PHOTO

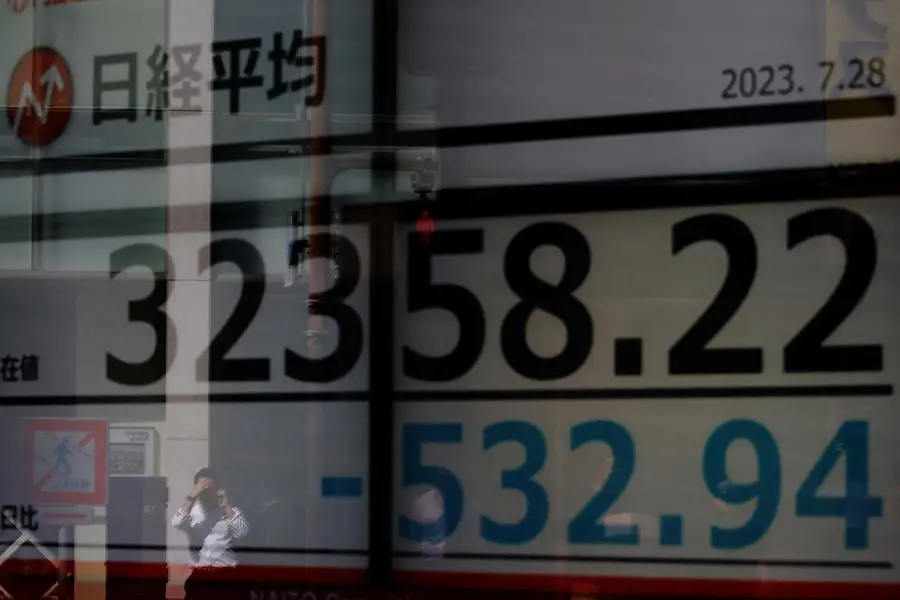

Japan's Nikkei share average touched a fresh 34-year peak on Wednesday before retreating sharply to record a second straight session of losses.

The stock benchmark initially rallied as a weaker yen buoyed the outlook for corporate profits among its many exporters, while chip-related stocks tracked overnight gains for U.S. peers, even as Wall Street's three main indexes slumped.

However, the Nikkei fell back sharply mid-morning in Tokyo after pushing up as much as 1.83% to its highest level since February 1990 at 36,239.22.

The slide accelerated into the close, with the index ending down 0.4% at 35,477.75, just above the day's low.

"The Japanese market has had a very strong performance since the beginning of the year. So it's natural to see some profit taking," said Shinji Abe, a strategist at Daiwa Securities.

The Nikkei has surged as much as 8.31% in 2024, vastly outperforming other major markets.

Technical indicators, however, have flashed warning signs. The relative strength index, or RSI, rose as high as 74.61 on Monday, well above the 70 line that signals overbought conditions, before retreating to 69.11 in the latest session.

Overnight, the yen slumped against a resurgent dollar and all three main Wall Street indexes declined after Federal Reserve Governor Christopher Waller suggested market expectations for U.S. interest rate cuts were overdone.

"There is still a sense of overheating" in the market, said Nomura Securities strategist Kazuo Kamitani, adding that the Nikkei may pause somewhere around 36,000 until the 25-day moving average, currently around 33,690, has a chance to catch up.

The Nikkei's rally has been driven mainly by foreign investors, drawn to Japanese stocks by the relatively better state of the local economy, said Stefan Hofer, chief investment strategist, LGT Bank Asia.

"In Japan, now we are moving to inflation and the Japanese are really spending. That is driving earnings growth," he said.

"We think this will continue in 2024 and probably 2025." (Reporting by Kevin Buckland; Additional reporting by Summer Zhen; Editing by Rashmi Aich and Sohini Goswami)