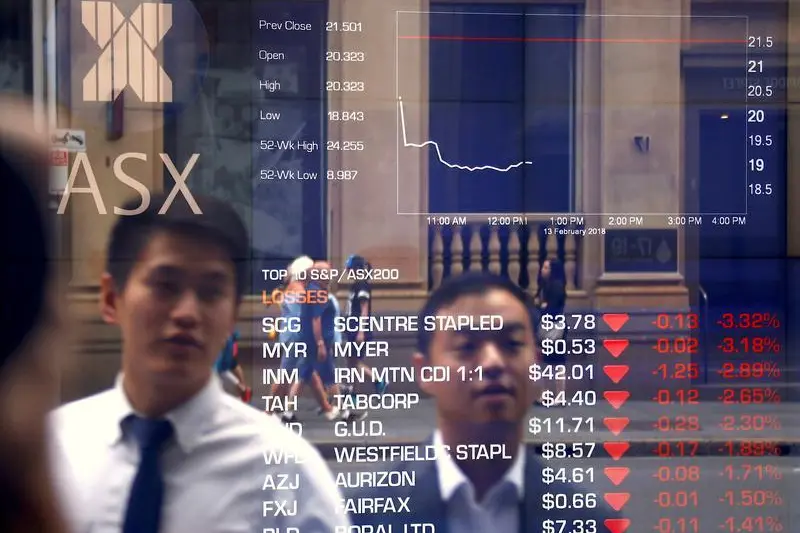

PHOTO

Australian shares fell for the first time in seven sessions on Friday, dragged down by financials and gold stocks, as stronger-than-expected U.S inflation data fuelled worries that the Federal Reserve will keep interest rates higher for longer.

The S&P/ASX 200 index ended 0.6% lower at 7,050.1 points, with most sectors closing in negative territory. The benchmark logged its first weekly gain in four, rising 1.4%.

Data showed overnight that consumer prices in the United States increased more than expected in September, bolstering the case for tight monetary policy in the world's largest economy.

"I think we'll see gradual recovery towards 7,400 (points) for the benchmark, but we still need Chinese stimulus to help the big miners," said Henry Jennings, a senior market analyst at Marcustoday Financial Newsletter.

Lenders led the decline on the Australian benchmark index, falling 0.6% after a three-day rally. The so called "Big Four" banks dropped between 0.5% and 1%.

If inflation "remains sticky", the Reserve Bank of Australia "should sit on the sidelines", Jennings said.

Gold stocks shed more than 1% in their biggest daily loss since Oct. 3. However, Newcrest Mining rose 1.7% as its shareholders voted in favour of the A$26.2 billion($16.57 billion) buyout offer from gold mining giant Newmont Corp .

Interest rate-sensitive technology stocks slumped 1.9%, with accounting software producer Xero and buy-now-pay-later firm Block Inc giving up 2.5% and 1.5%, respectively.

New Zealand's benchmark S&P/NZX 50 index slipped 1% in its worst session since Oct. 4.

Shares of Sky Network Television soared more than 13% in their best session since December 2021, after the media firm said it was in early talks over a recent non-binding indicative takeover offer. ($1 = 1.5810 Australian dollars) (Reporting by Shivangi Lahiri in Bengaluru; Editing by Subhranshu Sahu)