Fitch Ratings-London: Sukuk restructuring scenarios continue to develop slowly and unevenly across various jurisdictions, Fitch Ratings says.

Fitch will monitor a recent development at one of the UAE’s real estate development and investment companies, Aurum (Cayman Limited), which could provide additional insights on sukuk restructuring. However, we expect approaches to restructuring to continue to vary both across and within countries.

So far, distressed sukuk have been limited in most jurisdictions where sukuk issuance is prevalent; only 0.21% of all sukuk issued globally have defaulted as of end-1H23. Furthermore, a number of distressed issuers and investors have preferred out-of-court consensual restructurings. Hence, there is a lack of restructuring and legal precedents relating to effective enforcement, despite the growth of the global sukuk market over the past decade.

This week, Aurum (Cayman) Limited announced that it had signed an interim standstill agreement with an ad hoc committee of sukuk holders, while they continue discussions on the reprofiling of the repayment of the USD135 million secured amortising certificates due 2024 issued by TFG Sukuk I Limited. The company added that it had made a USD2 million principal repayment on 7 August, as well as making the profit payment due on that date in full. This follows the company’s July announcement that it was ‘facing liquidity tightening’ in relation to a USD27 million principal payment due on 7 August on the certificates. The company mentioned it was committed to ‘working collaboratively’ with the committee.

Fitch does not rate Aurum (Cayman) Limited or TFG Sukuk I Limited. However, discussions with sukuk holders and the eventual outcome could help inform our understanding of debt reprofiling and restructuring scenarios in the UAE and the industry in general. These can vary substantially, being heavily influenced by creditor composition and local economic imperatives.

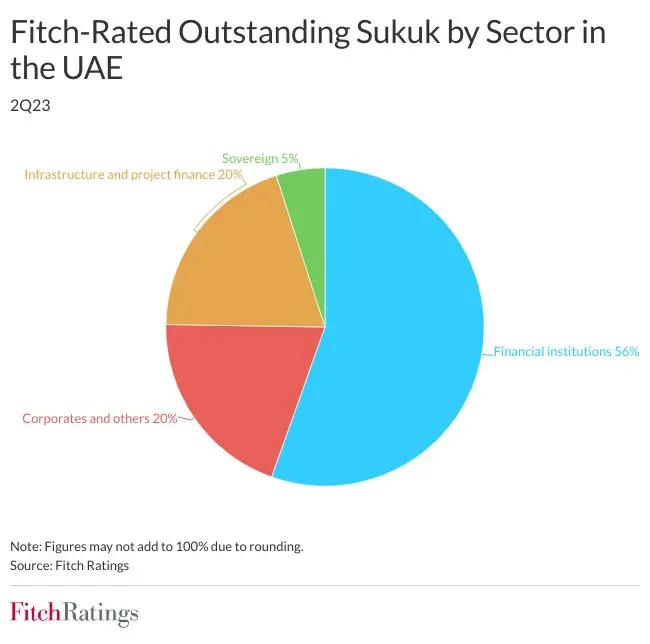

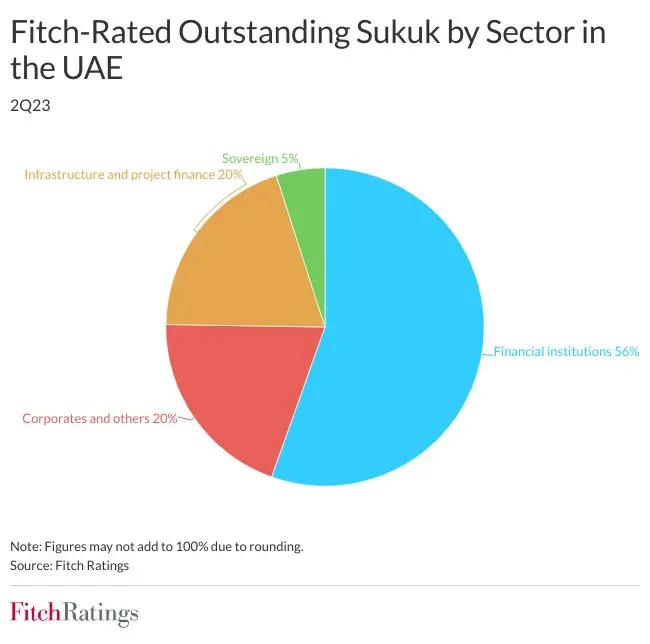

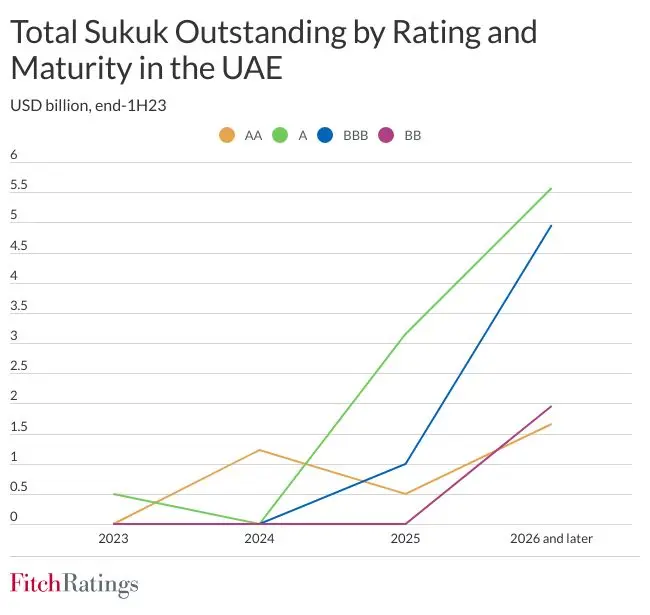

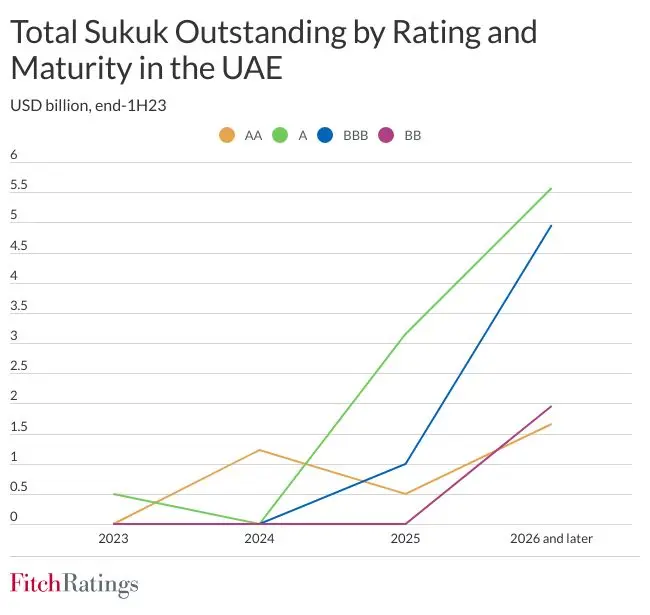

Fitch rates USD20.5 billion of UAE outstanding sukuk, 90.5% of which are investment-grade.

Sukuk issued on international capital markets are typically governed by English law, but a lack of legal precedents means it is often uncertain whether sukuk holders can enforce their contractual rights in local courts where the originator is domiciled, should this be necessary. This uncertainty also applies to conventional bonds issued in the same countries.

Efforts to improve standardisation and comparability across different sukuk structures and legal frameworks have continued, including the creation of the Higher Shari’ah Authority in the UAE. Still, the enforceability of investor rights, recourse, debt ranking and recoveries upon issuer default could be complicated by the differences in underlying Islamic contractual arrangements. Most sukuk have created an economic effect similar to that of conventional bonds, but they can resemble equity-like investments. The issuance of hybrid sukuk, with equity- and debt-like components, is also growing.

Fitch covers 14 out of the 57 member countries of the Organisation of Islamic Cooperation (OIC) in its updated Country-Specific Treatment of Recovery Ratings Criteria. Countries are split into four groups (A to D), with differing caps on instrument ratings and recovery ratings based on country-specific factors. Over half of OIC countries are in Group D – the lowest level of recovery, while none are in Group A. The UAE and Qatar are the only countries among the core Islamic finance markets in the second-highest category, Group B, where the recoveries range from superior to poor.

Fitch does not express an opinion on whether the relevant sukuk transaction documents are enforceable under any applicable law when rating sukuk. Our sukuk ratings are based on our assessment of credit risk and do not imply any confirmation that the sukuk are sharia compliant. As we have previously stated, if non-compliance has credit implications that cannot be quantified under our criteria, the instrument may not be rateable.

-Ends-

Matt Pearson

Senior Associate, Corporate Communications

Fitch Group, 30 North Colonnade, London, E14 5GN

E: matthew.pearson@thefitchgroup.com