PHOTO

ADNOC Gas, a subsidiary of the Abu Dhabi National Oil Company (ADNOC), manages the processing, transportation, and marketing of natural gas. Created as part of ADNOC's efforts to diversify its hydrocarbon portfolio, ADNOC Gas focuses on maximising the value of UAE’s natural gas reserves. It supplies to both domestic and international markets as the commodity becomes a vital energy source in commercial and residential power generation worldwide.

The company’s operations span the entire gas value chain, encompassing exploration, production, processing, transportation, and storage. ADNOC Gas manages the processing of raw natural gas from ADNOC's upstream fields, separating it into its various components, such as methane, ethane, and natural gas liquids (NGLs), which are then distributed for both domestic consumption and export.

ADNOC Gas operates an extensive pipeline network that facilitates the transportation of natural gas across the UAE, ensuring a continuous and efficient supply to meet demand. In addition to providing energy for domestic consumption, ADNOC Gas exports liquefied natural gas (LNG) globally.

Strategic Growth Drivers

ADNOC Gas is expanding its gas processing capacity through the Integrated Gas Development project. The latest phase, IGD-E2, is expected to come on stream soon, facilitating the supply of an additional 370 million standard cubic feet per day (mmscfd) of gas from Das Island to its onshore processing hub in Habshan, Abu Dhabi. This will bring the total gas export capacity to nearly 1.97 billion standard cubic feet per day (bscfd).

Meanwhile, its Ruwais LNG project, currently being developed in Al Ruwais Industrial City, Abu Dhabi, is poised to be the first LNG export facility in the Middle East and Africa region to operate on clean energy. The low-carbon facility will leverage artificial intelligence (AI) and digitalisation to boost efficiency and safety throughout the plant. Ruwais LNG comprises two LNG liquefaction trains with a total export capacity of 9.6 million tonnes per annum.

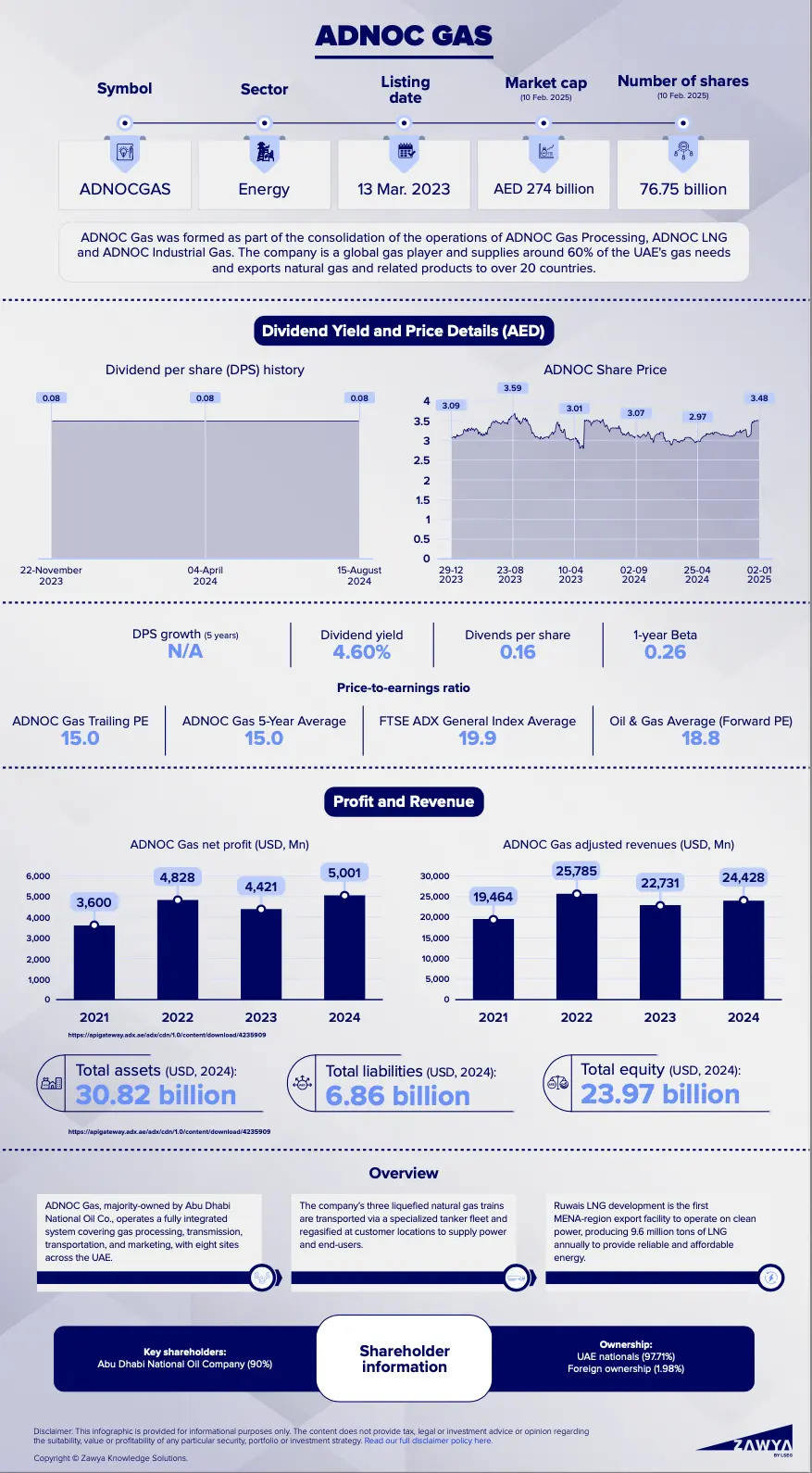

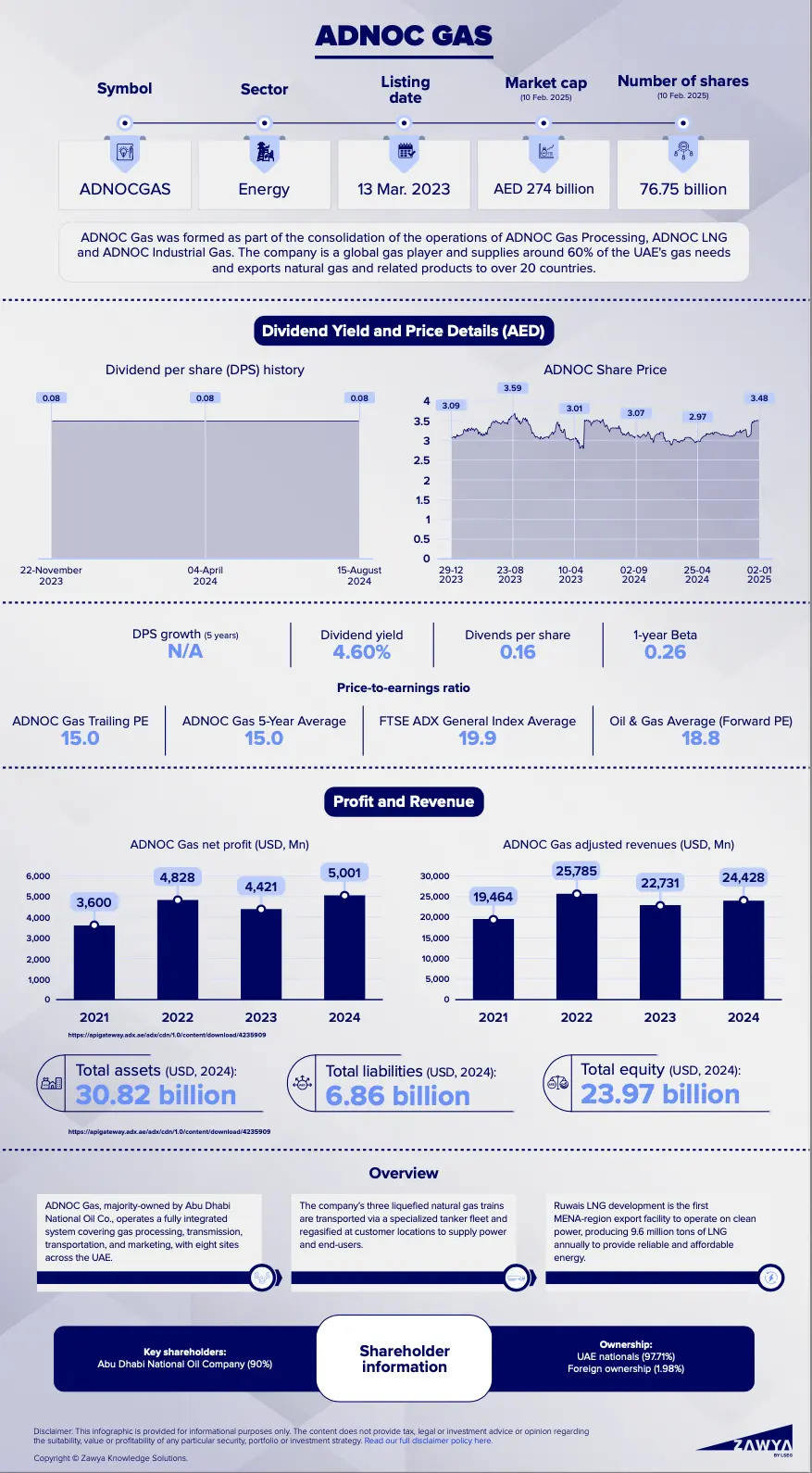

Click here to download infographic

Investment Analysis

ADNOC Gas has displayed strong fundamentals, including high profit margins, low debt levels, and growing dividends.

Share growth potential

ADNOC Gas currently has a risk rating of 10, which is significantly above the FTSE ADX General index average rating of 5.1.

ADNOC GAS shares are currently trading 3.2% above their 50-day moving average of 3.48 and 11.1% above their 200-day moving average of 3.23.

Relative valuation

ADNOC Gas currently has a Relative Valuation Rating of 4, which is significantly below the FTSE ADX General index average rating of 5.7.

- ADNOC GAS's 3.4 price-to-sales multiple is currently at the high end of

its 5-year range (lowest 3.0 to highest 3.5).

- ADNOC GAS's Trailing price-to-earnings (P/E) of 15.0 represents a 0.4% Premium to its 5-year average of 15.0.

- ADNOC GAS's Forward P/E of 18.8 represents a 17% premium to its 5-year average of 16.0.

Fiscal position

ADNOC Gas reported revenue of $24.4 billion in 2024 while net income stood at $5 billion for the same year, supported by sales in higher margin liquids coupled with increased efficiency. Revenues increased by 7% from $22.7 billion in 2023.

Domestic gas sales were up 2% from 2023 while ADNOC Gas’s share of LNG volumes increased by 13% in the same period. The company’s earnings before interest, taxation, depreciation, and amortisation (EBITDA) was $8.6 billion for 2024, representing a year-on-year increase of 14% over 2023’s EBITDA.

Capital expenditure totalled $1.83 billion for 2024, primarily due to ADNOC Gas’s growth projects such as Meram.

Return on equity

Market data revealed ADNOC Gas’ ability to deliver value to shareholders through a stable 22% return on equity, robust fiscal performance, and solid industry position.

For more insights on market data, please visit ADX Market Watch