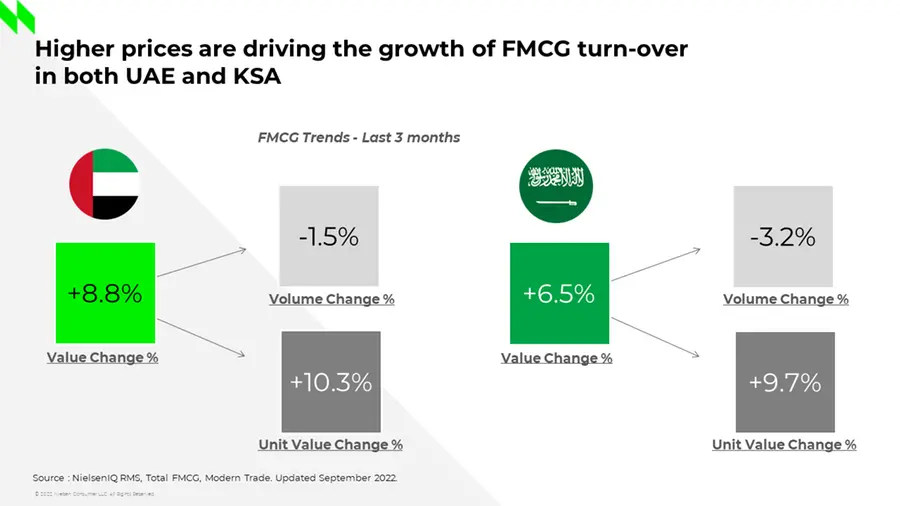

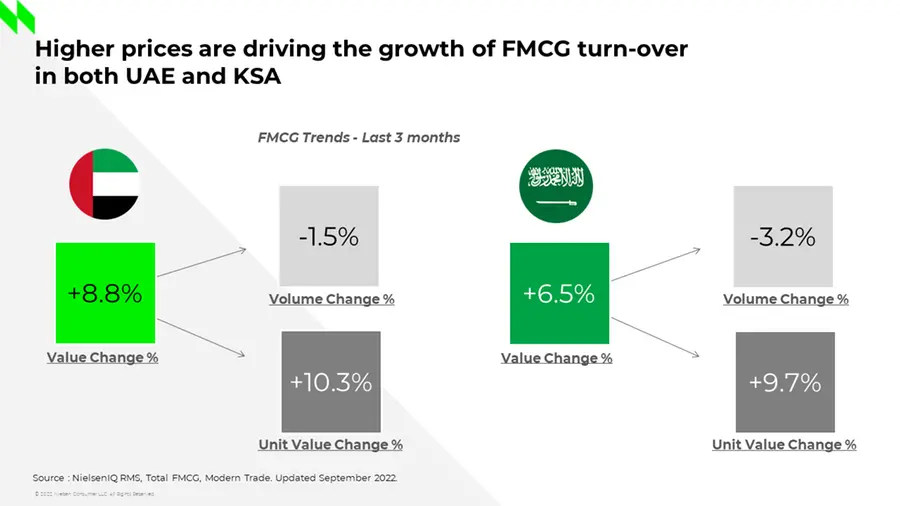

- In Modern Trade, the latest quarter’s value sales increased by 8.8% in the UAE and 6.5% in KSA versus a year ago

- Shoppers are facing double digit inflation and lower promotional intensity, having now to cope with this new environment

Dubai: Shoppers in Saudi and the Emirates cope with soaring prices, as revealed by NielsenIQ Middle East in its first Fast Moving Consumer Goods (FMCG) Barometer for United Arab Emirates and Kingdom of Saudi Arabia.

In the Modern Trade version of the Barometer, data emanates from NielsenIQ’s Retail Measurement Services, the largest retail (grocery) data source in UAE and KSA, used by retailers and manufacturers. This benchmark data comprises hypermarkets, supermarkets, self-service, groceries, catering stores for beverage, pharmacies and perfumeries: more than 90,000 retail outlets in KSA and 30,000 in UAE.

Rising prices across stores

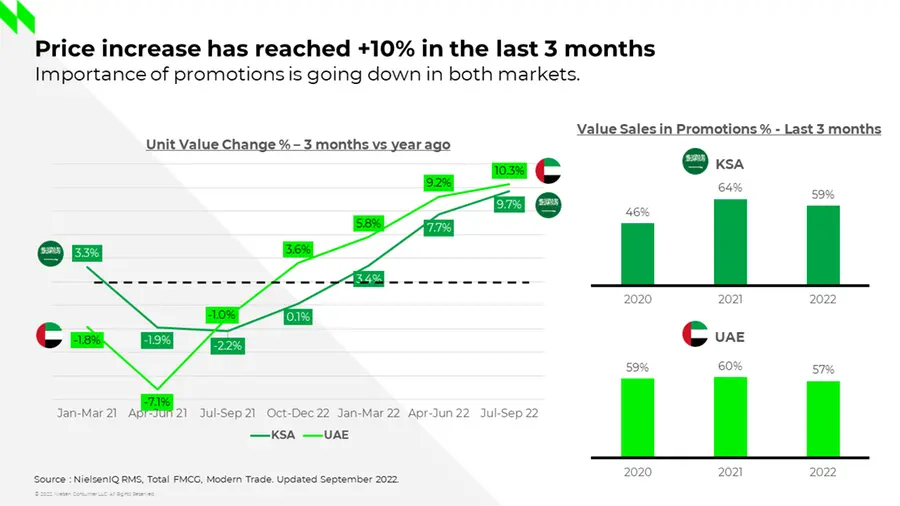

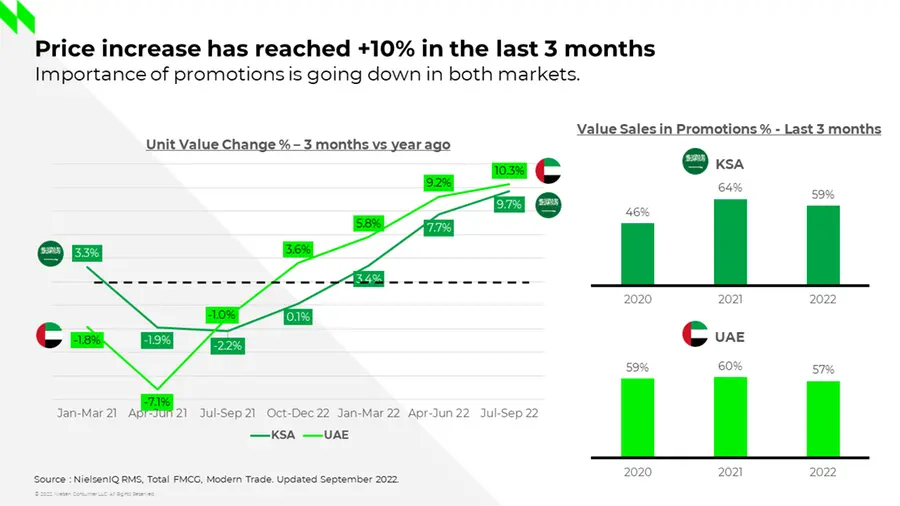

Saudi and Emirati shoppers can hardly miss it: 77% of them have the feeling that food prices are increasing... and in store indeed, it appears that 86% of the categories have been impacted by inflation versus last year, with promotion intensity declining in Modern Trade in both markets (-5 points for KSA and –3 points for UAE) in the short term.

Rising inflation has become a hallmark of the latest few months and has been exacerbated by the conflict in Ukraine, shortages in raw material, supply chain issues... If now inflation reaches the 10% year over year on average, Frozen Food (+19% in UAE, +15% in KSA) and Dairy products (+18% in UAE, +14% in KSA) are showing the highest price increase.

Volumes going down in an inflationary environment

In this context, NielsenIQ data shows an increase in value sales (+8.8% in the UAE, +6.5% in KSA) in the last three months, despite a decline in volume sales (–1.5% in the UAE, and –3.6% in KSA), compared to positive trends in volume during the 1st quarter of 2022.

This indicates that shoppers are spending more at grocery stores (due to inflation) but also buying less. For Andrey Dvoychenkov, General Manager Arabian Peninsula & Pakistan at NielsenIQ, “The strong nominal value growth across both countries is clearly driven by price increases. Most shoppers are now willing to focus on essentials and appear to be more and more concerned about inflation. But they are still ready to pay a premium for products with more functionality and benefits (healthy food, organic, wellness...). Health certainly is not compromised vs price.”

In both markets, the Snacking & Beverages categories enjoyed a consumption pickup despite higher prices.

A different picture in Traditional Trade

To provide the full picture to its clients, NielsenIQ also provides a Barometer for Traditional Trade, covering Groceries, Catering, Perfumeries. With a lower inflation rate, those traditional channels are growing in volume, with +1.5% in Saudi Arabia, and +13.8% in the UAE. As Andrey Dvoychenkov points out, “traditional Saudi stores have started recovering recently after a long-term decline, capitalizing on convenience, one of main drivers for shoppers when it comes to choose a store. In UAE, the growth across the channel is mainly driven by new shops opening across the landscape.”

-Ends-

About NielsenIQ

NielsenIQ is the leader in providing the most complete, unbiased view of consumer behavior, globally. Powered by a groundbreaking consumer data platform and fueled by rich analytic capabilities, NielsenIQ enables bold, confident decision-making for the world’s leading consumer goods companies and retailers.

Using comprehensive data sets and measuring all transactions equally, NielsenIQ gives clients a forward-looking view into consumer behavior in order to optimize performance across all retail platforms. Our open philosophy on data integration enables the most influential consumer data sets on the planet. NielsenIQ delivers the complete truth.

NielsenIQ, an Advent International portfolio company, has operations in nearly 100 markets, covering more than 90% of the world’s population. For more information, visit NielsenIQ.com.