PHOTO

Riyadh — NielsenIQ, the leading consumer intelligence company, has shared crucial insights about consumer behavior in Saudi Arabia, highlighting its significance for retailers and brands.

Price Sensitivity

Saudi consumers are highly price-sensitive, with 86% aware of the prices of their regular grocery items and attentive to price changes. This price consciousness leads 43% of consumers to switch stores to find the best promotional offers. Additionally, 78% take advantage of special deals, and 80% have visited more local retailers in the past six months.

Need for Innovation

There has been a fourfold increase in innovation within the last two years, indicating a significant shift towards a more innovative culture in Saudi Arabia. Out of 19,172 unique products (SKUs) launched in two years, only 20% show continued growth in their second year, attributed to strong propositions, execution, and activation.

Growing Saudi Retail Universe

The retail universe in Saudi Arabia grew by 12% from 2020 to 2024, with over 120,000 retail stores, 60% located in the top four metropolitan cities. Notably, only 20% of SKUs contribute to 90% of total FMCG sales in hyper/supermarkets.

Self-service and grocery stores are experiencing faster growth than other FMCG channels.

Rise of E-commerce

E-commerce in KSA has seen significant value and volume growth, especially in Home care and Personal care products, with shelf-stable food items also growing substantially.

Online channel generated almost a third of market revenue in early 2024, with a 3.3x increase in online channel revenue and a 17% increase in the number of brands online since 2019.

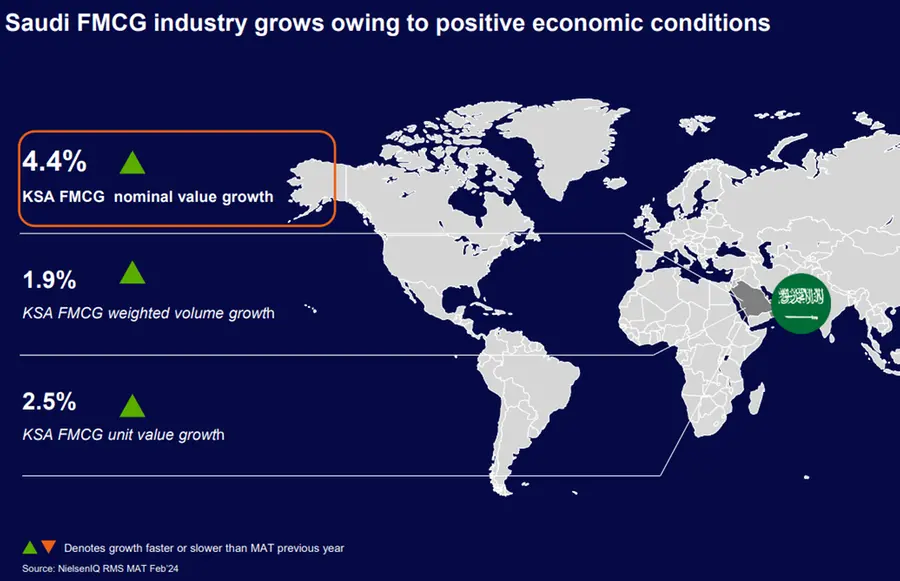

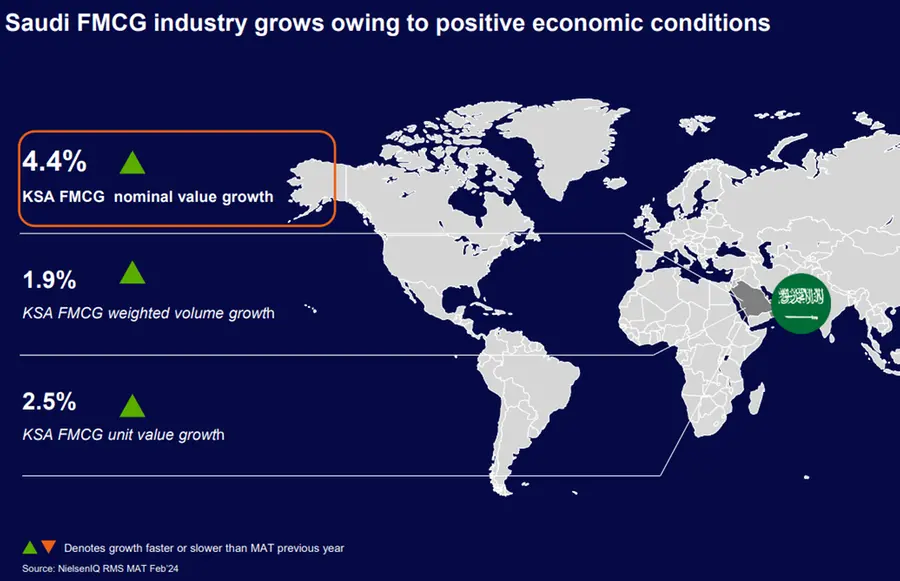

“In an evolving global retail landscape, Saudi Arabia stands out as remarkably resilient. Consumer volume has increased by 1.9% compared to last year in a market valued at SAR 73 billion. We've demonstrated how manufacturers can succeed with Saudi consumers, who are price-sensitive yet contribute 25% of FMCG sales to premium products. They are also open to new products, driving a quarter of the growth through innovations. We have highlighted the opportunities in this Kingdom of possibilities”, explains Pavlos Pavlou, NielsenIQ Managing Director in the Kingdom of Saudi Arabia.

What’s Next

- Consumer Spend: Anticipated to increase up to 4% in the next two years, driven equally by population growth and inflation.

- Retail Universe: As the retail landscape expands, brands must ensure product availability in the right stores with the appropriate assortment, especially considering the price sensitivity of Saudi consumers.

- Innovation: Essential for achieving incremental growth amidst competition for shelf space and visibility across both traditional and modern trade channels.

* Full set of data and other insights were recently unveiled at a C-suite summit event in Riyadh.

-Ends-

About NielsenIQ

NielsenIQ is the world’s leading consumer intelligence company, delivering the most complete understanding of consumer buying behavior and revealing new pathways to growth. In 2023, NielsenIQ combined with GfK, bringing together the two industry leaders with unparalleled global reach. With a holistic retail read and the most comprehensive consumer insights—delivered with advanced analytics through state-of-the-art platforms—NielsenIQ delivers the Full ViewTM.

NielsenIQ is an Advent International portfolio company with operations in 100+ markets, covering more than 90% of the world’s population. For more information, visit NIQ.com.