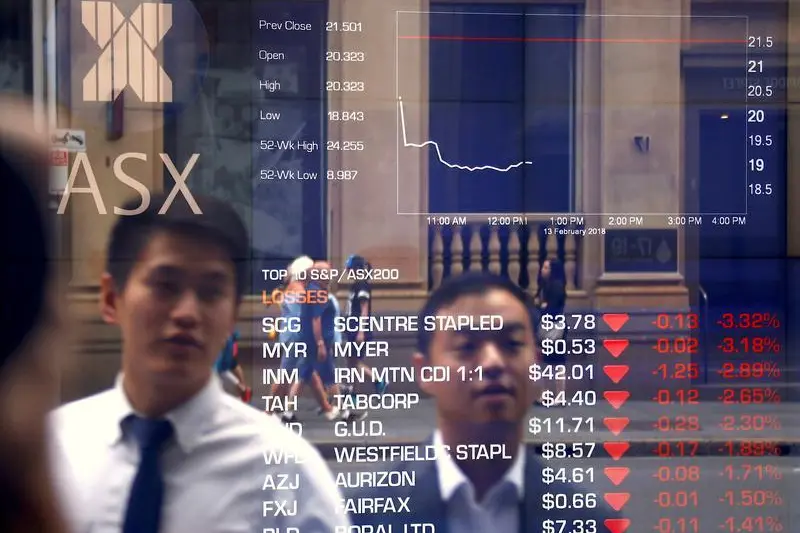

PHOTO

Australian shares fell marginally on Friday, as declines in the commodity sectors overshadowed gains in the financial and healthcare indexes, while investors digested U.S. economic data amid concerns over a slowing economy.

The S&P/ASX 200 benchmark index fell 0.1% to 7,244.3 by 0040 GMT, slipping for the fourth straight session.

Globally, investors stayed on the sidelines after a modest growth in initial jobless claims in U.S. indicated that demand was slowing, which could lead to a recession risks later in the year.

Back in Sydney, the mining index led declines, falling about 1.4% after China iron ore prices took a hit due to concerns over demand recovery in the top steel producer.

Sector heavyweights BHP Group, Rio Tinto and Fortescue Metals dropped between 1.2% and 1.7%.

Similarly, energy stocks were pressured by weak Brent crude prices overnight, with Woodside Energy and Santos slipping 1.1% and 0.6%, respectively.

On the bright side, financials gained about 0.3%, with the country's four largest banks trading higher in the range of 0.3% to 1%.

The healthcare and the technology indexes added 0.3% and 1.2% respectively.

Newcrest Mining fell about 1.8% after Australia's biggest gold miner said it had extended the exclusivity period by a week for Newmont Corp to complete its due diligence on its A$29.4 billion ($19.94 billion) final takeover offer for the company.

New Zealand's benchmark S&P/NZX 50 index inched up 0.1% at 11,895.5.

($1 = 1.4743 Australian dollars) (Reporting by Archishma Iyer in Bengaluru; Editing by Rashmi Aich)