PHOTO

China has extended its manufacturing domination to clean energy industries in recent years, alongside a global push for climate change action, but that is starting to worry the United States, Europe and others.

Washington is especially concerned about "overcapacity", where Chinese subsidies to industries such as solar, electric vehicles and batteries threaten to undercut these sectors in other countries.

US Treasury Secretary Janet Yellen has vowed to raise the issue in her talks with key Chinese officials this week.

Here is a look at China's power in these green tech sectors:

- Solar dominance -

China is the world's biggest emitter of the greenhouse gases driving climate change, such as carbon dioxide.

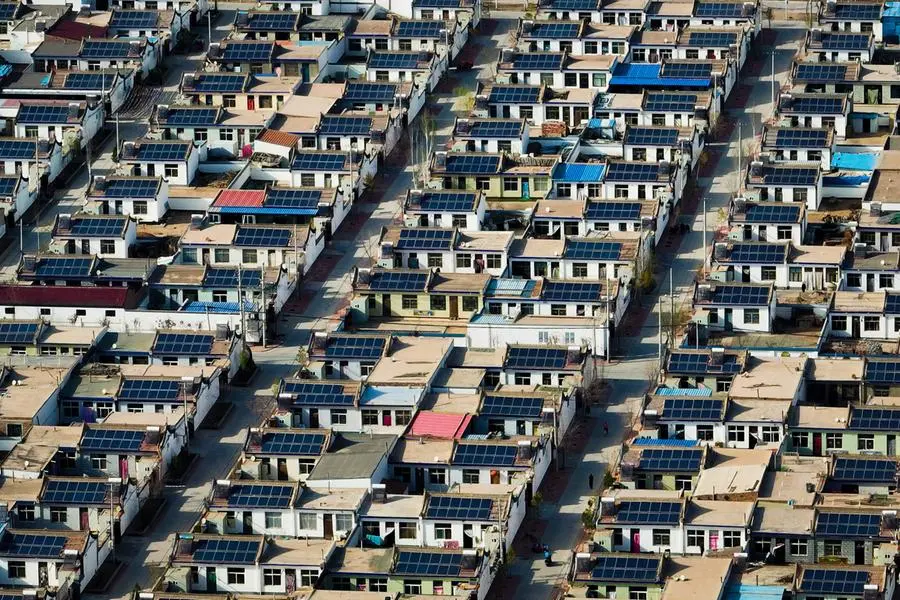

It is also pouring billions into green energy and is set to dominate the world's solar supply chain, according to Wood Mackenzie.

A report by the analytics firm noted that China put more than $130 billion into the solar industry in 2023.

With these investments, "China will hold more than 80 percent of the world's polysilicon, wafer, cell, and module manufacturing capacity from 2023 to 2026", Wood Mackenzie added, referring to materials key to the production of solar panels.

This is worrying for Washington, as the United States tries to build up its production capacity to reduce dependence on China and support its own green transition.

On Wednesday, Yellen told reporters that beyond tax subsidies for green industries, Washington would not rule out other means of protecting these sectors, such as trade barriers.

- Electric vehicles -

China's auto exports rocketed 57.9 percent on-year to a record of 4.9 million units in 2023.

This was driven by a 77.6 percent jump in new energy vehicles (NEVs) -- including all-electric and plug-in hybrids -- to more than 1.2 million units, state media reported, citing data from the China Association of Automobile Manufacturers (CAAM).

In 2023, state media noted, China made up more than 60 percent of global NEV sales.

Last year, the production of such vehicles rose around 36 percent as well to exceed 9.6 million units, state media said.

- Battery boost -

China's lithium-ion battery sector also grew in 2023, with state media reports saying total output surged 25 percent on-year.

Exports of such batteries, meanwhile, were up 33 percent on-year in 2023, reports added.

According to the Economist Intelligence Unit, China accounted for some 57 percent of global demand for lithium-ion batteries in 2022.

But there are warnings that the industry is grappling with excess production capacity.

- 'Extreme mismatch' -

The worry in Washington and Brussels is that Chinese green tech firms with subsidy-fuelled production muscle and huge inventories can offer prices so low that US and European firms would not be able to compete in the absence of trade barriers.

The "immense overcapacities in Chinese industries is not just an economic challenge for open economies, but runs the danger of provoking protectionist forces" among other countries, said Joerg Wuttke, president emeritus of the European Union Chamber of Commerce in China.

Yellen's visit to China this week is crucial when it comes to conveying this message to Chinese leaders, he told AFP.

China's manufacturing value-add -- the net output of the sector -- stands around 30 percent, significantly above the United States and other developed countries.

But China, the world's second-biggest economy, only makes up 14 percent of global consumption, Wuttke added, calling this an "extreme mismatch".