PHOTO

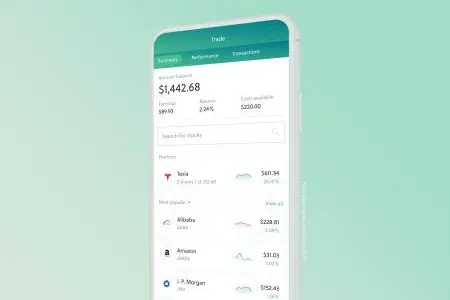

- Sarwa clients can trade stocks and ETFs through a simple mobile app — no commissions, no international transfer fees from local AED accounts, and no minimum account balance.

Abu Dhabi:- Sarwa today announced the launch of its highly anticipated product: Sarwa Trade. The new service will allow people to buy, sell, and track stocks and Exchange Traded Funds (ETFs) through a simple and intuitive mobile app. Users will have access to unlimited $0 commission trades of over 4,000 publicly traded stocks and ETFs listed on major U.S. exchanges.

Sarwa Trade is the first trading platform that offers zero commission as well as zero local transfer fee from AED accounts, for retail clients in the UAE. It gives them access to reliable, regulated, and affordable trading. Many trading platforms add a dealing charge, a management fee and/or an administration fee when you buy or sell shares through them. Zero commission means that Sarwa does not charge any fee on buying and selling stocks or ETFs, and no dealing fee, management fee, commission fee, or administration fee for Sarwa Trade.

"The options for stock trading in the MENA region are few and far between — traditional brokerages have high fees, the technology is dated, and the experience isn't exactly user-friendly," said Mark Chahwan, CEO and co-founder of Sarwa. "We saw an opportunity to take the simple, human approach we're known for and apply it to the trading experience. We always have our clients and community at the center of what we do, and that’s why our product is localized for transfers. This way, UAE residents with a local account can avoid the high international transfer fees.’

Since launching to consumers in February 2018, Sarwa continues to revolutionize financial products in the region with the announcement of this new feature, especially after the continual success of its flagship product, Sarwa Invest. The app simplifies the trading experience with an intuitive and elegant design, in comparison to the confusing way traditional brokerages typically present trade. There's no minimum account size: users can start trading with just $1. Opening an account is fast and easy, and existing Sarwa clients can sign up with just one tap.

Sarwa Trade is great for new investors who want to start their trading journey, existing Sarwa clients looking to consolidate their investments, as well as experienced investors who will finally have the option of a more affordable, user-friendly platform.

"Our approach to investing hasn't changed: the most efficient way to grow your money long-term is to have a diversified, low-cost portfolio that tracks the market. Contribute to your portfolio regularly and stay the course. But that doesn't mean there's no place for buying and selling individual stocks as part of a holistic financial plan, said Mark Chahwan. He continues by saying: “Some international firms that target the market are not regulated. This is scary when you think about the small retail investors. Our community has been venturing into trading, and we feel we should support by providing them with the right platform.”

The Sarwa Trade app is currently available on iOS and Android, and has the following features and functions:

- Zero commission trading

- Zero transfer cost from AED accounts

- Fractional shares: buy in bulk or in fraction

- No account minimums. You can start with only $1

- Access to 4,000+ US listed stocks

- View real time stock prices

- Access to most popular & top movers’ stocks, stock metrics and companies’ profile

- Fast and easy online account opening

- Bank level security and SSL encryption

Through its mobile app, Sarwa aims to continue delivering more innovative personal finance products. Sarwa Trade is a self-directed trading service, while Sarwa invest provides hands-off long-term investing through globally diversified portfolios that reflects the risk level of the client.

The above opinions should not be considered as personalized investment advice and all investing involves risk.

For more information, email social@sarwa.co or check Sarwa’s help desk with FAQs

-Ends-

About Sarwa

Sarwa is a personal finance and investment platform on a mission to help everyone grow their wealth and build for a better future, regardless of age, net worth, or background. Sarwa makes investing easy, simple, and affordable by combining proven investment strategies with smart technology that drives down cost. The company was founded by a team of financial, technology, and management experts, and is backed by top regional and international stakeholders. Sarwa is regulated by the ADGM Financial Services Regulatory Authority (FSRA). To learn more, visit www.sarwa.co

© Press Release 2021

Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.