PHOTO

- PMI continues to signal strong overall growth at 52.9

- Overall cost pressures ease further from October's four-year high

Doha, Qatar– The latest Purchasing Managers’ Index™ (PMI®) survey data from Qatar Financial Centre (QFC) compiled by S&P Global showed that Qatar's non-energy private sector had a strong end to 2024. The labour market remained a key driver of the overall improvement in business conditions, with the latest increases in employment and wages remaining among the highest on record. Demand for goods and services increased further, supporting growth in total activity and generating a rise in outstanding business. The 12-month outlook for activity remained positive. Despite elevated wage pressures, overall cost inflation retreated further from October's four-year high while firms discounted their own prices only marginally.

The Qatar PMI indices are compiled from survey responses from a panel of around 450 private sector companies. The panel covers the manufacturing, construction, wholesale, retail, and services sectors, and reflects the structure of the non-energy economy according to official national accounts data.

The headline Qatar Financial Centre PMI is a composite single-figure indicator of non-energy private sector performance. It is derived from indicators for new orders, output, employment, suppliers’ delivery times and stocks of purchases.

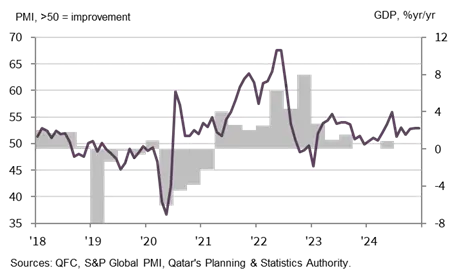

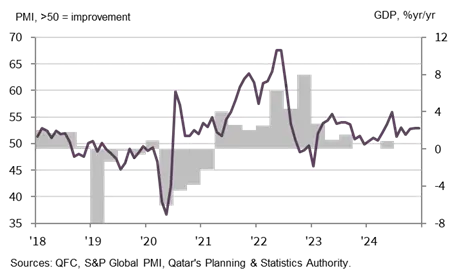

The PMI was unchanged in December at 52.9, signalling solid overall growth in business conditions in the non-energy private sector economy. The headline figure trended at 52.9 during the final quarter of 2024, up from 52.0 in the third quarter and above the long-run survey average of 52.3 since April 2017.

Qatar's non-energy private sector labour market remained very strong at the end of 2024. Throughout the last four months of the year, employment and wages have risen more quickly than at any other time in the survey history. Recruitment reflected efforts to raise output, improve services, win new business and address outstanding workloads.

Although wage pressures remained strong in December, overall input price inflation eased further from October's four-year high. Charges for goods and services fell for the fifth month running as firms sought to support sales by discounting prices, but at only a marginal rate.

While employment provided the strongest boost to the headline figure in December, the PMI also had positive contributions from output, new orders and stocks of purchases. The increase in new business was sufficient to generate a rise in backlogged work for the third time in the past four months. Meanwhile, the expansion in inventories of inputs was the third-fastest on record, as firms expect activity and new contracts to grow in 2025.

Qatari firms continued to hold an optimistic outlook for the next 12 months in December. Sentiment remained strong despite easing slightly since November. Anecdotal evidence provided by survey respondents linked positive forecasts to stable market conditions, construction and tourism demand, population growth, industrial development and investment in infrastructure.

QFC Qatar PMI vs. GDP

Financial Services

Financial services outlook strengthens in December

- Finance firms increasingly bullish on 2025 prospects

- Employment continues to rise at strong rate

- New business and total activity increase further

The year-ahead outlook for Qatari financial services strengthened at the end of 2024, driving a further sharp increase in employment in the sector. The Financial Services Future Activity Index rose from 62.1 in November to 68.3 in December, well above the long-run series trend of 63.6.

Employment in the sector continued to rise at one of the sharpest rates on record, albeit the slowest in four months. Meanwhile, total activity and new business both expanded for the forty-second successive month.

Financial services companies cut their prices charged for the fifth month running, albeit at a rate that eased from November's record. Average input prices rose at a stronger rate than in November.

Comment

Yousuf Mohamed Al-Jaida, Chief Executive Officer, QFC Authority:

"The headline PMI was unchanged at 52.9 in December, remaining above the long-run trend level of 52.3 and indicating a solid improvement in business conditions in the non-energy sector.

"The outlook for 2025 is strongly positive and continues to support a booming labour market. The two PMI sub-indices covering employment and wages have remained at elevated levels throughout the last four months of the year, reflecting strong demand for workers and efforts by companies to retain and reward staff.

"New business growth generated a renewed rise in outstanding work during December, and companies continued to build inventories in expectation of sales growth in the coming months."

ABOUT THE QATAR FINANCIAL CENTRE

The Qatar Financial Centre (QFC) is an onshore business and financial centre located in Doha, providing an excellent platform for firms to do business in Qatar and the region. The QFC offers its own legal, regulatory, tax and business environment, which allows up to 100% foreign ownership, 100% repatriation of profits, and charges a competitive rate of 10% corporate tax on locally sourced profits.

The QFC welcomes a broad range of financial and non-financial services firms.

For more information about the permitted activities and the benefits of setting up in the QFC, please visit qfc.qa

@QFCAuthority | #QFCMeansBusiness@QFCAuthority | #QFCMeansBusiness

MEDIA CONTACTS

QFC: Rasha Kamaleddine, Marketing & Corporate Communications Department, r.kamaleddine@qfc.qa

ENQUIRIES ABOUT THE REPORT

QFC: qatarpmi@qfc.qa

ABOUT S&P GLOBAL

S&P Global (NYSE: SPGI) S&P Global provides essential intelligence. We enable governments, businesses and individuals with the right data, expertise, and connected technology so that they can make decisions with conviction. From helping our customers assess new investments to guiding them through ESG and energy transition across supply chains, we unlock new opportunities, solve challenges, and accelerate progress for the world.

We are widely sought after by many of the world’s leading organizations to provide credit ratings, benchmarks, analytics and workflow solutions in the global capital, commodity, and automotive markets. With every one of our offerings, we help the world’s leading organizations plan for tomorrow, today. www.spglobal.com.

ABOUT PMI

Purchasing Managers’ Index™ (PMI®) surveys are now available for over 40 countries and for key regions including the Eurozone. They are the most closely watched business surveys in the world, favoured by central banks, financial markets and business decision makers for their ability to provide up-to-date, accurate and often unique monthly indicators of economic trends.

www.spglobal.com/marketintelligence/en/mi/products/pmi.html

METHODOLOGY

The Qatar Financial Centre PMI® is compiled by S&P Global from responses to questionnaires sent to purchasing managers in a panel of around 450 private sector companies. The panel is stratified by detailed sector and company workforce size, based on contributions to GDP. The sectors covered by the survey include manufacturing, construction, wholesale, retail, and services.

Survey responses are collected in the second half of each month and indicate the direction of change compared to the previous month. A diffusion index is calculated for each survey variable. The index is the sum of the percentage of ‘higher’ responses and half the percentage of ‘unchanged’ responses. The indices vary between 0 and 100, with a reading above 50 indicating an overall increase compared to the previous month, and below 50 an overall decrease. The indices are then seasonally adjusted.

The headline figure is the Purchasing Managers’ Index™ (PMI). The PMI is a weighted average of the following five indices: New Orders (30%), Output (25%), Employment (20%), Suppliers’ Delivery Times (15%) and Stocks of Purchases (10%). For the PMI calculation the Suppliers’ Delivery Times Index is inverted so that it moves in a comparable direction to the other indices.

Underlying survey data are not revised after publication, but seasonal adjustment factors may be revised from time to time as appropriate which will affect the seasonally adjusted data series.

Data were collected 5-16 December 2024.

For further information on the PMI survey methodology, please contact economics@spglobal.com.

CONTACT

S&P Global: Sabrina Mayeen | E. Sabrina.mayeen@spglobal.com