PHOTO

Shanghai-based New Development Bank (NDB) is looking at deepening its focus on local currency financing, said Vice-President and Chief Financial Officer Leslie Maasdorp.

“We will do more loans and investments into Renminbi, South African Rand, Indian rupee and so on,” he told CTGN, a state-owned TV channel last week.

“We will continue to lend in US dollars but make more use of the local currencies of our member countries,” he added.

NDB will direct 40 percent of all its lending to projects that reduce carbon emissions, either climate mitigation or adaptation.

“We will be expanding our footprint in all our member countries in the green and sustainable arena, helping them with their net-zero targets and green transition,” Maasdorp said.

Since its establishment in 2015, the BRICS-established bank has approved 99 infrastructure projects with a total value of $35 billion.

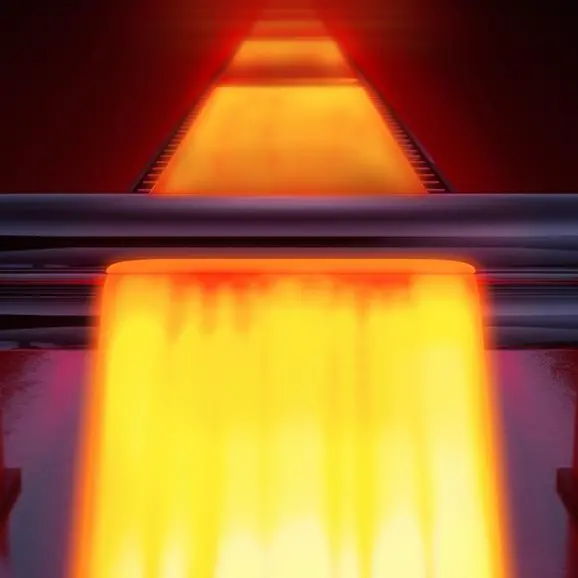

The portfolio comprises new power, battery storage, solar and wind power, and road and rail projects.

Brazil, Russia, India, China, and South Africa (BRICS) formally established the NDB.

In 2021, the Bank initiated membership expansion and admitted Bangladesh, Egypt, and the United Arab Emirates.

Uruguay is in the final stages of joining, Maasdorp said, adding Saudi Arabia has shown keen interest in becoming part of the bank.

(Writing by P Deol; Editing by Anoop Menon)