PHOTO

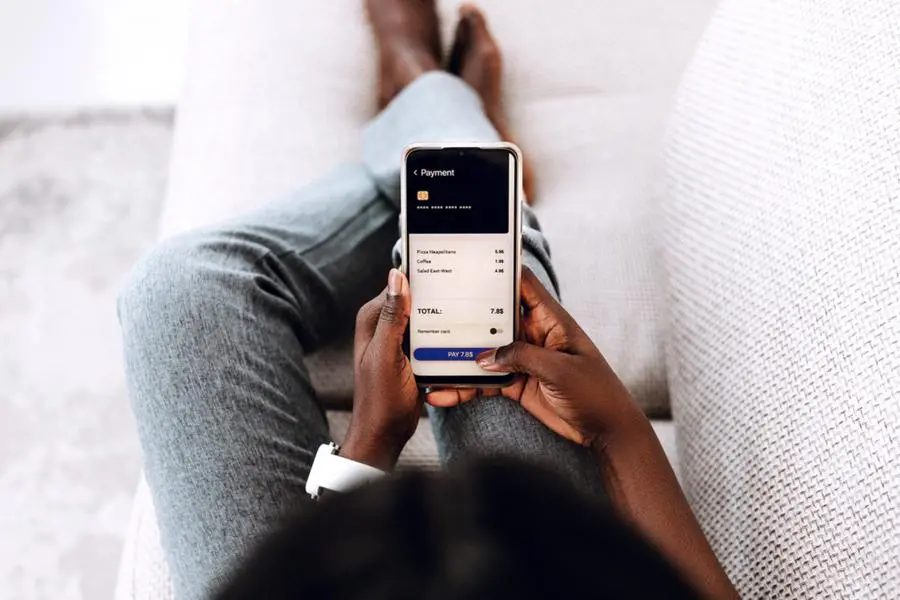

ONCE the poster child for fast-paced growth in a bumpy economy, Nigeria’s telecommunications sector, a catalyst for future growth, is fast losing its spark, a situation that will adversely affect remote banking services, improved accessibility and customer service.

Managing Director/CEO, Financial Derivatives Company Limited, Mr Bismarck Rewane, who disclosed this in the latest edition of the Lagos Business School breakfast session, attributed the decline to economic challenges, inflation, exchange rate pressures, regulatory burden, right-of-way conundrums and multiple taxations crunching the once vibrant sector.

According to him, industry players have consistently shown positive top-line performance over the years but have experienced slower growth in the last two years.

Related PostsWhy investment in cybersecurity is important in today’s society — IT expert, NgonamondiGombe Gov leads investment drive mission to MoroccoNASENI makes investment in Powerstove to boost carbon credit initiative

“Bottom-line performance, hampered by huge FX losses and squeezed margins, slow pace of profit growth gradually weighs on shareholder’s value and investor sentiment,” he said.

Although the sector’s growth outperforms annual Gross Domestic Product (GDP) growth, after discounting for inflation, it becomes evident that the sector is stagnating as revenue and margins decline.

Despite the current turbulence the telecoms sector faces, there is still hope, mainly because of the strong linkages with other critical and job-elastic sectors of the economy, including manufacturing, agriculture and trade.

Rewane noted that the way out is to boost aggregate telecom investment that had shrunk 47percent since 2021, crippling market efficiency and growth. The regulatory landscape and macro-fundamentals must be supportive to incentivise investments.

He said India for instance is the second largest telecom market in the world with a market size of $44billion. The country’s massive reforms and investments in the sector supported the growth and 2021 spectrum auctions alone fetched a record-breaking amount of approximately $10.5 billion, indicating the high level of investment and competition in the sector.

National Digital Communications Policy (NDCP) of India aims to attract $100 billion investment in the telecoms sector in four years.

Similarly, Rewane, on Nigerian economy’s June outlook, noted that inflation in May will rise marginally to 34 percent and food inflation up to 41 percent.

“The CBN will maintain the status quo at the July meeting and the stimulus package and growth plan will be unveiled – about N6 trillion with a multiplier of 2.8.

“The price of diesel will stay flat at N1,100 per litre, thanks to the Dangote refinery. The Naira will trade at N1,350-1,450 through June, while effective interest rates on loans will remain high at 32 percent per annum (p.a.).

“The stock market is expected to continue its correction, losing at least five percent of its value. International airfares out of Nigeria will fall in the face of fierce competition and Middle-East carriers Qatar, Turkish and east-African airlines will undercut the market ahead of Emirate’s re-entry,” he disclosed.

The FDC helmsman further stated that there is expectation that vacancy factors in real estate in Ikoyi, Victoria Island and Lekki will fall.

As business activity expands and growth kicks in, the same trend will emerge in Abuja and Port Harcourt.

Copyright © 2022 Nigerian Tribune Provided by SyndiGate Media Inc. (Syndigate.info).