PHOTO

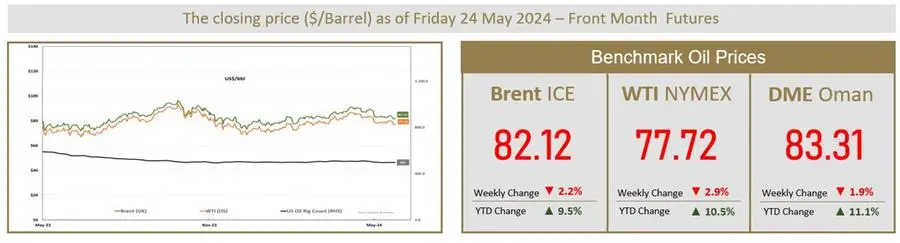

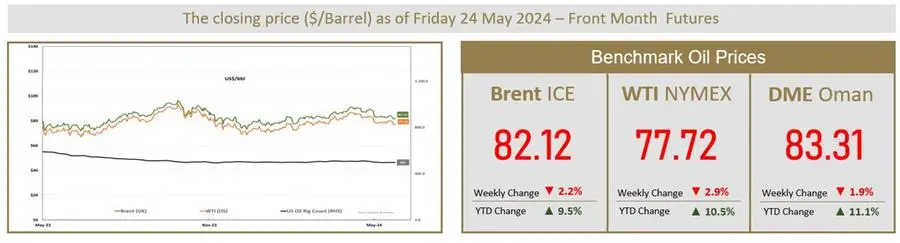

Oil Posts Weekly Loss as Interest Rate Policy Spurs Fuel Demand Worries

Oil prices rose about 1% on Friday, but fell for the week on worries that strong U.S. economic data would keep interest rates elevated for a longer period, curbing fuel demand. The Brent crude July contract rose 76 cents to $82.12 a barrel. U.S. West Texas Intermediate (WTI) crude futures settled 85 cents higher to $77.72. For the week, Brent closed down 2.1%, WTI settled down 2.8%. Worries over Federal Reserve interest rate policy and last week's bump in US crude oil inventories weighed on market sentiment. Minutes of the Fed's latest policy meeting released on Wednesday showed policymakers questioning whether interest rates were high enough to tame stubborn inflation. Some officials were willing to raise borrowing costs again if inflation surged. Consumer sentiment also fell to a five-month low on mounting fears about borrowing costs staying high. At face value, pessimism among households would imply slower consumer spending, though the relationship between the two has been weak. Oil demand is still robust from a broader perspective, analysts at Morgan Stanley wrote in a note, adding they expect total oil liquids consumption to increase by 1.5 million barrels per day this year.

Asian Spot LNG Prices at Five-Month High on Firm Demand, Geopolitical Risks

Asian spot liquefied natural gas (LNG) prices rose for the fourth straight week and hit its highest level in five months amid firm demand, tracking European gas market gains amid concerns over possible disruption to Russian gas supply. The average LNG price for July delivery into north-east Asia rose to $12.30 per million British thermal units (mmBtu), its highest level since mid-December and up from $10.90 per mmBtu in the previous week, industry sources estimated. Hot weather across some of the Asia region's markets has lifted power demand, supporting purchasing activity, while temperatures in eastern China are forecast to remain above seasonal norms, supporting power gas burn. In south-east Asia, some buyers recently issued tenders for longer-term cargoes. In Europe, gas market gains have tightened discounts to the Asian market substantially, amid maintenance outages in Norway and concerns over Russian pipeline supply after Austria's OMV said that gas supplies from Russia's Gazprom could be suspended in connection with a foreign court ruling. In the U.S., the front-month gas price fell about 4% on weekly bases after it soared about 63% over the prior three weeks.