PHOTO

China stocks dropped on Tuesday despite regulators' measures to boost market confidence, as sentiment remained fragile after the liquidation of property giant China Evergrande gave a fresh blow to Beijing's shaky real estate market.

** The blue-chip index was down 0.8%, and the Shanghai Composite slipped 0.6% by the midday recess.

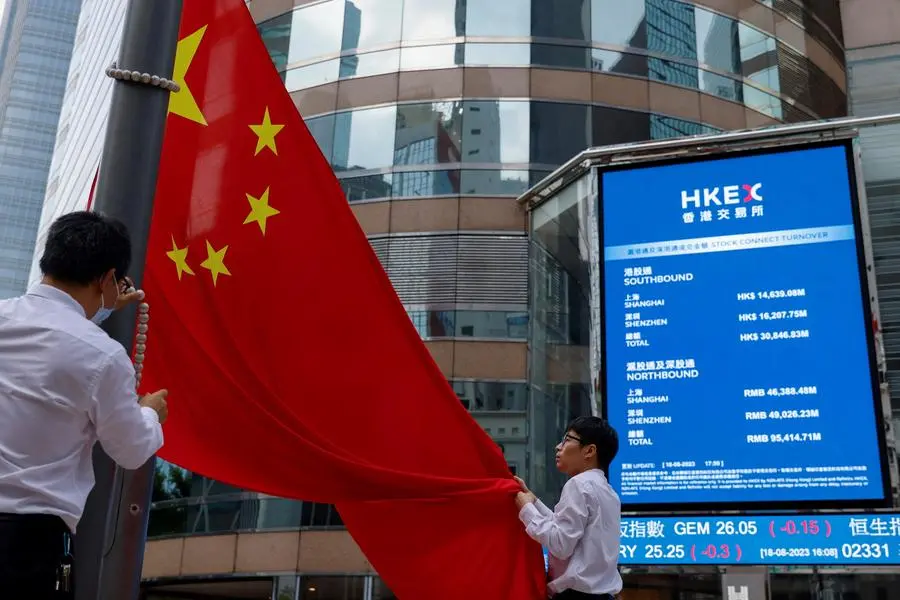

** Hong Kong's Hang Seng Index eased 2%, and the Hang Seng China Enterprises Index lost 2.2%.

** Broader Asian shares were also dragged lower by China markets, while rising geopolitical tensions propped up oil prices and kept a lid on risk appetite ahead of the U.S. Federal Reserve's meeting.

** A Hong Kong court on Monday ordered the liquidation of property giant China Evergrande Group.

** Hong Kong's leader confirmed on Tuesday his intention to pass fresh national security laws soon to build on sweeping legislation Beijing imposed on the city in 2020.

** Some business people, diplomats and academics are closely watching the developments, saying the prospect of new laws targeting espionage, state secrets and foreign influence, known as Article 23, could have a deep impact on the global financial hub.

** Tech giants listed in Hong Kong lost 2.7%, and mainland property developers slumped 3.5%.

** In onshore markets, shares in food & beverage and semiconductors lost more than 2% each to lead the decline.

** Ting Lu, chief China economist at Nomura, said the latest economic dip is likely to worsen into the spring, and Beijing might still need to find the most effective measures for preventing downward spirals.

** China's 10-year government bond yield dropped to the lowest in more than two decades as investors still expect more policy easing to lift economic recovery after China announced a cut to bank reserves last week.

** Yields on China's 10-year government bonds dropped below 2.47%, the lowest since June 2002.

(Reporting by Shanghai Newsroom; Editing by Sherry Jacob-Phillips)