PHOTO

Fitch Ratings-Dubai/London: Prices of comparable sukuk and bonds analysed by Fitch maintained high correlation over 1H24, continuing the pattern observed over the previous five years, although there are sometimes brief instances of price volatility when correlation falls, Fitch Ratings says.

We expect this trend to continue in 2H24 and 2025. However, additional complexities due to macro developments or sharia-related issues could affect this trend. Similar pricing trends were also observed in certain global bond and sukuk indices analysed by Fitch.

About 81% of Fitch-rated sukuk are investment-grade. Most are senior unsecured obligations of the issuer and rank pari passu with other senior unsecured obligations, including bonds. However, sukuk are structurally more complex than bonds, with extra dissolution triggers, such as tangibility event, total loss event, and others.

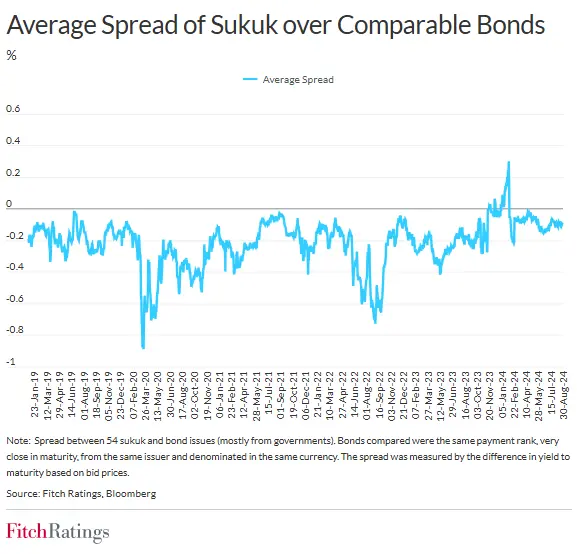

We examined the pricing of over 50 sukuk and bonds issued by the same entities from the Gulf Cooperation Council (GCC), Indonesia and Turkiye. Sukuk and bonds showed a high average pricing correlation between 2019 until August 2024, with a yield-to-maturity correlation of about 0.9 (on a scale of 0 to 1). There is still a scarcity of directly comparable sukuk and bonds in terms of payment priority, issuance dates, maturity and currency denomination from the same issuer, but we believe these metrics at least partially capture investors' perceptions of relative credit risk for sukuk and bonds.

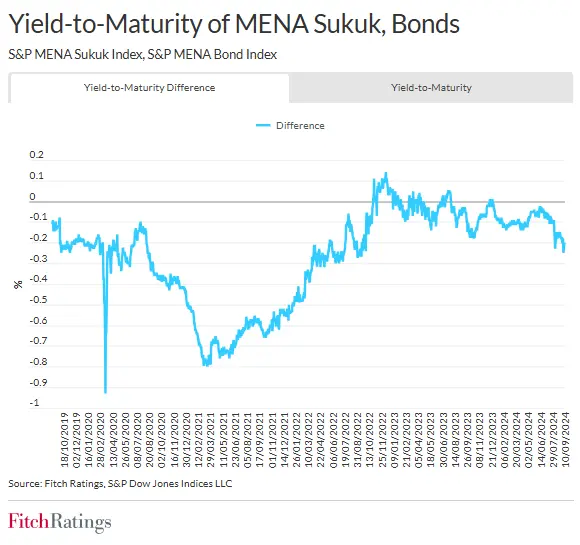

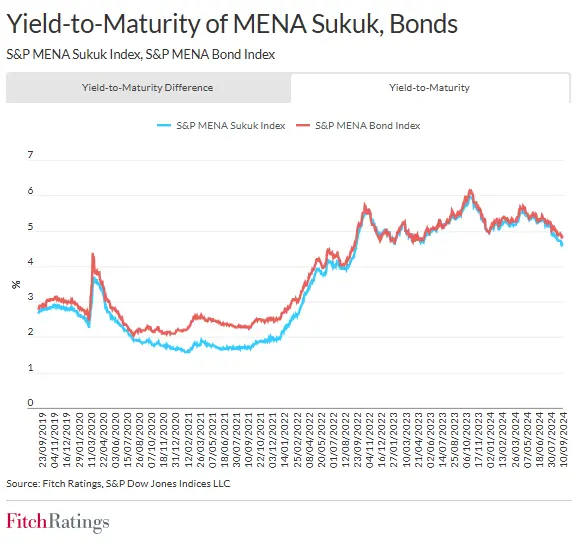

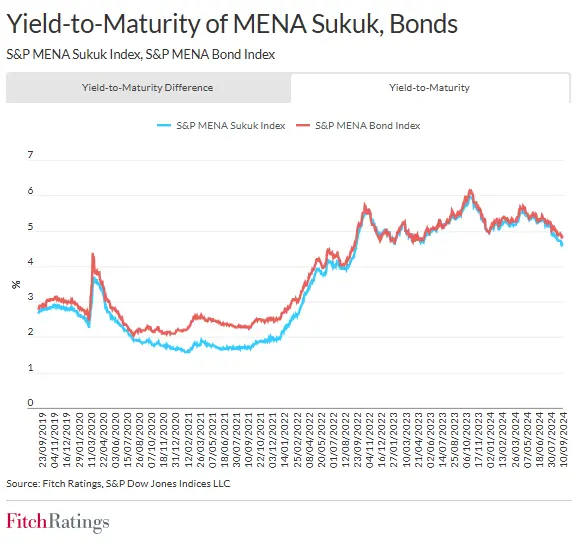

Fitch also analysed the yield-to-maturity (YTM) of the S&P MENA Sukuk Index and the S&P MENA Bonds Index. These indices showed a high correlation of 0.99 over the five years to end-August 2024. The difference in the YTM averaged only -26bp over the past five years, with the YTM of sukuk generally lower than that of bonds. In 1H24, the YTM differential narrowed, and it has averaged -10bp year-to-date.

However, the sukuk-bond spread has widened abruptly during periods of market stress before reverting to the mean. These stresses might reflect broader financial market volatility around interest rates or oil prices, or geopolitical events. But they have also been caused by sharia-related uncertainties that are specific to sukuk. For example, the average YTM differential widened to -64bp in 2021, partly due to the implementation of AAOIFI Sharia Standard No. 59 and resulting uncertainty over potential differences in sukuk and bondholder treatment in some markets. A more sudden widening occurred on the onset of the coronavirus pandemic, when the YTM differential peaked close to -100bp in March 2020 before normalising rapidly.

Fitch expects 4Q24 global sukuk issuance to pick up due to funding diversification efforts, refinancing goals and governments’ need to finance budget deficits and support development plans. Global outstanding sukuk was about USD888 billion at end-2Q24, up 10.2% yoy.

AAOIFI Sharia Standard No. 62 on sukuk, currently in exposure draft format, could be finalised this year. Its adoption could alter the structure of sukuk from asset-based to asset-backed by requiring the transfer of ownership of the underlying assets to investors, among other changes. However, it is early to conclude how Standard No. 62 will affect the market as its final format has not yet been confirmed, and it is unclear by whom or how it will be implemented.

The above article originally appeared as a post on the Fitch Wire credit market commentary page. The original article can be accessed at www.fitchratings.com. All opinions expressed are those of Fitch Ratings.

-Ends-

Disclaimer

All Fitch Ratings (Fitch) credit ratings are subject to certain limitations and disclaimers. Please read these limitations and disclaimers by following this link: https://www.fitchratings.com/understandingcreditratings. In addition, the following https://www.fitchratings.com/rating-definitions-document details Fitch's rating definitions for each rating scale and rating categories, including definitions relating to default. Published ratings, criteria, and methodologies are available from this site at all times. Fitch's code of conduct, confidentiality, conflicts of interest, affiliate firewall, compliance, and other relevant policies and procedures are also available from the Code of Conduct section of this site. Directors and shareholders’ relevant interests are available at https://www.fitchratings.com/site/regulatory. Fitch may have provided another permissible or ancillary service to the rated entity or its related third parties. Details of permissible or ancillary service(s) for which the lead analyst is based in an ESMA- or FCA-registered Fitch Ratings company (or branch of such a company) can be found on the entity summary page for this issuer on the Fitch Ratings website.

In issuing and maintaining its ratings and in making other reports (including forecast information), Fitch relies on factual information it receives from issuers and underwriters and from other sources Fitch believes to be credible. Fitch conducts a reasonable investigation of the factual information relied upon by it in accordance with its ratings methodology, and obtains reasonable verification of that information from independent sources, to the extent such sources are available for a given security or in a given jurisdiction. The manner of Fitch's factual investigation and the scope of the third-party verification it obtains will vary depending on the nature of the rated security and its issuer, the requirements and practices in the jurisdiction in which the rated security is offered and sold and/or the issuer is located, the availability and nature of relevant public information, access to the management of the issuer and its advisers, the availability of pre-existing third-party verifications such as audit reports, agreed-upon procedures letters, appraisals, actuarial reports, engineering reports, legal opinions and other reports provided by third parties, the availability of independent and competent third- party verification sources with respect to the particular security or in the particular jurisdiction of the issuer, and a variety of other factors. Users of Fitch's ratings and reports should understand that neither an enhanced factual investigation nor any third-party verification can ensure that all of the information Fitch relies on in connection with a rating or a report will be accurate and complete. Ultimately, the issuer and its advisers are responsible for the accuracy of the information they provide to Fitch and to the market in offering documents and other reports. In issuing its ratings and its reports, Fitch must rely on the work of experts, including independent auditors with respect to financial statements and attorneys with respect to legal and tax matters. Further, ratings and forecasts of financial and other information are inherently forward-looking and embody assumptions and predictions about future events that by their nature cannot be verified as facts. As a result, despite any verification of current facts, ratings and forecasts can be affected by future events or conditions that were not anticipated at the time a rating or forecast was issued or affirmed. Fitch Ratings makes routine, commonly-accepted adjustments to reported financial data in accordance with the relevant criteria and/or industry standards to provide financial metric consistency for entities in the same sector or asset class.

The information in this report is provided 'as is' without any representation or warranty of any kind, and Fitch does not represent or warrant that the report or any of its contents will meet any of the requirements of a recipient of the report. A Fitch rating is an opinion as to the creditworthiness of a security. This opinion and reports made by Fitch are based on established criteria and methodologies that Fitch is continuously evaluating and updating. Therefore, ratings and reports are the collective work product of Fitch and no individual, or group of individuals, is solely responsible for a rating or a report. The rating does not address the risk of loss due to risks other than credit risk, unless such risk is specifically mentioned. Fitch is not engaged in the offer or sale of any security. All Fitch reports have shared authorship. Individuals identified in a Fitch report were involved in, but are not solely responsible for, the opinions stated therein. The individuals are named for contact purposes only. A report providing a Fitch rating is neither a prospectus nor a substitute for the information assembled, verified and presented to investors by the issuer and its agents in connection with the sale of the securities. Ratings may be changed or withdrawn at any time for any reason in the sole discretion of Fitch. Fitch does not provide investment advice of any sort. Ratings are not a recommendation to buy, sell, or hold any security. Ratings do not comment on the adequacy of market price, the suitability of any security for a particular investor, or the tax-exempt nature or taxability of payments made in respect to any security. Fitch receives fees from issuers, insurers, guarantors, other obligors, and underwriters for rating securities. Such fees generally vary from US$1,000 to US$750,000 (or the applicable currency equivalent) per issue. In certain cases, Fitch will rate all or a number of issues issued by a particular issuer, or insured or guaranteed by a particular insurer or guarantor, for a single annual fee. Such fees are expected to vary from US$10,000 to US$1,500,000 (or the applicable currency equivalent). The assignment, publication, or dissemination of a rating by Fitch shall not constitute a consent by Fitch to use its name as an expert in connection with any registration statement filed under the United States securities laws, the Financial Services and Markets Act of 2000 of the United Kingdom, or the securities laws of any particular jurisdiction. Due to the relative efficiency of electronic publishing and distribution, Fitch research may be available to electronic subscribers up to three days earlier than to print subscribers.

For Australia, New Zealand, Taiwan and South Korea only: Fitch Australia Pty Ltd holds an Australian financial services license (AFS license no. 337123) which authorizes it to provide credit ratings to wholesale clients only. Credit ratings information published by Fitch is not intended to be used by persons who are retail clients within the meaning of the Corporations Act 2001.

Fitch Ratings, Inc. is registered with the U.S. Securities and Exchange Commission as a Nationally Recognized Statistical Rating Organization (the 'NRSRO'). While certain of the NRSRO's credit rating subsidiaries are listed on Item 3 of Form NRSRO and as such are authorized to issue credit ratings on behalf of the NRSRO (see https://www.fitchratings.com/site/regulatory), other credit rating subsidiaries are not listed on Form NRSRO (the 'non-NRSROs') and therefore credit ratings issued by those subsidiaries are not issued on behalf of the NRSRO. However, non-NRSRO personnel may participate in determining credit ratings issued by or on behalf of the NRSRO.

Copyright © 2024 by Fitch Ratings, Inc., Fitch Ratings Ltd. and its subsidiaries. 33 Whitehall Street, NY, NY 10004. Telephone: 1-800-753-4824, (212) 908-0500. Reproduction or retransmission in whole or in part is prohibited except by permission. All rights reserved.

Matt Pearson

Senior Associate, Corporate Communications

Fitch Group, 30 North Colonnade, London, E14 5GN

E: matthew.pearson@thefitchgroup.com