PHOTO

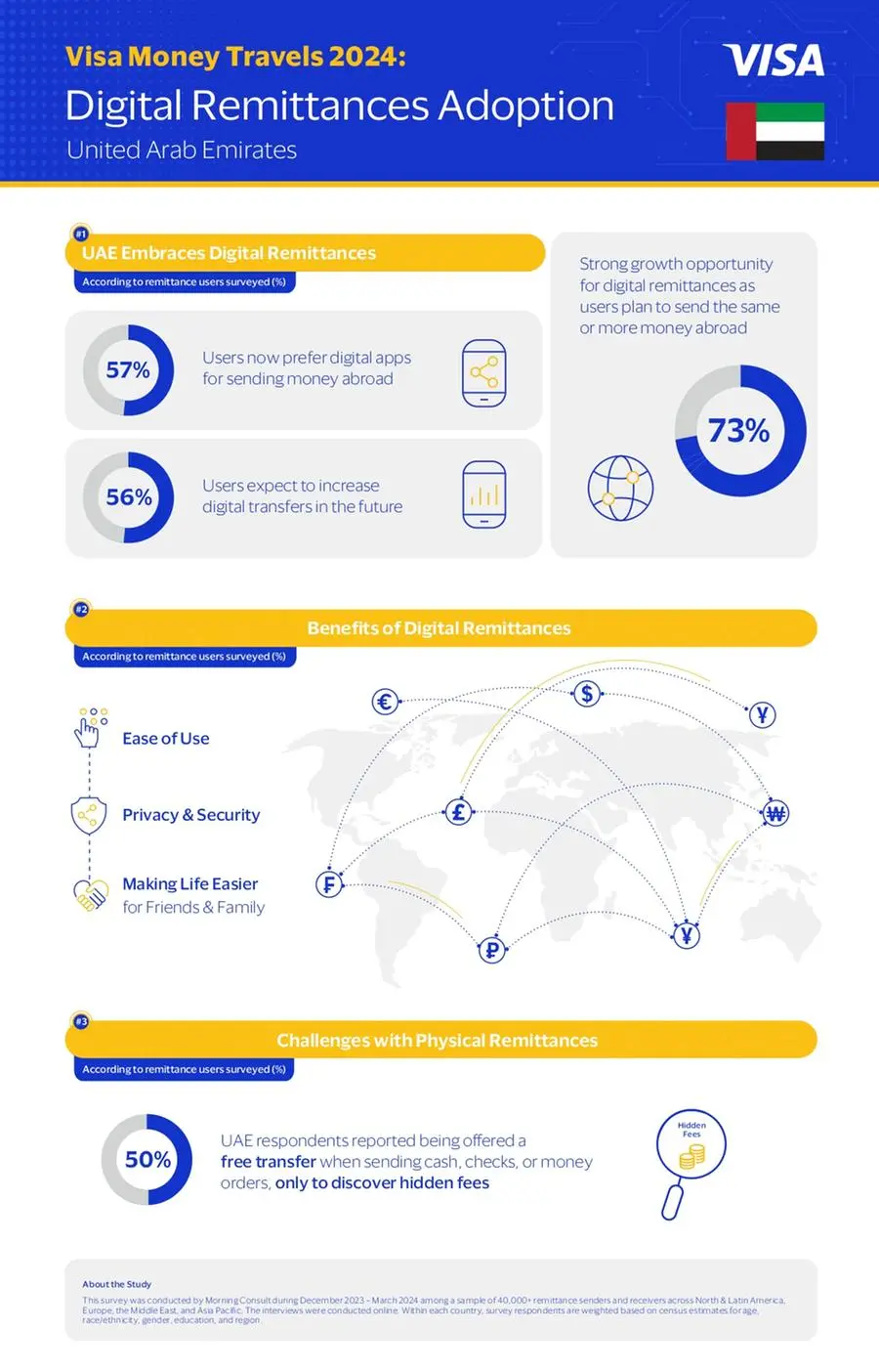

- The top benefits of sending or receiving international payments digitally are ease of use, privacy/security, and making life easier for friends and family.

- 56% of surveyed remittance users in the UAE expect to use digital money transfers more often in the future

Dubai, UAE — As remittances remain a lifeline for millions of expatriates in the UAE and their families, Visa’s annual “Money Travels: 2024 Digital Remittances Adoption” research report found that UAE remittance senders are primarily motivated by the need to provide regular support to their families abroad and address unexpected emergencies. Additionally, the report revealed that beyond supporting their families, senders also prioritize aiding those in need in response to global events.

The Money Travels: 2024 Digital Remittances Adoption study examines how consumers send money abroad, diving into the rates, methods, and reasons for sending and receiving payments. According to the global survey of nearly 45,000[1] respondents, the need for fast, easy and secure payments has never been more important to families, communities and economies in the UAE and worldwide. The report also found that digital applications are the preferred method for moving money globally for over two-thirds of remittance users in various markets.

While global remittances declined year-over-year due to various economic challenges, survey results in the UAE - identified as one of the countries with a higher percentage of remittance senders compared to receivers - have also shown a positive outlook on future remittances, with 73% of respondents in the country planning to send the same or more money abroad.

“Security, ease and speed are the top priorities for expatriates in the UAE when sending money abroad to support families back home or aid people in crisis,” said Visa’s Salima Gutieva, VP and Country Manager for UAE. “This research shows that digital payments are becoming a key tool for providing instant support, whether for unexpected medical bills, education, or food. There is more work to be done within the industry, however, to make cross border money movement more streamlined to create new opportunities for financial inclusion and wealth building in communities globally that rely on these lifeline payments.”

Highlights of the study include:

- Digital payments are the quickest payment method used among senders and receivers. Ease of use, privacy, security, and making life easier for friends and family are highlighted as the top benefits of sending or receiving international payments digitally.

- Digital apps remain the top method for both sending and receiving remittances in the UAE, followed by digital remittances at a physical location. Usage of physical remittances declines among senders in UAE. In December 2022, 9-15% of senders did not use cash/check/money order.

- Physical payments equate to hidden fees. Fifty percent (50%) of UAE respondents have been offered a free transfer when sending cash, checks, or money orders, only to find out there were hidden fees.

- High fees – including how exchange rates are calculated - are a top issue for digital transfers. Fees were a key issue for 38% of remittance senders and 33% of recipients. Additionally, 20% of senders and 23% of recipients struggled with calculating exchange rates.

- Motivation for sending remittances in the UAE. Education costs and supporting the lives of people in crisis are among the top cited reasons why UAE remittance users send or plan to send money to help improve prospects.

Visa works in collaboration with global remitters and enablement partners such as Brightwell, Thunes, Remitly, Western Union and Asia United Bank (AUB) to help enable efficient money movement through digitized remittances. Here in the UAE, Visa is working with its financial institution partners to enable Visa Alias Directory to meet the growing demand among local consumers for easier, cost-effective and more secure ways to move money internationally. Instead of dealing with long, complex account details, Visa Direct Alias allows consumers to seamlessly send and receive money internationally by using their phone numbers.

For more information about Visa Direct, please visit: https://corporate.visa.com/en/products/visa-direct/resources/money-travels-report-2024.html.

Survey Methodology

This survey was conducted by Morning Consult during December 2023 – March 24 among a sample of 40,000+ remittance senders and receivers across North & Latin America, Europe, the Middle East, and Asia Pacific. The interviews were conducted online. Within each country, survey respondents are weighted based on census estimates for age, race/ethnicity, gender, education, and region.

About Visa

Visa (NYSE: V) is a world leader in digital payments, facilitating transactions between consumers, in territories. Our mission is to connect the world through the most innovative, convenient, reliable and secure payments network, enabling individuals, businesses and economies to thrive. We believe that economies that include everyone everywhere, uplift everyone everywhere and see access as foundational to the future of money movement. Learn more at About Visa, visamiddleeast.com/blog and @VisaCEMEA.

[1] The Money Travels: 2024 Annual Remittances Adoption Report surveyed 43, 789 remittance users across North & Latin America, Europe, the Middle East, and Asia Pacific.