PHOTO

China International Capital Corp (CICC) is cutting the base pay of onshore investment bankers by as much as 25%, three sources said, in a major effort to reduce costs amid volatile markets and Beijing's austerity drive.

Some of the impacted dealmakers were notified on Friday about the cuts, said the sources, who have knowledge of the pay reductions but declined to be named as they are not authorised to speak to the media.

The cuts will take immediate effect, two of the sources said. CICC didn't immediately respond to Reuters' request for comment on Sunday.

The salary cuts will affect more than 2,000 bankers, and come after one of the largest investment banks in China by headcount trimmed bankers' bonuses last year by up to 40%, as Reuters reported in April last year.

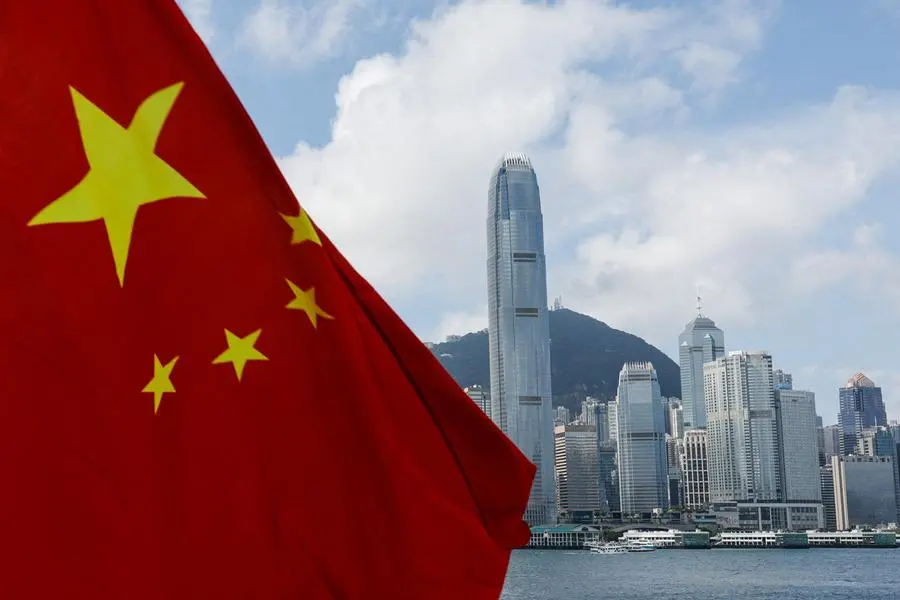

The rare move by the top investment bank to reduce base pay by as much as a quarter underscores the challenges Chinese financial firms face amid a slowing economy and sluggish IPOs in the main listing destinations in China and Hong Kong.

Investment bankers are typically subject to volatile bonus payments based on performance but drastic reductions in base salary are less common. Last year rival CITIC Securities lowered pay across its investment banking division by up to 15%, Reuters reported in June, citing sources.

Money raised via IPOs by Chinese companies, from both onshore and offshore bourses, plunged 80% to $2.9 billion in the first quarter compared to a year earlier, according to LSEG data.

Chinese financial firms have also jumped on an austerity drive in the last couple of years - cutting salaries and bonuses and asking staff not to wear expensive clothes and watches at work - as Beijing pushes to bridge the wealth gap.

Also, as Beijing pushed ahead with its "common prosperity" drive, China's top graft-busting watchdog last year vowed to eliminate ideas of a Western-style "financial elite" and rectify the hedonism of excessive pursuit of "high-end taste".

Financial professionals are among the highest-paid workers in communist China and their wealth and flashy lifestyles have often come under criticism from the public on social media as the economy slowed.

The bank is also mulling job cuts at its offshore investment banking unit in Hong Kong, one of the three sources said. It's unclear how many bankers are permanently based offshore.

The bank has not yet announced bonuses for 2023, according to two of the three sources, who said bankers at the firm last year started receiving bonus intimations from early April.

Funds raised via initial public offerings by CICC in the mainland dropped 31% to 359 billion yuan ($49.5 billion) in 2023 from 2022, while Hong Kong IPO proceeds plunged by 56% to $5.9 billion, according to data from the bank's annual report published in March.

Profit attributable to the shareholders of the Beijing-headquartered brokerage dropped 19% in 2023 from 2022 to 6.2 billion yuan, following a 29% drop in 2022 from an all-time high of 10.8 billion in 2021, the report showed.

($1 = 7.2464 yuan)

(Reporting by Selena Li, Julie Zhu and Summer Zhen in Hong Kong; Additional reporting by the Shanghai bureau; Editing by Sumeet Chatterjee and Tom Hogue)