Saudi Arabia is expected to experience significant growth in the next decade, as investors are attracted by the government's large-scale economic initiatives, including NEOM. The market has already shown signs of growth, with residential property prices in Riyadh, the country's capital, rising by up to 60 percent over the last 6 months.

State of the Saudi market

Over the past few years, real estate has emerged as a top priority for the local government in response to the swiftly changing demographics of Saudi Arabia. The country's population has surged by more than 20 percent from 1970 to 2020, with over half of its citizens being under the age of 30. Many of these young people migrate from rural areas to cities in search of employment opportunities. It is expected that Riyadh, the capital of the Kingdom, will see the addition of 100 000 new homes by the end of 2023.

In an effort to reduce the country’s reliance on revenue generated from oil, the local government is also pursuing its Vision2030 plan, which aims to transform the country's economy. This plan, combined with the increasing demand for housing, has spurred investments in several new futuristic cities. By 2030, the Kingdom is planning to build eight new megapolises, Including Neom, Qiddiya, Red Sea Project, Amaala, Al-Ula, Diriyah Gate, and others. Investment in these projects accounted for almost $575 billion. This funding will allow the development of 1,3 million housing units.

Current prices

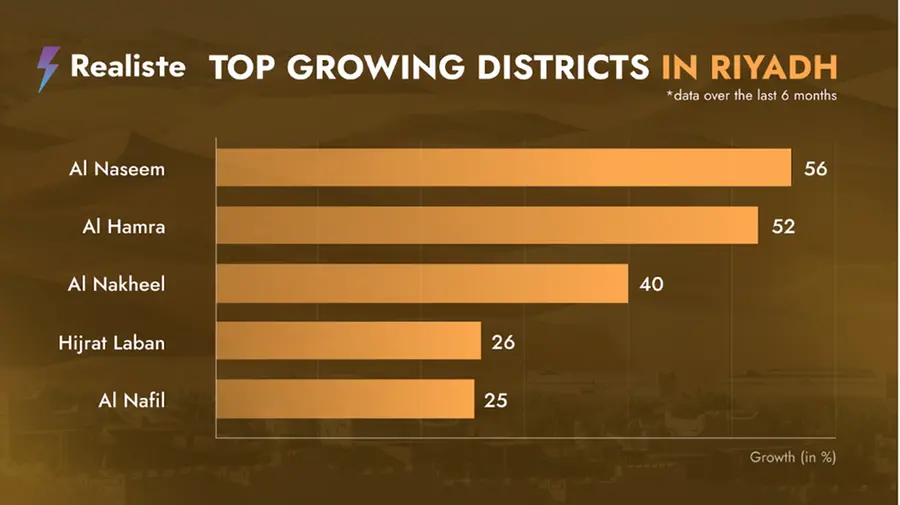

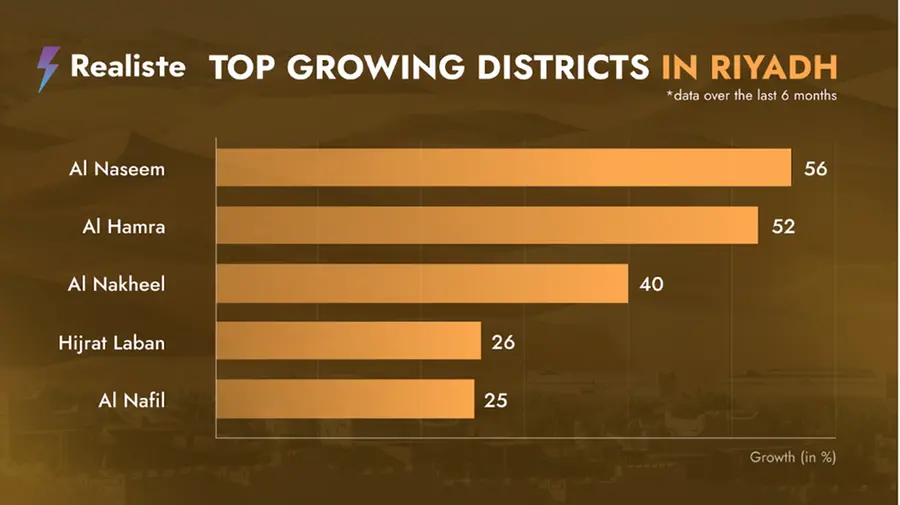

The construction boom in Saudi Arabia has had an impact on property prices in Riyadh. According to data from Realiste’s AI, property prices have risen by 9 percent in the past six months, with some districts seeing increases of up to 60 percent.

Notably, the districts of Al Naseem and Al Hamra have experienced the most growth, with a 56 and 52 percent increase in prices, respectively. Al Nakheel has also seen a significant rise of 40 percent. Other districts in the top five for growth over the same period include Hijrat Laban (26 percent) and Al Nafil (25 percent).

Currently, the most expensive areas of Dubai are Al Nakheel, Al Rabee, and Al Malga with average property prices ranging from 7962 Saudi riyal to 10254 Saudi riyal per square meter.

The most affordable housing options are located in Al Badi’ah, Al Dar Al Baida, and Al Shifa, Realiste’s AI reveals.

Future growth

In the next ten years, the property market in Saudi Arabia will be growing at a rocket pace. One of the factors behind this growth is establishing Riyadh as a new hub for innovation in the MENA region. Last year Saudi Arabia announced more than $6.4 billion in investments in future technologies and entrepreneurship as a part of its diversification plans. That can secure its desired position as the MENA region's leader in digital transformation.

Saudi Arabia is also easing regulations towards expats, including visa rules, to attract more foreigners to the market. The country aims to double the inflow of foreign direct investment by more than 18 times during the upcoming decade and gain SR388 billion (virtually $90 million) annually.

Quote:

‘We see more interest towards the Saudi market from investors. We expect that those who will buy 10, 20, apartments in Saudi and leave it for five years, will be able to come back and see them grow by 100, 200 percent over that period,’ says co-founder of Realiste Alex Galtsev.

-Ends-

About Realiste

Realiste is a proptech startup based in the UAE. The company develops AI-powered products for real estate investing. The company’s goal is to build the first real estate exchange that can help to identify the most profitable options in the market, allow purchase online within seconds directly from developers, and manage all the purchased assets in one place. In 2022, it was recognised as the leading artificial intelligence company in the UAE by Future Innovation Summit.

Realiste aims to revolutionize the real estate market in the MENA region by increasing its transparency and accessibility for investors worldwide. The company is confident that its AI-driven products can benefit not only the property investors but all parties involved, including government, property investors, construction companies, and banks, by streamlining and accelerating property deals.

The company’s headquarters are located in Dubai. Overall, Realiste covers over 20 cities, including London, New York, Riyadh, and Bangkok. By the end of 2023, the team aims to expand Realiste to more than 30 cities globally, partnering with local businesses that share the company’s vision and have an in-depth understanding of their markets.

In February 2023, Realiste officially launched a joint venture in Saudi Arabia with local partners, including Ahmed Alenazi, the former CEO of STC Pay, a successful fintech unicorn startup. This joint company was valued at $10M. Realiste plans to collaborate with local developers and banks in Saudi Arabia and digitalize 13 cities by the end of 2023.

The revenue in Dubai’s company stands at $1M, and the team aims to reach $30M by the end of 2023.