PHOTO

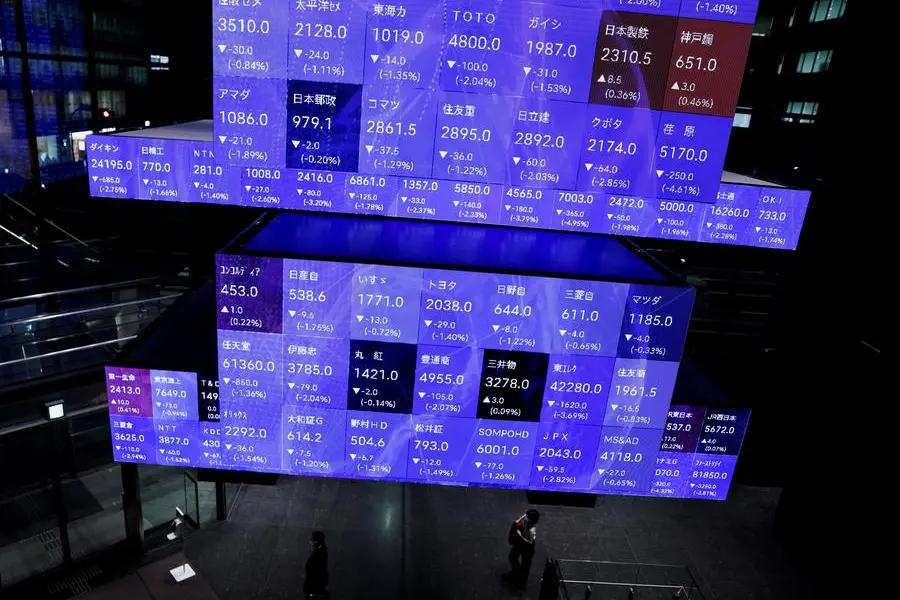

Japanese shares plunged on Tuesday, led by losses in tech stocks that tracked peers across global markets, though travel-related companies remained firm as Japan re-opens its borders to regular tourism this week.

The Nikkei share average fell 2.34% after returning to trade from a three-day weekend. It opened well below the 27,000 level and was at 26,480.97 at the midday break.

The broader Topix fell 1.6%.

The Philadelphia semiconductor index lost 3.5% overnight after U.S. President Joe Biden announced a new set of export controls last week that could stymie China's chipmaking industry.

"Washington's moved to further restrict China's access to U.S. technology, which adds to signs of slowing global chip demand," Saxo Bank market strategist Redmond Wong wrote in a note.

The move seemed to weigh on Japanese companies involved in semiconductor production. Chipmaking equipment manufacturer Tokyo Electron dropped 5.51% and industrial robot maker Fanuc Corp fell 3.52%.

Electric motor manufacturer Nidec Corp declined 8.7% after a report that it engaged in inappropriate handling of share buybacks. The company denied the report and said it was considering legal action.

"It looks like the company has been tainted by the share buyback allegations," said a strategist at a domestic securities firm.

Electrical equipment manufacturer Yaskawa Electric Corp fell 5.02% after cutting its profit guidance for the current financial year.

Travel-related stocks performed well as investors expect a bounceback from this week's resumption of regular inbound tourism.

Department store operator Takashimaya Co Ltd rose 2.12%, while East Japan Railway Co was up 1.54%. Topix air travel stocks rose 1.36%.

Of the Nikkei's 225 constituents, 183 made losses, 37 advanced, and five traded flat. (Reporting by Sam Byford and Tokyo markets team; editing by Uttaresh.V)