PHOTO

Dubai, UAE: Based on Bayut’s H1 2024 findings, Dubai's off-plan property market is experiencing a remarkable surge, marked by impressive sales figures, high rental yields and strong investor confidence. Demand continues to outstrip supply, and the market's exceptional performance promises a positive future outlook.

The off-plan market in Dubai has reached new heights, with sales transactions totaling AED 103.8 billion in the first six months of 2024. This unprecedented growth is complemented by the thriving rental market in the city, helping investors to gain higher rental yields on their investment properties in the long run. The overall performance of Dubai's off-plan market underscores its status as a premier destination for real estate investment.

Trends in the Off-Plan Market

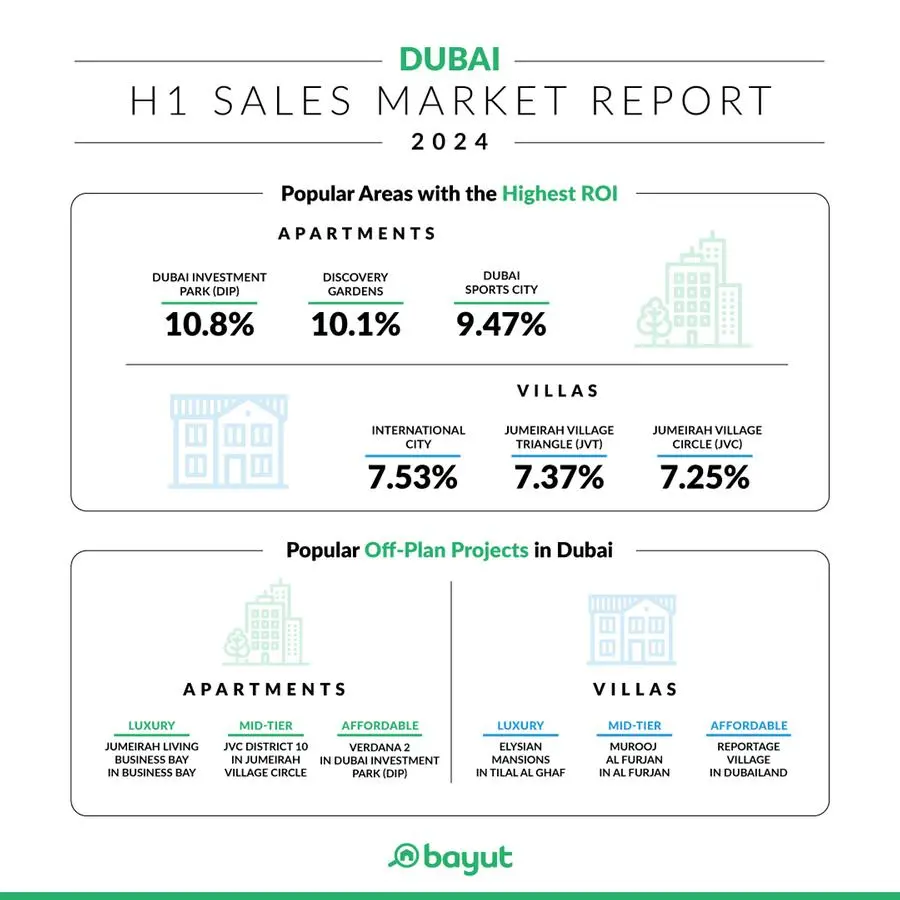

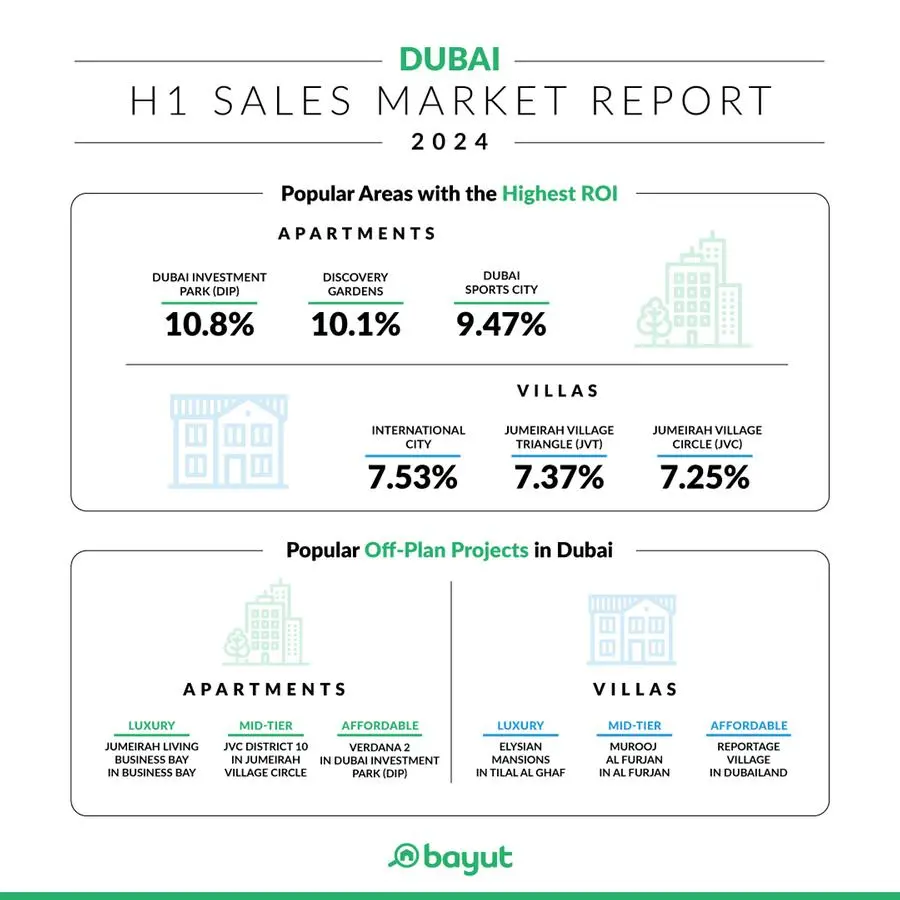

- Based on consumer interest recorded on Bayut, popular areas for affordable off-plan properties in Dubai include Dubai Investments Park (DIP), Dubailand, Dubai Residence Complex and Dubai South.

- Verdana 2 in DIP emerged as a top choice for budget-conscious investors, with average prices just above AED 500k, making it highly sought-after for affordable off-plan apartments in the first half of 2024. Similarly, Reportage Village in Dubailand has seen significant interest for its affordable off-plan villas, offering units priced slightly over AED 2M.

- For mid-tier off-plan properties, Jumeirah Village Circle (JVC), Arjan and Jumeirah Lake Towers (JLT) are popular among apartment seekers, while Al Furjan, Arabian Ranches 3 and Nad Al Sheba 1 attracted buyers interested in villas.

- In the luxury segment, high-rise off-plan projects in Business Bay, Downtown Dubai and Palm Jumeirah have dominated buyer interest.

The high demand for off-plan properties and limited supply has heightened competition in Dubai's real estate sector. Investors are drawn to prime locations for their potential returns and strategic benefits. Innovations like AI-driven platforms such as TruEstimateTM are transforming investment strategies, providing enhanced market transparency. Additionally, proactive government policies aimed at protecting investor interests and promoting sustainable growth have strengthened investor confidence, helping to maintain a stable and secure investment environment in Dubai.

In response to the overall performance of the off-plan market in Dubai, Haider Ali Khan, CEO of Bayut and Head of Dubizzle Group MENA, remarked:

“Over the past year and during the first six months of 2024 in particular, Dubai’s off-plan market has been thriving like never before and showing promising signs of extraordinary growth. With approximately 48,000 new units being launched during H1, demand is still high with the influx of new residents continuing to rise.

The momentum is also strong, thanks to ongoing infrastructural developments and Dubai government’s constant adeptness at navigating global economic shifts. At this pivotal time, during the rise of the off-plan market, strategic initiatives such as enhanced market transparency through advanced tools like TruEstimateTM, will go a long way towards empowering investors with real-time data and comprehensive market insights.

With Dubai’s continuous innovative efforts to create value for investors, we can easily expect the off-plan market to be poised for sustained success in the long-term.”