PHOTO

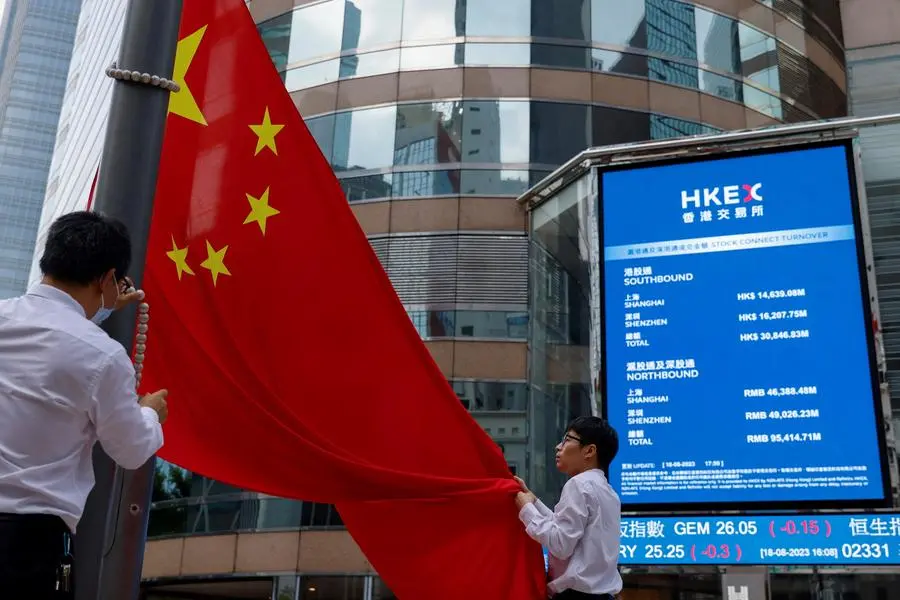

China and Hong Kong stocks fell on Wednesday, as food delivery giant Meituan's cautious fourth-quarter guidance raised market concerns about the prospects for China's consumer spending recovery.

** The blue-chip CSI 300 Index dropped 0.7%, while the Shanghai Composite Index was down 0.3%.

** Hong Kong's Hang Seng Index fell 2%, and the Hang Seng China Enterprises Index lost 2.2%.

** Hang Seng Index heavyweight Meituan slumped 11% after the firm on previous day said it expects fourth-quarter revenue growth for its core food delivery business to slow versus the preceding quarter, citing persistent consumer caution and warmer weather for the winter season hitting orders as reasons.

** Its shares fell to a 3-1/2 year low on Wednesday, despite the company promising a $1 billion buyback.

** Caroline Yu Maurer, head of China and specialised Asia strategies at HSBC Asset Management, expects China markets stay volatile in the near-term.

** "There is potential for further savings drawdown to support consumer spending, though confidence needs to clearly improve and is key to the outlook," she said.

** Meanwhile, analysts do not expect a quick turnaround in the property market in 2024, despite intensified policy support.

** "Homebuyers’ sentiments remain weak amid uncertain employment and income prospects," Fitch Ratings said in a report on Wednesday.

** Hong Kong-listed mainland developers dropped 4.4%.

** In mainland markets, real estate and insurance companies fell 2.6% and 2%, respectively, leading the decline.

** A Reuters poll on Wednesday expects that China's manufacturing activity likely contracted for a second consecutive month in November. (Reporting by Summer Zhen; Editing by Mrigank Dhaniwala)