PHOTO

Saudi Arabia’s construction contract awards touched 25.2 billion Saudi riyals ($6.7 billion) during the third quarter of 2022 driven by Vision [2030] Realisation Programmes (VRP) related to tourism and housing along with physical infrastructure, according to a report by the US-Saudi Business Council (USSBC).

Though the third quarter contract awards dipped 6 percent year on year (YoY), the value of awarded contracts so far is on track to exceed 2021’s performance, the report said.

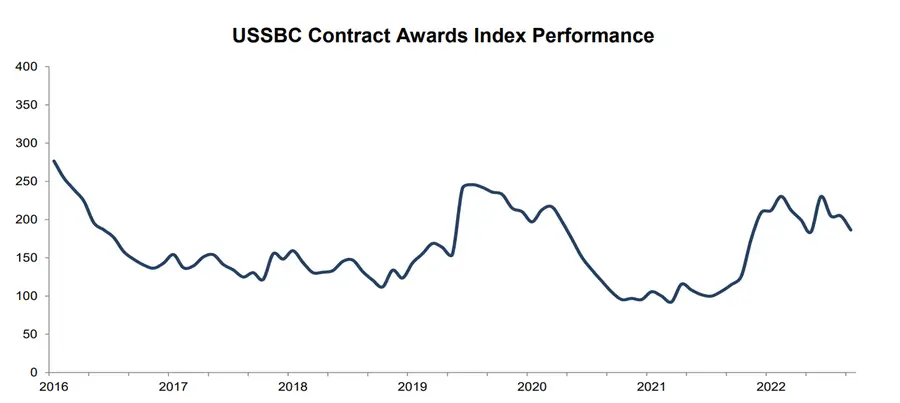

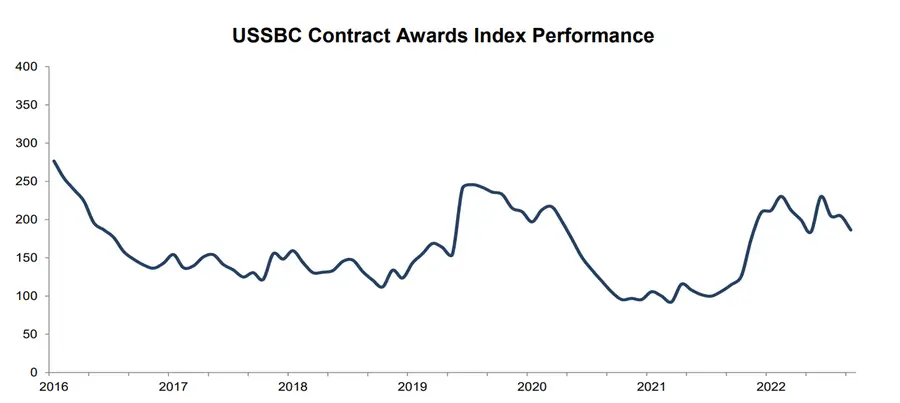

Contract Awards Index (CAI) Performance Through Q3 2022

The USSBC Contract Awards Index (CAI) retracted to 188.11 points by the end of the third quarter. Although the CAI dipped below 200 points, the first since the third quarter of 2021, it remains well above the 100-point threshold that separates expansion from contraction, according to the report.

During third quarter of 2022, the CAI grew by 73.27 points or 64 percent YoY but decreased by 41.88 points or 36 percent QoQ.

The CAI’s performance during the first three quarters of 2022 reveals the health of the construction sector as value of construction projects under execution continue to soar.

The value of executed projects witnessed a sizeable rebound after bottoming out in 2020. Mega projects awards across a number of sectors and delivery of VRPs are expected to keep construction activity buoyant in the coming years.

Awarded Contracts by Sector Q3 2022

Through the first three quarters of 2022, the value of awarded contracts reached SAR119.7 billion ($31.9 billion), representing a 67 percent increase YoY.

Real Estate: The real estate sector rebounded from a soft second quarter as it awarded 15 contracts worth SAR12.6 ($3.3 billion) during the third quarter. Mixed-use real estate led with one contract worth SAR7.5 billion ($2 billion), while the residential real estate market witnessed eight contracts worth SAR4 billion ($1.1 billion), followed by commercial real estate with four contracts worth SAR548 million ($146 million), and hospitality with two contracts worth SAR544 million ($145 million).

Overall, the real estate sector grew by SAR11.7 billion ($3.1 billion) QoQ during the third quarter and increased by SAR6.3 billion ($1.7 billion) or 102 percent YoY.

Through the first three quarters of 2022 (YTD), real estate gained the third highest value of awarded contracts by sector with SAR23 billion ($6.1 billion) or 19 percent of the total, after transportation and oil & gas.

On a YoY comparison, the real estate sector’s awarded contracts grew by SAR9.7 billion ($2.6 billion) or 73 percent.

Transportation

The transportation sector witnessed a drop in contract awards during the third quarter but remained the second highest performer with a value of SAR3.4 billion ($912 million). The 12 contract awards during the quarter were dominated by Neom’s four infrastructure and earthwork packages pertaining to The Line’s highspeed rail link called ‘The Spine.’

The transportation sector awards declined by SAR18.9 billion ($5 billion) QoQ but advanced by SAR780 million ($208 million) or 30 percent YoY. On a YTD basis, the transportation sector has attracted SAR32.6 billion ($8.7 billion) in contract awards or 27 percent of the total, which ranks at the top.

On a YoY comparison, the transportation sector remains well ahead of last year’s pace as it posted an increase by SAR8.1 billion ($2.2 billion) or 303 percent.

Water

The water sector maintained its position as the third highest in terms of awarded contracts to reach SAR3.2 billion ($863 million). All four contracts were awarded by SWCC and NWC evenly, and involved the construction of reservoirs, pump stations, water transmission pipelines, and developing sewage networks.

The water sector declined by SAR2.9 billion ($772 million) or 47 percent QoQ and by SAR3.3 billion ($890 million) or 51 percent YoY. On a YTD basis, the water sector has garnered SAR12.6 billion ($3.4 billion) in awarded contacts or 11 percent of the total, which ranks as the fourth highest. On a YoY comparison, the water sector increased by SAR555 million ($148 million) or 5 percent.

Awarded Contracts by Region Q3 2022

The Makkah region registered the highest tally as it attracted SAR10.2 billion ($2.7 billion) or 42 percent contribution. The real estate sector accounted for a majority of contracts garnering SAR7.8 billion ($2.1 billion) or 76 percent of the total.

The power sector registered the second highest value of awarded contracts in Makkah with SAR1.3 billion ($340 million) as the Saudi Electricity Company (SEC) undertook the construction and expansion of several substations. The urban development sector accounted for the third largest share with SAR506 million ($135 million).

The Tabuk region accumulated the second largest share of awarded contracts by region with SAR4.5 billion ($1.2 billion) or 18 percent of the total. Neom’s awarding of five transportation infrastructure packages including the initial development of ‘The Spine,’ accounted for SAR2.2 billion ($590 million) or 49 percent of Tabuk’s total. The remaining contracts involved development packages at Red Sea Global worth SAR469 million ($125 million). The other major contributing sector was water with SAR1.8 billion ($480 million) or 40 percent.

The Eastern Province contributed SAR3.7 billion ($974 million) or 15 percent of the total. The oil & gas sector accounted for the highest share with SAR1.6 billion ($420 million) or 43 percent. The industrial sector accounted for the second highest value with SAR900 million ($240 million). The real estate sector accounted for the third highest share with SAR713 million ($190 million) or 20 percent.

Contract awards outlook

“The improved macroeconomic environment spurred by the Kingdom’s oil revenues coupled with ongoing non-oil sector initiatives have helped propel project awards,” said Albara’a Alwazir, Director of Economic Research at the U.S.-Saudi Business Council.

Saudi’s economic diversification projects have fuelled surge in cement sales, which has now grown seven consecutive months since May 2022. The gradual decrease in the cost of building materials has aided the viability of projects in the execution stage.

Over the last two quarters, NEOM has played a significant role in ramping up construction contracts. Thus far in 2022, it has awarded SAR23.7 billion ($6.3 billion) worth of contracts across a number of sectors. Projects such as ‘The Line’ and its railway network, ‘The Spine’ have contributed to the biggest developments at Neom to date.

The total value of contract awards through the first three quarters of SAR119.7 billion ($31.9 billion) is 67 percent higher than the same period last year.

The government’s financial position as reflected in its budgetary performance is expected to increase the rate of mega project awards over the next few years.

(Writing by Senthil Palanisamy; Editing by Anoop Menon)