Global equities recorded a positive performance during the week as investors were encouraged by improving macroeconomic indicators, especially better-than-expected retail sales and strong upsurge in housing demand in the US. Furthermore, positive signs on vaccine development during midweek also boosted sentiments, which appeared to ease resurgence concerns. Oil prices were down 0.23% during the week as OPEC and its allies agreed to lower supply cuts from August 2020 amid growing uncertainty over the recovery in oil demand due to resurgence in new COVID-19 cases.

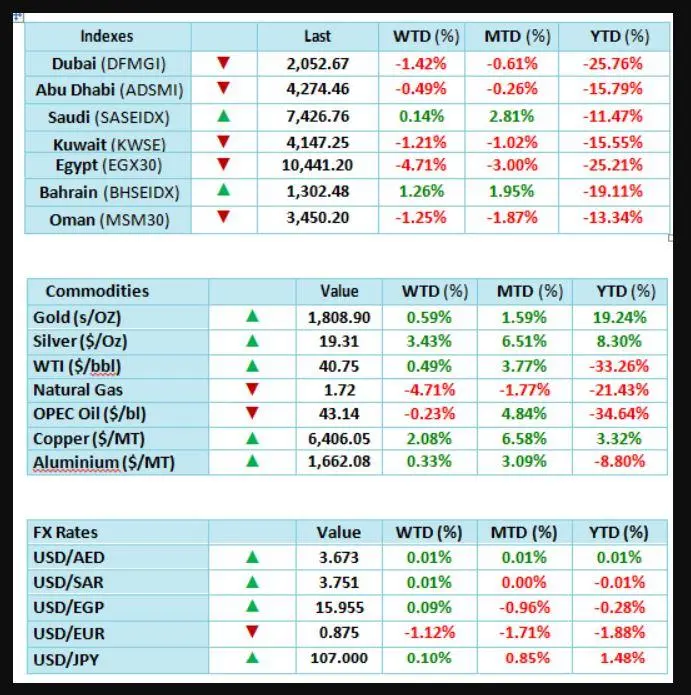

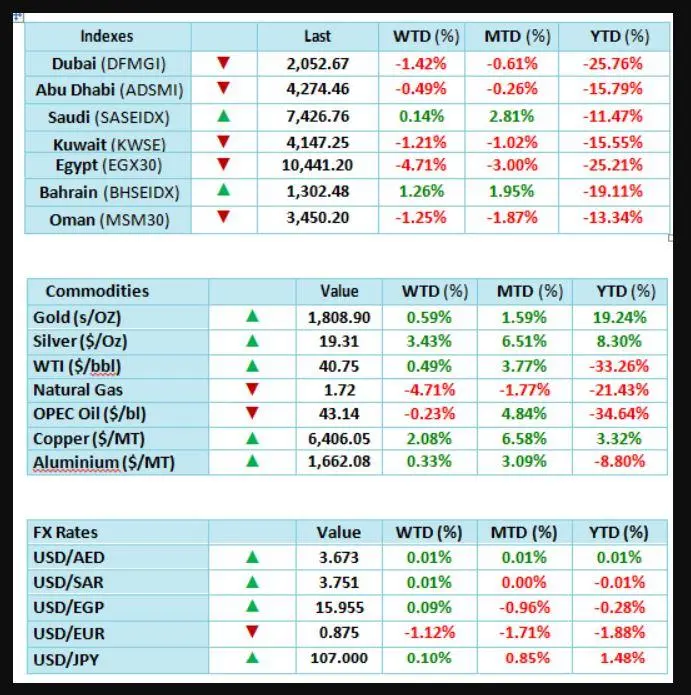

For the MENA region, equity markets continued to underperform the global markets, which can be largely attributed to depressed oil prices and its subsequent impact on the regional economies. For the week, 5 out of the 7 regional indexes closed in negative territory, while Bahrain and Saudi Arabia closed in positive territory with gains of 1.26% and 0.14%, respectively. Egypt was the worst performer regionally with losses of 4.71%, followed by 1.42% in Dubai, 1.25% in Oman, 1.21% in Kuwait, and 0.49% in Abu Dhabi.

Going forward, the outlook remains uncertain as the resurgence in new COVID-19 cases could possibility slowdown the global economic recovery. The acceleration in economic activity witnessed during the past two months has been encouraging, but it will be important to maintain the demand trajectory to continue the pace of recovery in economic activity. Volatility in equity markets are likely to remain at elevated levels, which will be largely influenced by reoccurrence of new virus cases.

For the MENA region, performance of the equity markets will be dominated by movement in oil prices and upcoming earnings season. Moreover, investors will draw meaningful cues from corporate earnings to gauge the real impact on businesses and accordingly position themselves within the markets.

About Allied Investment Partners PJSC

Established in 2007, Allied Investment Partners PJSC is licensed by Securities and Commodities Authority, UAE and is a leading investment firm providing various services like Asset Management, Alternative Investments, Wealth Management, Securities and Custody Services, Corporate Finance and Investment Banking Advisory.

For more information, please visit

For media enquiries, please contact Matrix Public Relations

Krishika Mahesh: Krishika@matrixdubai.com

© Press Release 2020

Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.