PHOTO

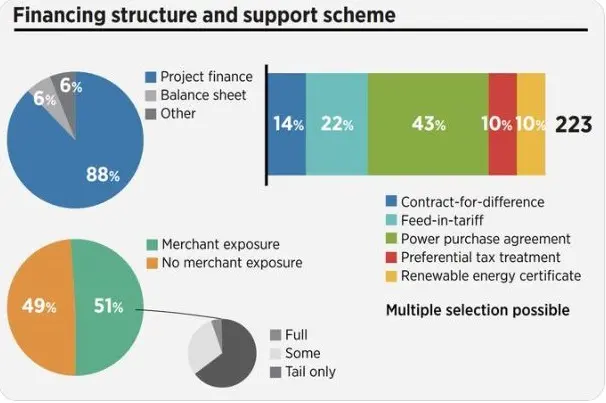

Project finance dominated renewable energy finance deals with 88 percent of the experts surveyed by the International Renewable Energy Agency (IRENA) choosing it over other mechanisms.

The findings of the survey conducted with experts in 45 countries in six continents was detailed in a report titled “The cost of financing for renewable power” released this week.

A few balance sheet projects (about six percent), distributed equally between solar photovoltaic and onshore wind, were located mainly in China, with one each in Chile, Bulgaria, Peru and Romania.

“For these deals, the regulatory environment may be more uncertain and hence project finance structures without recourse might entail too much risk to be a viable option, driving debt costs to uncompetitive levels,” the report observed.

Merchant exposure is common

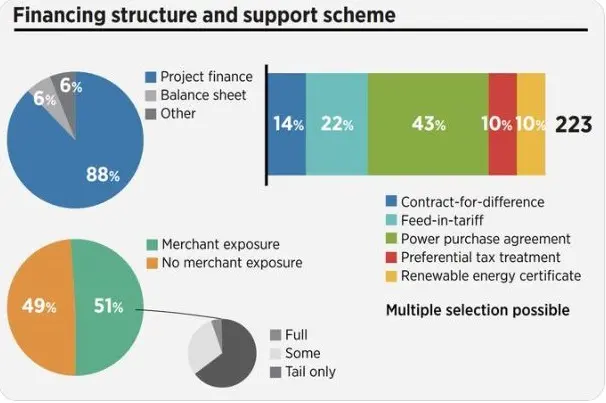

While renewable energy projects are increasingly financed with merchant exposure these days, the survey found that full merchant exposure remains rare.

Many renewable power projects could earlier only be financed if they received a guaranteed price for electricity produced from a credible offtaker – often utilities or a government entity.

“The majority of projects facing merchant exposure either have some merchant exposure during their lifetime (for example, a price floor or less than 100 percent of output covered by a fixed-price contract - or a tail exposure only (for example, exposure after the end of the contracted period of the guaranteed price by the trusted offtaker). The extent of tail exposure varies depending on the support scheme in place, or contract duration, and can range from minimal to 10-15 years or more. As renewable power generation economic lifetimes grow, however, these “tail only” merchant exposures are likely to become more prevalent and important in scope.”

Though it is not clear if this will have a material impact on financing conditions for project developers, there will be an increasing market in the future for refinancing by asset owners at the tail end of the project’s lifetime, the report stated.

“Contractual arrangements for securing revenue flows of existing assets part way through their operational lifetime (for example, through a power purchase agreement (PPA) with a corporate buyer), will thus become more important through time.” the report noted.

PPAs dominate revenue streams

About 43 percent of the respondents picked PPAs with governments, utilities or corporate buyers as the common mechanism to secure revenues. Feed-in-tariffs accounted for 22 percent of responses and contracts-for-difference (CfDs), for another 14 percent.

“The contractual details of all these approaches can vary in important ways, including their duration, pricing arrangements, volume responsibilities relative to the market. These arrangements provide the revenue security that can be used to make a project “bankable” and ensure access to reasonable financing conditions,” the report noted.

It continued: “The structure of offtake arrangements may also involve more than one type of mechanism, with government backed CfDs or PPAs covering a portion of the plant’s output and merchant exposure anticipated to be hedged with corporate PPAs. Given that corporate or utility PPAs tend to have shorter durations than those provided by governments, this portion of the output might need to be offered to the market more than once over the life of the asset.”

(Writing by Sowmya Sundar; Editing by Anoop Menon)