PHOTO

Accelerated delivery of the Company’s transformational growth strategy with value-accretive strategic investment targets of over $5 billion to be realized by 2028

The Company enhances its global reach with the announced acquisition of Navig8, with presence in 15 cities across five continents

The Navig8 acquisition will also add 32 tankers to the fleet, including 4 MR newbuilds, on top of newly-signed construction contracts for up to 10 LNG Carriers; 9 VLECs; and up to 4 VLACs

Abu Dhabi, UAE: ADNOC Logistics and Services plc (ADNOC L&S / the Company) (ADX symbol ADNOCLS / ISIN AEE01268A239), a global energy maritime logistics leader, today announced its second quarter (“Q2”) and first half (“H1”) 2024 financial results.

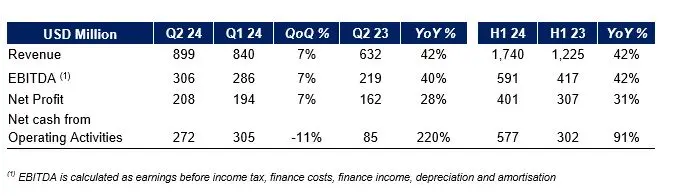

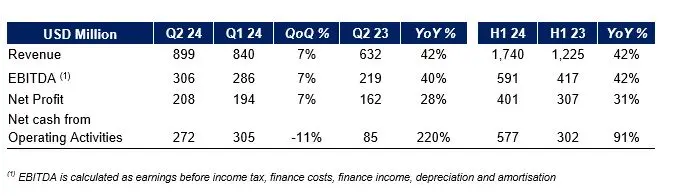

During H1 2024, ADNOC L&S recorded a net profit of $401 million (AED1,473 million), equating to $0.05 (AED0.20) per share, an increase of 31% on H1 2023. The Company reported revenues of $1,740 million (AED6,390 million) in the same period, up 42% on H1 2023. EBITDA rose by 42% to $591 million (AED2,170 million) driven by robust performance across all business segments, sustaining EBITDA margins at 34%.

The Company’s second quarter revenue increased by 42% year-on-year (y-o-y) to $899 million (AED3,302 million) with EBITDA growing 40% y-o-y to $306 million (AED1,124 million). Net profit for the second quarter grew 28% y-o-y to $208 million (AED764 million).

This strong financial growth was driven by the ongoing implementation of ADNOC L&S’ transformational growth strategy whereby the Company intends to invest of over $5 billion (AED18.4 billion) in value-accretive growth opportunities in energy-related maritime logistics by the end of 2028. ADNOC L&S has committed over 50% of this strategic investment target one year post its record-breaking IPO, including significant investments against long-term contracted demand.

Commenting on the Company’s financial results, Captain Abdulkareem Al Masabi, CEO of ADNOC L&S, said: “ADNOC L&S has delivered another set of exceptional financial results in the second quarter, maintaining our strong momentum throughout the year and building on the robust growth we achieved in 2023. The sustained execution of our transformational growth strategy is driving our financial performance across all business segments with strong growth in revenues and net profit. To meet the growing demand for low-carbon energy sources in the UAE and beyond, we have continued to expand our market-leading fleet through significant new energy-efficient vessel construction contracts and geographical expansion through our acquisition of Navig8. We will continue to target value-accretive investments to serve an increasing global customer base and deliver long-term value to our shareholders.”

Segmental Financial Performance for H1 2024

Revenues from ADNOC L&S’ Integrated Logistics segment increased to $1,132 million (AED4,157 million), up 55% on H1 2023. This growth was fueled by higher transported volumes and an enhanced contribution from Jack Up Barges (JUBs) owing to an expanded fleet, increased rates, and further-improved utilization. Additionally, the continued delivery of Integrated Logistics project activities and the growth of the owned fleet all contributed to revenue growth in the period. EBITDA rose by 42% to $329 million (AED1,208 million) in the first half of the year.

Revenues from the Shipping segment increased 27% to $519 million (AED1,906 million) on H1 2023, driven by robust charter rates for Tankers and Dry Bulk, along with additional earnings from the four new Very Large Crude Carriers (VLCCs) during 2023. This growth in Shipping was partially offset by a decrease in earnings from Gas Carriers due to a reduction in spot charter-in activity and lower LNG Carrier time charter equivalent rates compared to H1 2023.

Shipping EBITDA increased 38% to $232 million (AED852 million) from H1 2023, contributing to a 4-percentage point expansion in EBITDA margin to 45%.

Revenues from the Marine Services segment increased 1% to $89 million (AED327 million) compared to H1 2023. This segment generated an EBITDA of $29 million (AED107 million), up 64%, primarily driven by higher volumes in petroleum ports operations and by the marine terminal operations contract with ADNOC Offshore effective from 1 January 2024.

Strategic Update

ADNOC L&S continues to accelerate the execution of its transformational growth strategy.

The acquisition of Navig8 will expand the Company’s geographic footprint and its diversified fleet by adding 32 owned modern tankers and a presence in 15 cities across five continents. Navig8’s global presence will greatly enhance ADNOC L&S’ international profile as a global energy maritime logistics company and expand its blue-chip customer base in key markets. The acquisition, announced in Q2 2024 and currently subject to customary regulatory approvals, will be immediately value-accretive and is projected to increase earnings per share by at least 20% for ADNOC L&S shareholders.

The Company awarded South Korean shipyards, Samsung Heavy Industries and Hanwha Ocean, up to $2.5 billion (AED9.2 billion) in shipbuilding contracts for the construction of 8-10 new Liquified Natural Gas (LNG) Carriers. The vessels are expected to be delivered beginning 2028 and will be time chartered to ADNOC Group subsidiaries for a period of 20 years to support the growing export volumes of natural gas as an in-demand and critical, lower-carbon transitional fuel. The new vessels will increase the Company’s fleet of LNG Carriers from 14 to at least 22 vessels.

In Q2 2024, AW Shipping, a strategic joint venture between ADNOC L&S and Wanhua Chemical Group, signed shipbuilding contracts with Jiangnan Shipyard in China priced at approximately $1.9 billion (AED7 billion) in aggregate, for the construction of nine Very Large Ethane Carriers (VLECs), priced at approximately $1.4 billion (AED5.1 billion) and scheduled to be delivered from 2025 to 2027, and two Very Large Ammonia Carriers (VLACs), priced at approximately $250 million (AED918 million) with the option for another two VLACs at the same pricing, scheduled to be delivered from 2026 to 2028. The VLECs will be deployed on 20-year time charter contracts, generating revenue of $4 billion (AED14.7 billion) through 180 years of aggregated contract coverage. The VLACs are not yet contracted and are targeted to serve the emerging ammonia transportation market, which is anticipated to see substantial growth.

Technology and AI Adoption

ADNOC L&S continues to accelerate the application of industry leading Artificial Intelligence (AI) solutions to improve operational efficiencies and increase the safety for its people and assets, enabling a 100% HSE culture. In 2023, the Company strengthened its use of the “Smart Ship” system, an AI-based maritime predictive maintenance solution for planning optimization and operational efficiency of ocean-going vessels, improving overall fleet performance and asset reliability.

The Company also deployed the AI-based “SMARTi” system which is running onboard more than 80 vessels to bolster maritime health and safety, by acting as an early warning system in the prevention of harm and injury to seafarers.

These AI systems have played a critical role in the Company’s market-leading HSE success including a 30% decrease in the carbon emissions intensity of fleet operations since 2020, and a 71% reduction in the Lost Time Incident Frequency rate between 2018 and 2023. The newbuild LNG Carriers from South Korea will employ cutting-edge technologies to increase fuel efficiencies and carbon intensity reductions in line with ADNOC L&S’ sustainability goals.

Sustainability and Decarbonization

ADNOC L&S serves as a critical custodian of the UAE’s maritime legacy and continues to accelerate its sustainability journey in line with ADNOC Group’s 2045 Net Zero target, the UAE’s 2050 Net Zero strategy, and the International Maritime Organization’s 2050 Net Zero target and goal to reduce carbon emissions intensity by 40% by 2030.

The Company continues to make major progress in this journey, including a 24% improvement in energy efficiency across the Company’s shipping fleet since 2020; approximately $2 billion (AED7.3 billion) committed to building environmentally efficient vessels; and with 13 vessels running on biofuels since 2020.

The order placed for the new LNG carriers by ADNOC L&S, along with the orders for VLECs and VLACs placed by AW Shipping, represent a major step forward in the ADNOC L&S transformational growth strategy by accelerating the Company’s decarbonization objectives. The VLECs can be powered by ethane or conventional fuels, the VLACs can be powered by liquefied petroleum gas (LPG) or conventional fuels. As new energy resources, ethane and ammonia will play critical roles in decarbonizing industrial processes around the world.

The LNG vessels will feature cutting-edge sustainability technologies, including a cargo conditioning system designed to reduce LNG cargo evaporation whilst in transit, systems to direct cargo boil-off gasses to the engines that will increase fuel efficiency and decrease fuel consumption, a real-time emissions monitoring system, and pioneering cargo containment systems to reduce methane emissions.

Financial Summary

Outlook

The Company has revised its full-year 2024 guidance upwards:

- Group Revenues: The Company revised annual revenue growth upwards to the low to mid 30% range in 2024 (previously low 30% YoY). Over the medium term (2024-2028), the Company expects high single-digit year-on-year percentage growth.

- Group EBITDA: The Company anticipates annual EBITDA growth from 2023 to 2024 in the low 30% range. Over the medium term (2024-2028), the Company targets average annual EBITDA growth in the mid-teens percentage wise.

- Group Net Income: The Company expects annual year-on-year net income growth in the low 20% range into 2024. Over the medium term, the Company targets average annual net income growth in the low percentage teens.

- Dividend policy: Remains unchanged with a projected total dividend payable for 2024 of $273 million (5% increase from 2023 annualized dividend), payable 50% for 1H 2024 in Q4 2024, subject to approvals.

- Capital Structure: The Company targets a 2.0-2.5x net debt / EBITDA ratio over the medium term, with debt and free cash flows after dividends being the primary funding sources for growth investments.

About ADNOC Logistics & Services

ADNOC Logistics & Services Plc, listed on the Abu Dhabi Securities Exchange (ADX symbol ADNOCLS / ISIN AEE01268A239) is a global energy maritime logistics company based in Abu Dhabi. Through its three business units, integrated logistics, shipping and marine services, ADNOC L&S delivers energy products to more than 100 customers in over 50 countries.

To find out more, visit: www.adnocls.ae

For media enquiries, please contact media@adnocls.ae

For investors enquiries, please contact: IR@adnocls.ae