PHOTO

Abu Dhabi, UAE – InspIR Connect, a bespoke advisory solution that strategically matches Emerging Markets companies with investors to improve the quality of their shareholder base, revealed today select findings from its recent independent survey of North American investors that actively manage a total of $16 trillion in assets. The survey explored institutional investors’ interest in GCC companies and how the region’s corporates can attract more equity capital from the U.S. and Canada.

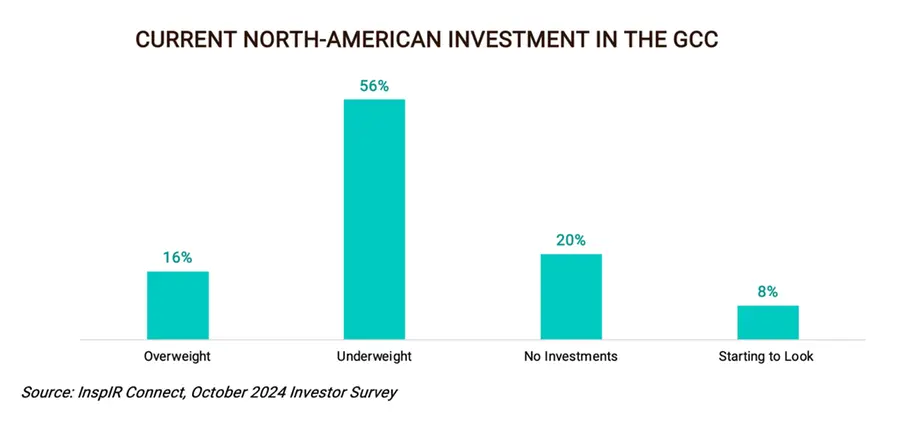

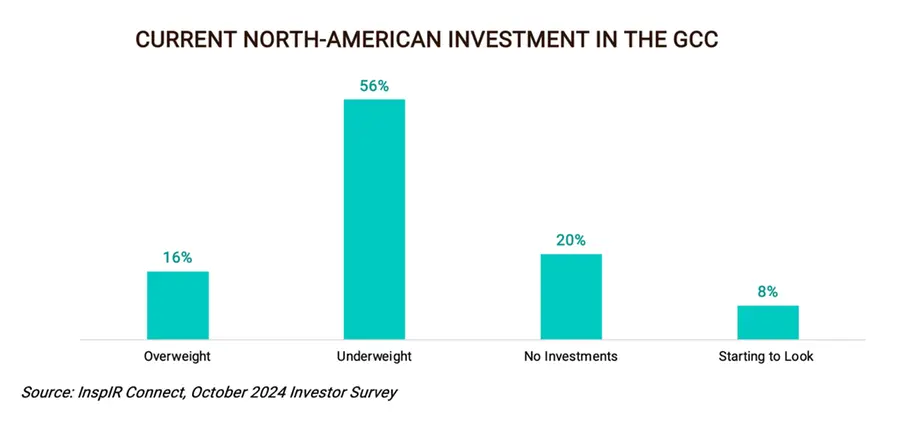

Jeff Tewlow, Managing Director of InspIR Connect, said, “Our survey of some of the leading institutional investors in the U.S. and Canada revealed a strong and growing interest in GCC companies. Currently, there is a tremendous opportunity to tap North America’s massive pool of equity capital, with 56% of those we surveyed underweight the GCC relative to the MSCI Emerging Markets Index. When talking with portfolio managers, we discovered a consensus view that over the next five years, the GCC will represent the fastest growing portion of Emerging Market capital, and the region will eventually surpass all of Latin America in the MSCI and FTSE indices.”

The survey’s other key findings included:

- GCC companies have achieved significant progress in corporate governance over the past 10+ years.

- Continued strengthening of governance practices will help unlock access to significant pools of North American capital.

- Increased transparency and accessibility will drive trading liquidity and market valuations of GCC companies.

Mr. Tewlow added, “The GCC is quickly moving from ‘potential’ to ‘reality’, as North American investors already see many attractive opportunities, and not only among the region’s well-known energy and financial services companies. We have never seen a more opportune time for public and private companies of the GCC to engage with foreign investors, particularly those that can become core long-term shareholders that support a company’s market valuation and capital raises.”

InspIR Connect will reveal the survey’s other key findings in Abu Dhabi at the 2024 MEIRA Annual Conference, the largest investor relations conference in the Middle East. Through its sponsorship of the event, InspIR Connect is officially launching its unique investor engagement solution in the region. The service is available to listed companies seeking to diversify their shareholder base and attract new, quality investors from North America. It is also available to the region’s private companies ahead of IPOs or other transactions.

InspIR Connect is part of InspIR Group (InspIR), the leading cross-border strategic investor relations and sustainability consultancy in the Americas for public and private companies. Monique Skruzny, CEO of InspIR, commented, “InspIR Connect offers companies an opportunity to tap into vast new pools of capital as well as develop long-lasting investor relationships that are aligned with their strategic long-term goals. Working exclusively on behalf of the corporate client, we serve as independent and principled advisors, leveraging our deep and extensive institutional relationships to introduce companies to quality investors that will improve and diversify shareholder composition and, thus, market valuation.”

About InspIR Connect

InspIR Connect empowers Emerging Market companies to improve their shareholder base by strategically matching them with investors, leading to improved valuation. Leveraging deep relationships with North American institutional investors, InspIR Connect provides direct access to investors that are appropriate for the client company, fostering meaningful engagement and long-term partnerships.

About InspIR Group

Headquartered in New York City, InspIR is a leading strategic IR and Sustainability consultancy in the Americas advising global- often high-growth- companies at all stages of development, from early stage through post-IPO. InspIR elevates and redefines the value of our clients’ equity and debt Investor Relations through strategic storytelling and counsel informed by deep experience, analytics, and research. InspIR practices include IR and Debt advisory, Investor Access through InspIR Connect, IPO preparation, ESG Advisory, Investor Day development and Perception research.

To learn more, please visit www.inspirgroup.com and follow the company’s news on LinkedIn.