PHOTO

The hospitality industry in the Middle East and Africa region is experiencing notable shifts in its pipeline activity, according to the latest data released by CoStar Group, a global provider of real estate data, analytics, and news.

Kostas Nikolaidis, STR’s Senior Account Manager for Middle East & Africa, said: “There are a plethora of factors affecting hotel pipeline activity globally and regionally in the MEA region. One should not forget the testing and uncertain environment the industry has had to navigate in the last four years.”

He mentioned that COVID-19, travel bans, hotel closures, supply chain disruptions, rampant inflation, interest rate increases, wars, energy crises, and so on were among the challenges.

“However, the hospitality sector has successfully overcome the challenges even if some of the side effects remain in the form of temporary disruptions in the hotel pipeline,” explained Nikolaidis.

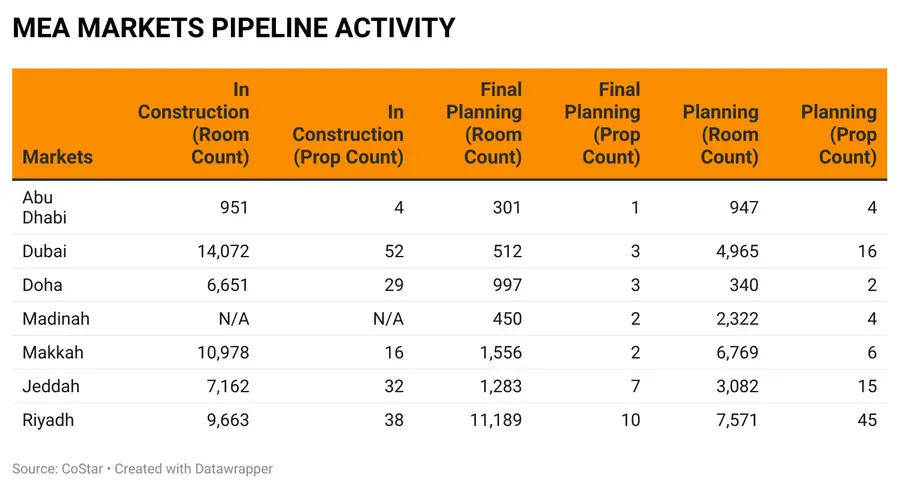

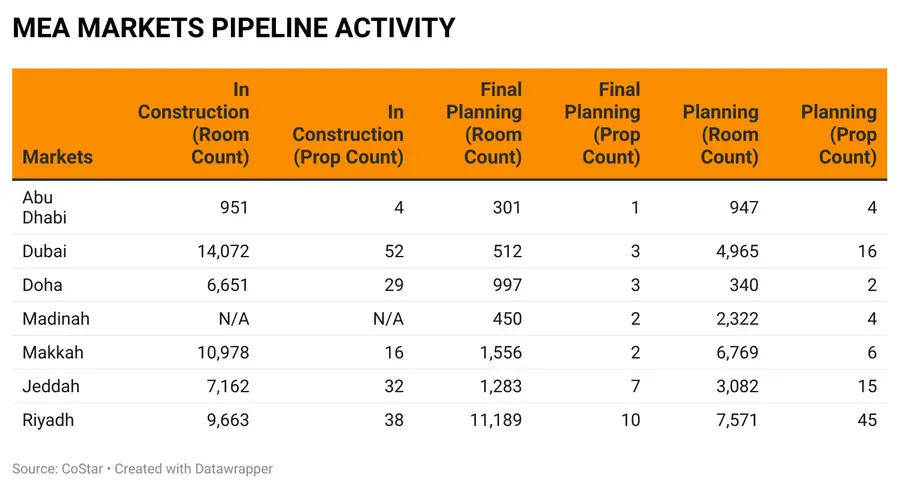

As of the end of the first quarter, CoStar data indicate a mixed picture for the MEA region.

In construction, there are 110,783 rooms, showing a decrease of 7.3 percent. Final planning stages show 36,173 rooms, down by 20.9 percent, while planning stages have 81,316 rooms, a 3.3 percent decrease. Overall, the total under contract stands at 228,272 rooms, marking an 8.5 percent decline.

“Apart from organic growth that naturally drives hotel development worldwide, key MEA markets have recently gone through significant event-driven hotel development cycles,” said Nikolaidis.

He stated that in the three years leading up to Expo 2020, Dubai had opened 136 hotels with 34,811 rooms. Similarly, Qatar had opened 66 properties with 12,268 rooms in the three years before the World Cup 2022.

“Following the recent development frenzy, it is expected to go back to normal growth which is what both those markets are currently experiencing,” explained Nikolaidis.

Notably, much of the region’s pipeline activity concentrates in the Middle East, with Saudi Arabia leading with 42,464 rooms under construction, closely followed by the United Arab Emirates with 19,046 rooms. These figures underscore the ongoing commitment to hospitality infrastructure development in these nations.

Nikolaidis mentioned that as a developing region, the spotlight keeps shifting, with Saudi Arabia's hotel development growing exponentially in the past years to match their ambitious vision.

“A familiar pattern reemerges where Riyadh has been chosen as the host city of Expo 2030. It is no coincidence that the Saudi capital currently leads the total under-contract pipeline in the MEA region.”

He mentioned that a total of 28,423 rooms are currently being developed on an existing supply of 20,926 rooms, representing a growth of 140 percent. Makkah and Dubai follow with 23,323 rooms and 19,549 rooms, respectively, in the pipeline.

As the region navigates through economic shifts and evolving travel trends, stakeholders continue to adapt strategies to ensure sustained growth and resilience in the hospitality sector.

CoStar Group highlights in its report that various markets, ranging from vibrant cities to sacred pilgrimage sites, display unique patterns of development and expansion.

The data, exclusively shared with Zawya Projects, unveils the following trends in the key markets of the MEA region:

Abu Dhabi: Despite a slight decrease in the number of projects in the final planning stage, the total room count remains steady, indicating a continued focus on expanding hospitality offerings in the capital city.

Dubai: With its reputation as a global hub for tourism and business, Dubai maintains a robust pipeline of hospitality projects. While the number of properties in the final planning stage has decreased, the sheer volume of rooms under construction signifies sustained investment in the city's hospitality infrastructure.

Doha: Qatar's capital city, Doha, demonstrates a mixed picture in pipeline activity. While the number of rooms in the final planning stage has decreased, there is a notable increase in projects under construction, reflecting ongoing efforts to enhance the city's hospitality landscape.

Madinah: As a sacred destination for millions of Muslims worldwide, Madinah experiences steady growth in hospitality projects. The significant jump in the number of rooms under construction underscores the importance of catering to the needs of pilgrims and visitors to the holy city.

Makkah: Home to the holiest site in Islam, Makkah continues to witness substantial investment in hospitality infrastructure. Despite a decrease in the number of projects in the final planning stage, the number of rooms under construction remains high, reflecting the demand for accommodation in the pilgrimage city.

Jeddah: As a key gateway to Saudi Arabia, Jeddah's hospitality sector is dynamic and diverse. While there is a notable increase in the number of projects in the planning and final planning stages, the number of rooms under construction indicates a shift towards execution and delivery.

Riyadh: The capital city of Saudi Arabia showcases impressive growth in hospitality projects across all stages of development. With a significant number of rooms under construction and in the final planning stage, Riyadh solidifies its position as a burgeoning hospitality market in the region.

Overall, the MEA hospitality pipeline activity reflects a mix of expansion, consolidation, and strategic development across various markets. As the region continues to attract tourists, business travelers, and pilgrims alike, stakeholders in the hospitality industry remain poised to capitalise on emerging opportunities and meet evolving consumer demands.

(Reporting by Syed Ameen Kader; Editing by Anoop Menon)

Subscribe to our Projects' PULSE newsletter that brings you trustworthy news, updates and insights on project activities, developments, and partnerships across sectors in the Middle East and Africa.