PHOTO

Loans & Advances (L&A) increased by 3.2 percent QoQ, driven by corporate/wholesale banking.

Banks looking at an interest rate cycle reversion likely to begin in September’24

Kingdom of Saudi Arabia – Leading global professional services firm Alvarez & Marsal (A&M) today released its latest KSA Banking Pulse for Q2 2024. The report shows that the ten largest Saudi banks reported a 3.2 percent quarter on quarter (QoQ) increase in Loans & Advances (L&A), driven by a 7.2 percent rise in corporate and wholesale banking. Deposits grew by 2.3 percent QoQ, led by a 4.1 percent increase in time deposits.

Operating income rose by 1.9 percent QoQ, primarily due to a 2.5 percent growth in net interest income (NII), despite a slight 0.1 percent decline in non-interest income. A 27.0 percent reduction in impairment charges boosted net income by 4.3 percent QoQ.

Key prevailing trends identified for Q2 2024 are as follows:

1. Loans & advances (L&A) of the main Saudi banks grew by 3.2 percent quarter on quarter (QoQ), primarily driven by a 7.2 percent QoQ growth in corporate/wholesale banking. Deposits increased by 2.3 percent QoQ, with term deposits seeing the highest growth at 4.1 percent QoQ. Consequently, the loans-to-deposit ratio (LDR) increased by 0.8 percentage points QoQ to 97.8 percent in Q2’24.

2. Operating income increased by 1.9 percent QoQ to SAR 34.8bn in Q2’24, mainly due to a 2.5 percent QoQ growth in net interest income (NII) to SAR 27.4bn. Non-interest income fell marginally by 0.1 percent QoQ to SAR 7.4bn. Net fees and commission income increased slightly by 1.4 percent QoQ in Q2’24.

3. Aggregate net interest margin (NIM) contracted by 2 basis points to 2.94 percent in Q2’24. Yield on credit (YoC) increased by 10 basis points QoQ to 8.4 percent, while the cost of funds increased by 10 basis points QoQ to 3.4 percent. Seven of the top ten banks in KSA reported a contraction in NIM.

4. Cost efficiencies improved during the quarter, with the cost-to-income (C/I) ratio improving by 29 basis points QoQ to reach 31.3 percent in Q2’24. The increase in operating income (+1.9 percent QoQ) outpaced operating expenses in Q2’24.

5. The cost of risk continued to improve for KSA banks, reaching a multi-year low. The cost of risk improved by 11 basis points QoQ to settle at 0.28 percent in Q2’24. Half of the top ten banks reported a deterioration in the cost of risk.

6. Aggregate profit after tax for KSA banks increased by 4.3 percent QoQ to SAR 19.5bn in Q2’24 due to net interest income (NII) growth (+2.5 percent QoQ) and a substantial decline in impairment charges (-27.0 percent QoQ). The increase in net income resulted in return on equity (RoE) expanding to 16.8 percent (+0.7 percentage points QoQ) while return on assets (RoA) remained steady at 2.0 percent for the quarter.

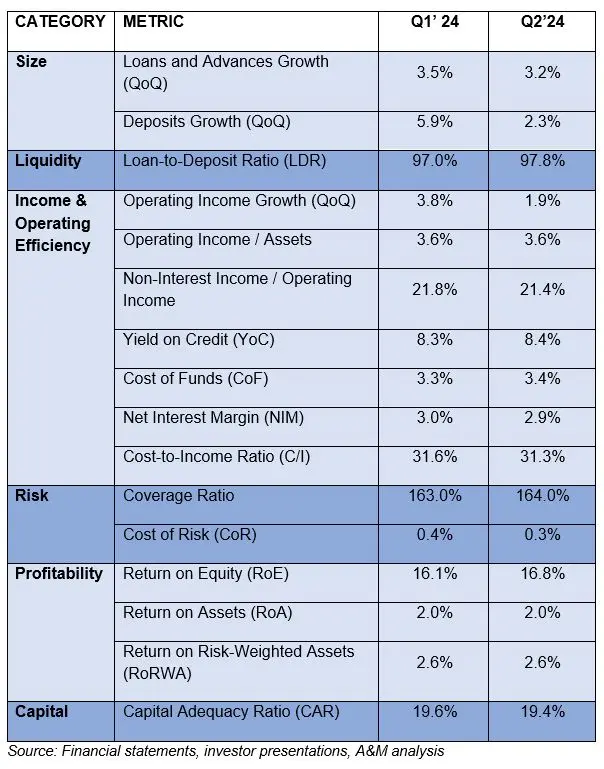

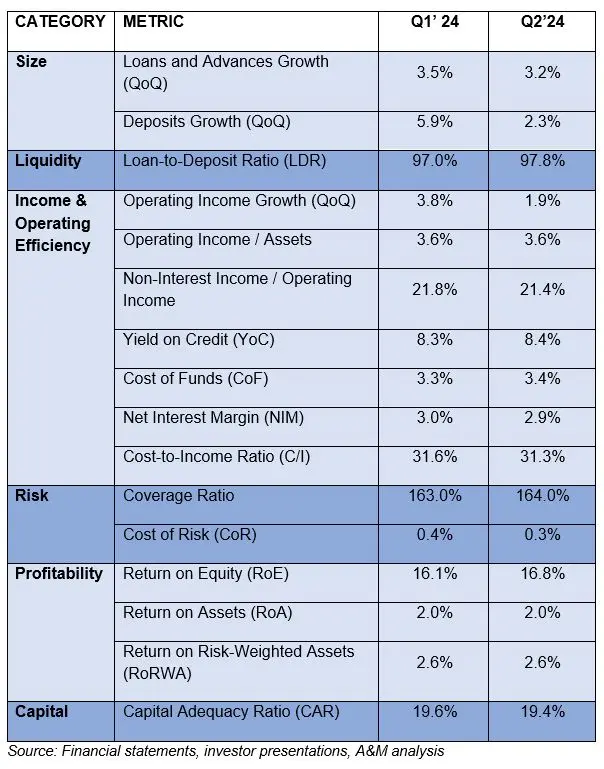

A&M’s KSA Banking Pulse examines data of the 10 largest listed banks in the Kingdom, comparing the Q2 2024 results against Q1 2024 results. Using independently sourced published market data and 16 different metrics, the report assesses banks’ key performance areas, including size, liquidity, income, operating efficiency, risk, profitability, and capital.

The country’s 10 largest listed banks analyzed in A&M’s KSA Banking Pulse are Saudi National Bank (SNB), Al Rajhi Bank, Riyad Bank (RIBL), Saudi British Bank (SABB), Banque Saudi Fransi (BSF), Arab National Bank (ANB), Alinma Bank, Bank Albilad (BALB), Saudi Investment Bank (SIB) and Bank Aljazira (BJAZ).

OVERVIEW

The table below sets out the key metrics:

Asad Ahmed, Managing Director and Head of Middle East Financial Services at A&M commented, “The continued positive performance in Q2 2024 reflects a balance of growth and improved cost efficiencies among Saudi Banks. Profitability has increased primarily due to an increase in net interest income (NII) and a significant reduction in impairment charges.

As the Saudi Central Bank (SAMA) maintains interest rates in line with the US Fed, a potential rate cut in September, could begin to affect interest margins. Banks are no doubt looking to see how the effect of rate cuts plus any regional headwinds are best handled; focus on non-interest income (mainly fees and commission income) and improved cost efficiencies, is most likely to remain central going forward.”

About Alvarez & Marsal

Companies, investors and government entities around the world turn to Alvarez & Marsal (A&M) for leadership, action and results. Privately held since its founding in 1983, A&M is a leading global professional services firm that provides advisory, business performance improvement and turnaround management services. When conventional approaches are not enough to create transformation and drive change, clients seek our deep expertise and ability to deliver practical solutions to their unique problems.

With over 10,000 people across six continents, we deliver tangible results for corporates, boards, private equity firms, law firms and government agencies facing complex challenges. Our senior leaders, and their teams, leverage A&M’s restructuring heritage to help companies act decisively, catapult growth and accelerate results. We are experienced operators, world-class consultants, former regulators and industry authorities with a shared commitment to telling clients what’s really needed for turning change into a strategic business asset, managing risk and unlocking value at every stage of growth.

To learn more, visit: AlvarezandMarsal.com