PHOTO

Abu Dhabi Islamic Bank (ADIB) is a leading financial institution in the UAE and one of the largest Islamic banks globally. Serving over 1.3 million customers, it offers a comprehensive range of retail, corporate, business, private banking, and wealth management solutions. Outside of the UAE, ADIB has a significant presence in six strategic markets, including Egypt where it operates 70 branches, Saudi Arabia, the United Kingdom, Sudan, and Iraq.

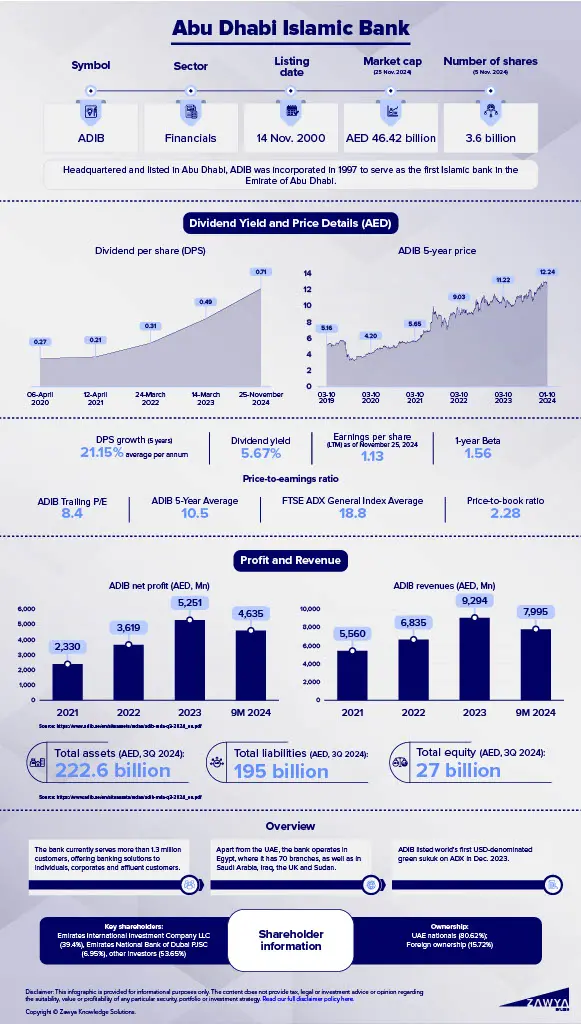

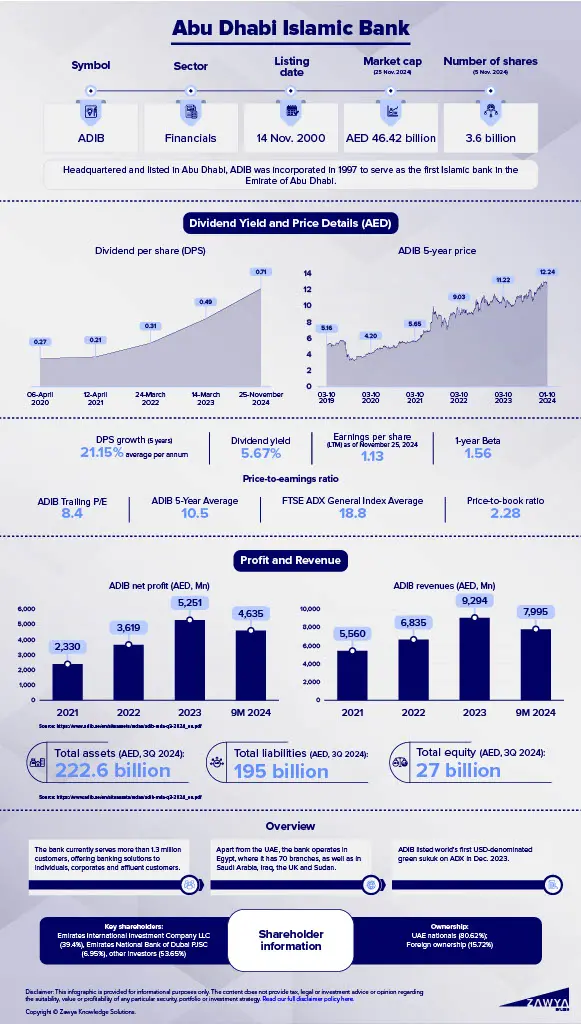

Recent financial results illustrate ADIB’s robust performance. In the first nine months of 2024, the bank reported a net income of AED 4.6 billion, marking a 24% year-on-year increase driven by strong customer financing and rising non-funded income. Additionally, ADIB achieved a 14% year-to-date growth in current and savings accounts (CASA), representing an increase of AED 6.4 billion, highlighting its success in expanding market share.

Click here to download infographic

Over the past five years, the bank’s stock has risen by 125.5% as of October 2024, outperforming the average share performance of its peers on the Abu Dhabi Securities Exchange (ADX). With a price-to-earnings (PE) ratio of 8.5 times, ADIB’s valuation surpasses the peer average of 7.3 times, reflecting investor confidence in its continued growth potential.

The bank's financial performance is underpinned by a strong dividend track record and high liquidity. ADIB consistently delivers attractive dividends, with an average yield exceeding 5%.

A major area of focus for ADIB is sustainability and responsible banking. In 2023, the bank issued the world's first USD green sukuk by a financial institution, valued at USD 500 million. It has also facilitated AED 5.7 billion in sustainable finance, furthering its impact in the sector. This dedication to environmental, social, and governance (ESG) principles is reflected in its AA rating from MSCI ESG, underscoring ADIB’s commitment to ethical and sustainable practices.

ADIB has also set a clear path for future growth through several strategic initiatives. The ADIB 2035 Vision outlines a roadmap for the bank's development, focusing on innovation and expansion to strengthen its market position. Part of this strategy is ADIB Ventures, a programme designed to foster collaboration with the global fintech sector, driving digital transformation and embracing technological advancements in financial services.

This move is significant as 80% of existing ADIB customers are engaged through digital platforms, and 99% of its banking transactions are completed digitally. The digital shift includes pioneering efforts in generative AI, where ADIB is developing a framework for AI-driven solutions in fraud management, compliance, and customer service, aiming to enhance operational efficiency and customer experience.

ADIB’s product and service offerings are diverse. In investment and corporate finance, the bank provides services in investment banking, corporate banking, and contracting, catering to the complex needs of large enterprises and institutions. In the realm of transaction and commercial banking, ADIB offers liquidity management, trade finance, payments, and cash management, making it a vital partner for businesses seeking efficient financial solutions.

Additionally, ADIB is active in wholesale banking, operating in countries like Iraq, Qatar, and Sudan, reflecting its ambition to capture business opportunities in key Middle Eastern markets.

For more insights on market data, please visit ADX Market Watch