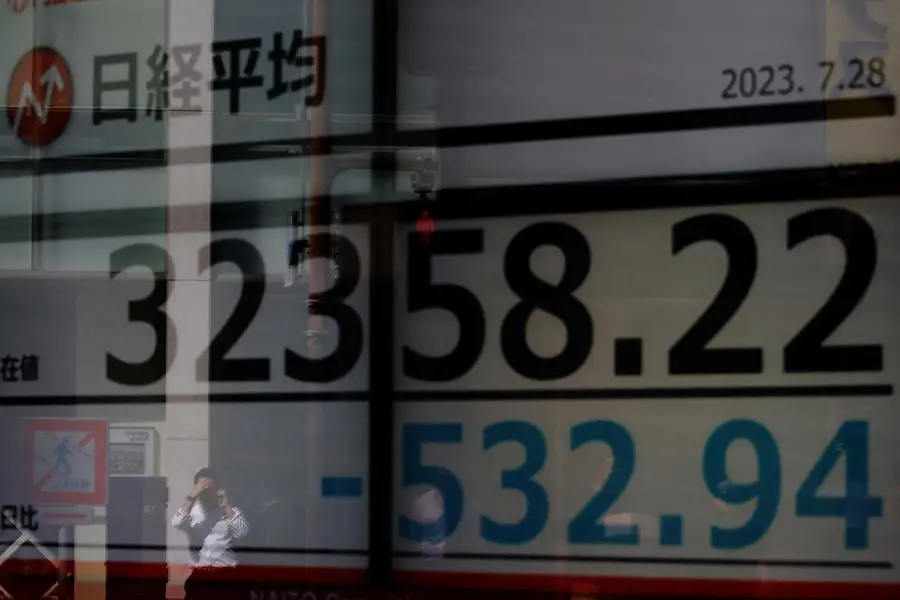

PHOTO

Japan's Nikkei share average ended marginally lower on Tuesday, as the yen's rebound against the dollar prompted a sell-off in automakers' stocks.

The Nikkei inched down 0.1% to 33,354.14 after opening up 0.2% and trading marginally higher during the session.

The broader Topix slipped 0.2% to 2,367.79.

"The Japanese market did not mirror the overnight Wall Street's strength because of the yen's gain against the dollar," said Masahiro Ichikawa, chief market strategist at Sumitomo Mitsui DS Asset Management.

Wall Street's three major stock averages closed higher overnight, with Nasdaq's 1% rally leading the charge as heavyweight Microsoft hit a record high after it hired prominent artificial intelligence executives.

The yen regained its momentum as the dollar slipped to fresh milestone lows against major currencies as China guided the yuan higher.

Honda Motor lost 2.21% and Toyota Motor slipped 1.62%. Mazda Motor dropped 4.5%.

The autos sector index fell 1.75% to become the worst performer among the Tokyo Stock Exchange's 33 industry sub-indexes.

A stronger yen weighs on exporters as it hurts the value of overseas profits in yen terms when firms repatriate them to Japan.

"Investors sold stocks also to lock in profits after the Nikkei hit its highest level in more than 30 years in the previous session," said Ichikawa.

The Nikkei rose to its highest since March 1990 on Monday before reversing course to end lower.

Trading firms were weak, with Itochu falling 3.66% and Mitsui & Co losing 2.9%,

The wholesales index lost 1.69%.

GS Yuasa tanked 10.82% after the battery maker announced a plan to raise as much as 47.2 billion yen ($315.47 million) in a sale of new shares and third-party allotment to Honda Motor.

Panel display maker Sharp jumped 9.52% to become the top performer on the Nikkei.

($1 = 149.6200 yen) (Reporting by Junko Fujita; Editing by Rashmi Aich and Mrigank Dhaniwala)