PHOTO

China stocks slipped on Monday, with the blue-chip benchmark touching a nearly five-year low, after data showed the consumer prices in the world's second-largest economy fell the fastest in three years in November while factory-gate deflation deepened.

** The blue-chip CSI 300 Index fell 0.9%, and the Shanghai Composite Index dropped 0.6% by the midday recess.

** Hong Kong's Hang Seng Index slumped 2%, and the Hang Seng China Enterprises Index declined 2.6%.

** Other Asian shares drifted lower ahead of a week packed with a quintet of central bank meetings and data on U.S. inflation.

** China's consumer price index (CPI) dropped 0.5% both from a year earlier and compared with October, indicating rising deflationary pressures as weak domestic demand casts doubt over the economic recovery.

** The country will continue to implement a proactive fiscal policy, which will be moderately strengthened, and implement a prudent monetary policy, which will be "flexible, moderate, precise, and effective", the Politburo, a top decision-making body of the ruling Communist Party, said on Friday.

** The statement "continued to send pro-growth signals," said Goldman Sachs in a note. "However, the discussion around high-quality growth and emphasis of 'appropriate pace of easing' imply policy support will likely still be measured rather than being aggressive."

** Investors are awaiting the upcoming Central Economic Work Conference (CEWC), which will likely be held over the next few days, for more policy clues.

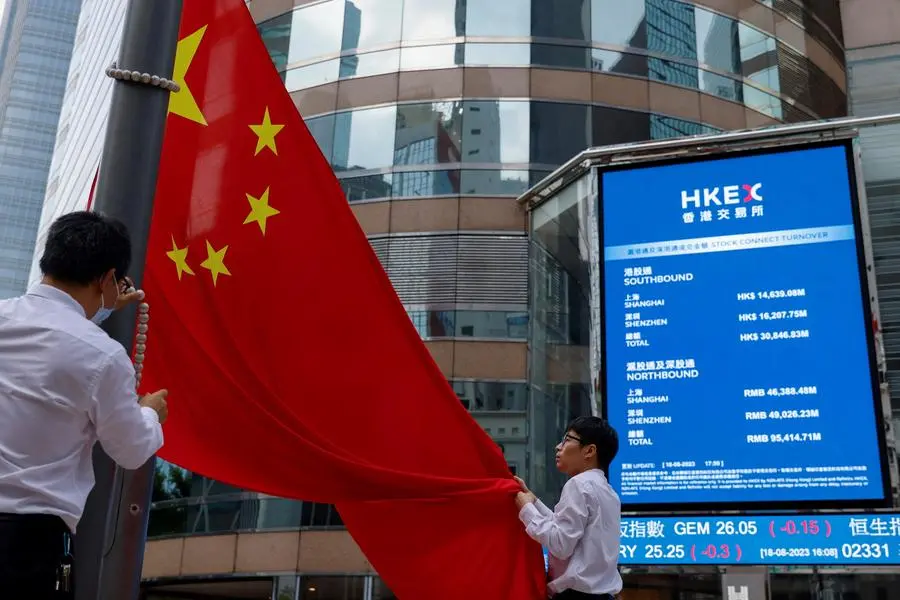

** Foreign investors sold a net 9.6 billion yuan ($1.34 billion) of Chinese shares via the Stock Connect so far.

** Shares in real estate and consumer staples slumped more than 2% each, while new energy firms lost 1.7%.

** Hong Kong-listed tech giants plunged 2.6%, and mainland developers listed in the city were down 3%. ($1 = 7.1867 Chinese yuan renminbi)

(Reporting by Shanghai Newsroom; Editing by Rashmi Aich)