PHOTO

The Abu Dhabi Investment Authority (ADIA) has doubled down on India for its robust growth and investor-friendly policies, with the UAE sovereign wealth fund investing close to $1 billion across five deals in the South Asian economy in the first half of 2024.

With strategic competition between the US and China picking up pace, many sovereign wealth funds are likely to see opportunities for emerging markets to attract investments from them and deliver significant gains, experts say.

“Most sovereign investors are seeking alternatives in Asia, given the current distress (economic deceleration and geopolitical uncertainty) in China,” Diego López, founder and Managing Director of Global SWF, told Zawya. “India presents interesting opportunities, especially in sectors associated with middle market growth, such as retail and consumer, and in certain segments in real estate.”

According to López, ADIA has been increasingly active in India in recent months, leveraging a number of select domestic partners, such as Reliance Industries Limited (RIL), Kotak AIF, HDFC Capital Advisors and Greenko, an owner and operator of clean energy projects in the country.

India rally

ADIA’s most recent investment rally in India kicked off in the months following Prime Minister Narendra Modi’s November state visit to Abu Dhabi. At the time, a Bloomberg report claimed the UAE was considering investing as much as $50 billion in India, its second-largest trading partner, as part of a broader bet to increase non-oil bilateral trade to $100 billion.

A flurry of dealmaking followed, involving private equity funding and open market transactions, with ADIA’s name also linked to the establishment of a $4 billion to $5 billion fund in Gujarat International Finance Tec-City (Gift City) in February. This allowed the wealth fund to invest in India through a tax-neutral finance hub in Modi’s home state.

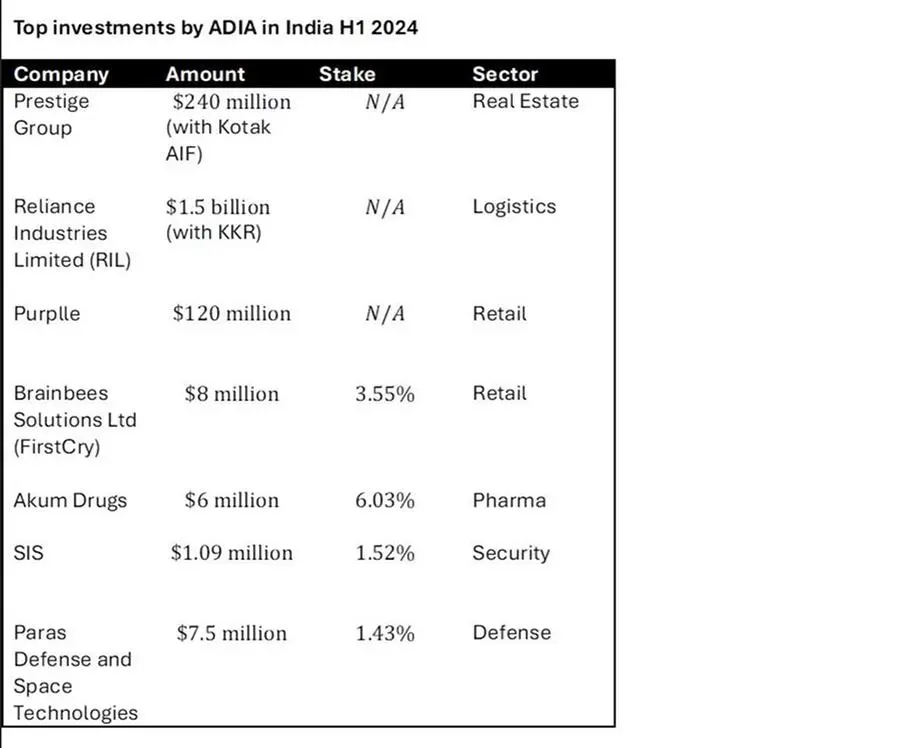

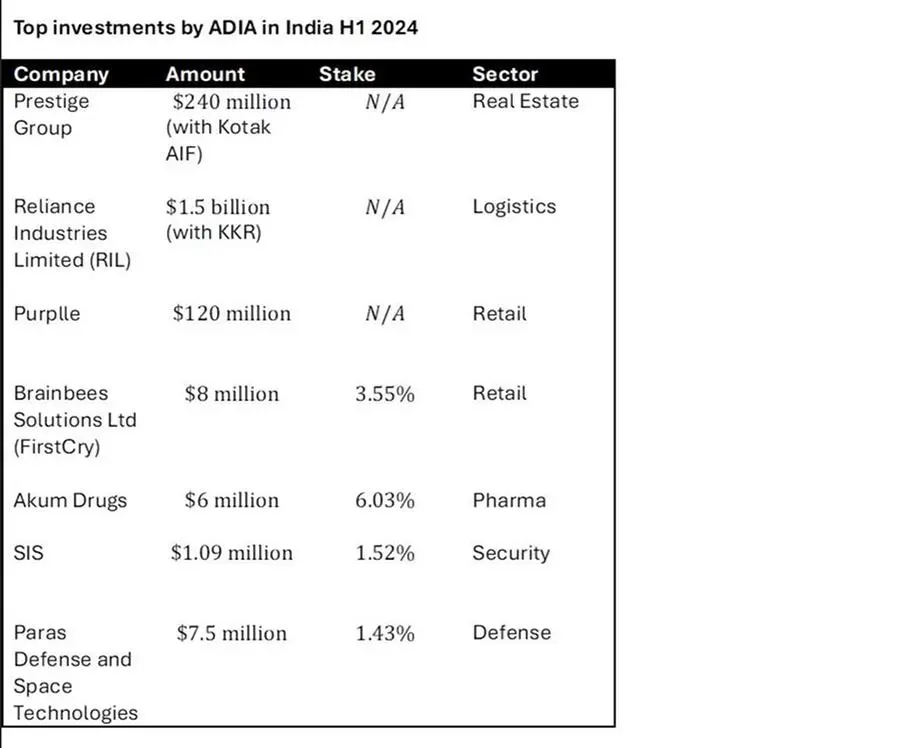

Notable deals included a $240 million agreement with real-estate firm Prestige Group and Kotak AIF to develop residential projects in the country. ADIA and the US-based KKR were also named in a $1.5 billion investment in warehousing assets owned by a subsidiary of RIL.

Similarly, Indian startups benefited from ADIA’s big-ticket funding, with beauty retailer Purplle closing a ₹1 billion ($120 million) round led by the sovereign fund in July. The wealth fund was also named as a possible investor in India’s audio storytelling platform Pocket FM, with a $1.2 billion capital infusion.

Emerging markets

ADIA's strategy to invest in India is in line with its renewed interest in emerging markets.

“For years, ADIA has tried to increase its exposure in Asia and in emerging markets; however, it is a challenging task given their mandate and size of their portfolio, and because most sizable opportunities continue to arise in North America,” said López.

According to the industry tracker, ADIA’s investments in India hit $2.7 billion in 2022, accounting for 11% of its portfolio, before slipping to $1.7 billion in 2023 despite its portfolio share increasing to 17%.

Currently, 23% of ADIA’s $8.3 billion portfolio is invested in emerging markets, according to Global SWF’s H1 2024 data.

This number is expected to rise, with several more India investments in the works, including a ₹400 billion stake in food brand Haldiram’s as part of a Blackstone consortium.

The UAE sovereign wealth fund is also in talks with Amsterdam-based EQT Baring Private Equity to acquire a 10% stake in Indian non-bank education financier HDFC Credila Financial Services, according to a Moneycontrol report.

López expects the investment trend to continue for the remainder of the year as the South Asian giant continues to lure investors through favourable policies, including an extension of tax benefits for startups and investments from sovereign wealth or pension funds until March 31, 2025.

(Reporting by Bindu Rai, editing by Seban Scaria)