PHOTO

In much of the world, 2025 presents a favorable environment for buyers compared with the last two years. Weak demand from goods-consuming industries will prevent large price increases from sticking. In the US, manufacturing costs are increasing at a time of sluggish demand for goods. That suggests costs are likely to increase faster than prices. Uncertain trade policy makes it difficult for medium-term or even short-term planning, tilting the balance toward businesses opting for a wait-and-see policy to major decisions.

Key forecast highlights from the analysis include:

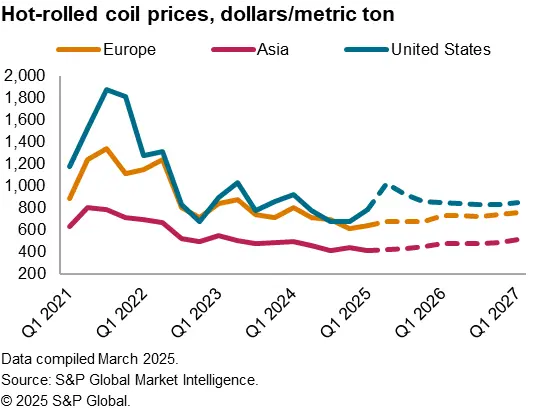

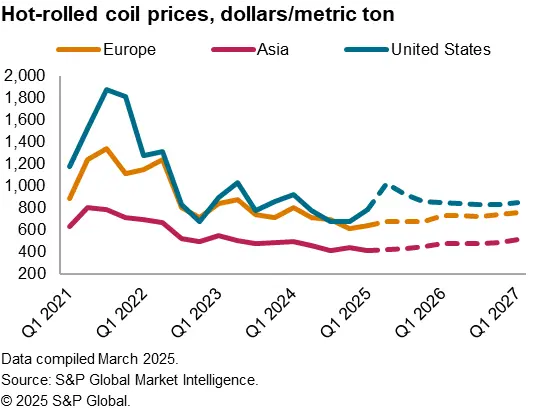

- With the exception of the United States, steel will remain a buyer’s market through 2025, and the outlook is favorable for 2026 as well. Demand is soft and significant capacity remains idle.

- In the US, steel prices, including hot-rolled coil, will increase over the first half of 2025 in response to the removal of country exemptions and product exclusions from the 25% import tariffs. Additional tariffs on Canada and Mexico add further upward pressure to US pricing. The United States has sharply tightened Section 232 tariffs on imported steel as of March 12, and the forecast reflects this.

- Minimal increases in steel prices for mainland China are expected over the second half of the year but predicated on the expectation of production cuts. Capacity utilization of rebar mills remains below 50%, while for wire rod mills capacity utilization hovers around 30%. Traders’ inventories keep rising month over month, which further underlines just how weak demand is. With construction not expected to recover meaningfully until 2026, long steel prices will remain extremely attractive for buyers until the end of 2025 and early 2026.

- Protectionism is also likely to rise in other global steel markets. Europe appears ready to strengthen its tariff rate quotas (TRQ) and steel sheet prices have already increased in reaction. Vietnam has imposed antidumping on mainland China and India is beginning the process of safeguard duties.

- The outlook for seaborne iron ore prices for 62% iron (Fe) fines on a cost-and-freight-to-China (CFR China) basis will stay weak in 2025, with prices treading in the $96–$104/dry metric ton (dmt) range. The imposition of Section 232 tariffs by the US administration on steel and aluminum imports, effective March 12, is also likely to affect iron ore pricing indirectly. We have consistently maintained that iron ore prices will fluctuate in a range around $100/dmt as a psychological level in 2025. This is made clear by the trend in the first few months of the year in which prices have moved in the $96–$109/dmt range from January to early March.

- US coking coal prices are also forecast to continue experiencing range-bound prices given a muted Asia-Pacific market. The market will be depressed amid the US government’s plan to impose fees ranging from $500,000 to $1.5 million per port call on vessels built in mainland China. The current 18% tariff on US coal exports to mainland China has already significantly reduced trade between the two since February. The new proposal for surcharges on mainland Chinese-built ships further complicates the situation for US suppliers with lower profit margins who are trying to maintain sales to mainland China.

To speak with our expert, please contact press.mi@spglobal.com.

* Please note: This was produced by S&P Global Market Intelligence, not S&P Global Ratings, which is a separately managed division of S&P Global. Please attribute any commentary/data you cite from this analysis to S&P Global Market Intelligence.

###

If you prefer not to receive news releases from S&P Global Market Intelligence, please email kritikhurana@spglobal.com. To read our privacy policy, click here.