PHOTO

Saudi Arabia continues to dominate the venture capital (VC) space in the Middle East and North Africa (MENA) region, bagging more than half of the deployment during the first six months of the year.

The kingdom recorded SAR 1.5 billion ($412 million) in VC funding from January to June this year, accounting for 54% of the region’s total VC investments and marking a significant jump from the 38% share a year ago, according to data firm Magnitt.

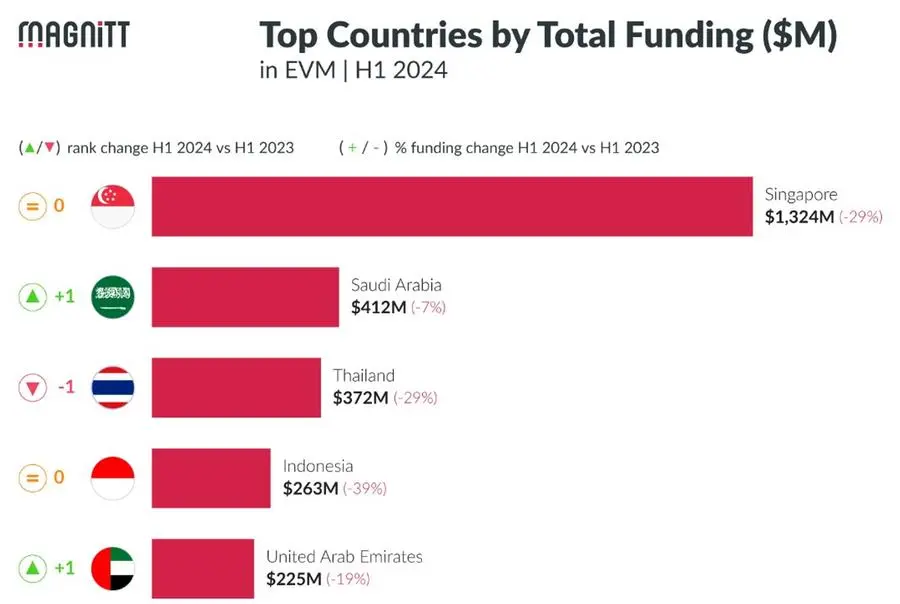

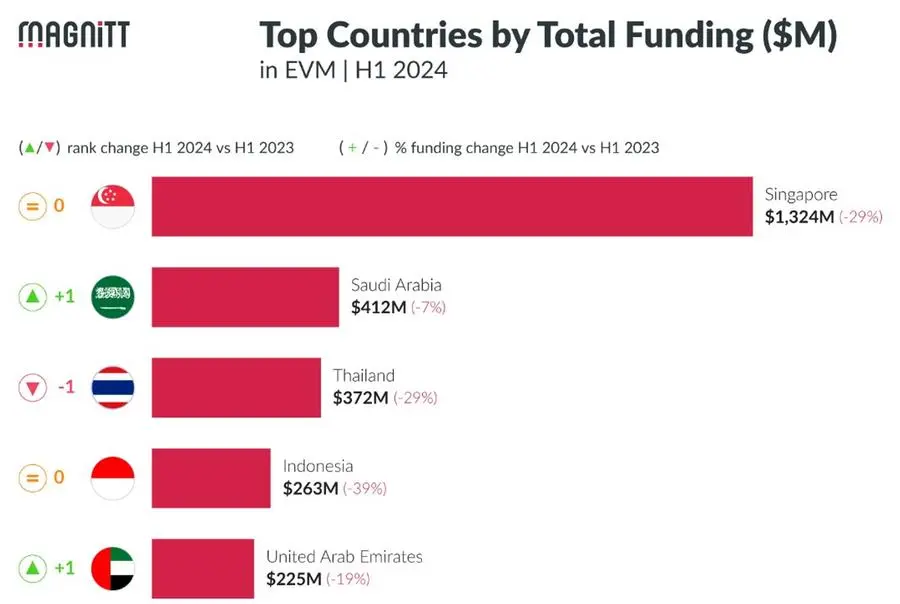

Across the emerging markets, Saudi Arabia came second after Singapore, which landed the top spot with $1,324 million. The UAE, which bagged $225 million, came fifth, just behind Thailand ($372 million) and Indonesia ($263 million).

Saudi’s e-commerce and retail sector scored the bulk (52%) of the investments, amounting to $215 million, although fintech businesses continued to lead in terms of the total number of deals, capturing 14% of the transactions in the first half.

The kingdom’s deal flow accounted for 30% of the deal activity across the MENA region, up from 24% in the first half of last year.

“MAGNITT’s data show that KSA led H1 VC funding in MENA, while non-mega funding (deals less than $100 million) saw an impressive 84% [year-on-year] growth,” noted Philip Bahoshy, CEO at MAGNITT.

“This positive trend underscores the growth of investment in the foundational ecosystem, building a strong pipeline for future late-stage investments.”

(Writing by Cleofe Maceda; editing by Seban Scaria) seban.scaria@lseg.com