PHOTO

- MENA’s venture landscape in 9M2023 raised $1.4BN representing a 44% YoY retreat from 9M2022, in line with global and US venture trends

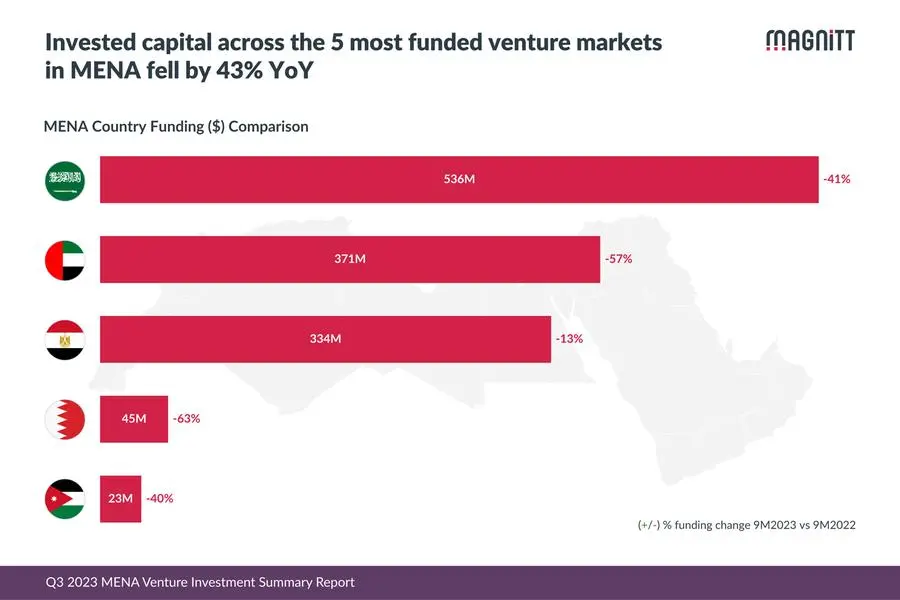

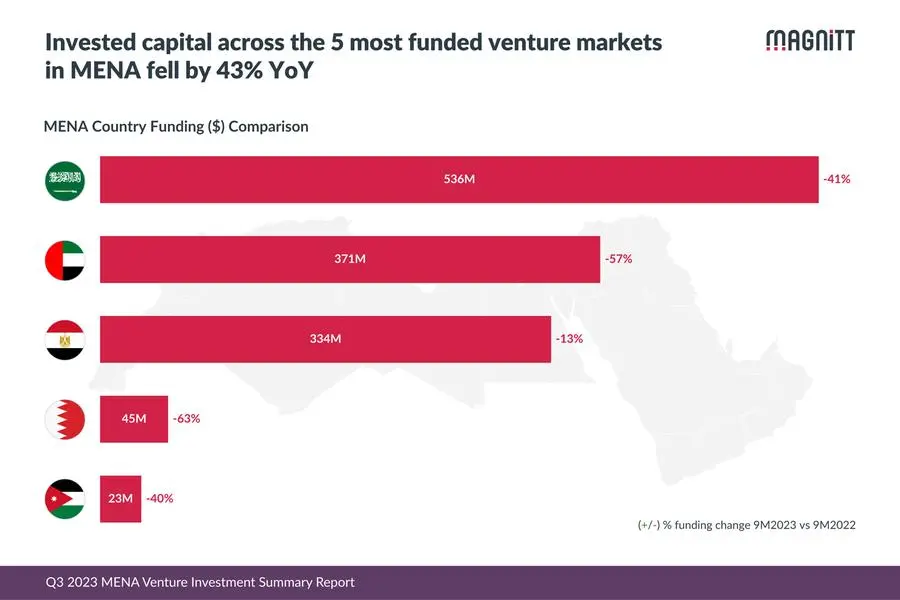

- Saudi Arabia retained its top funding rank, raising $536M in 9M2023, while the UAE retained its top deal rank by recording the most number of transactions (93) in MENA

- Despite FinTech and E-commerce maintaining their top positions, MENA’s top five industries saw a 50% drop in total number of deals this year compared to 9M 2022

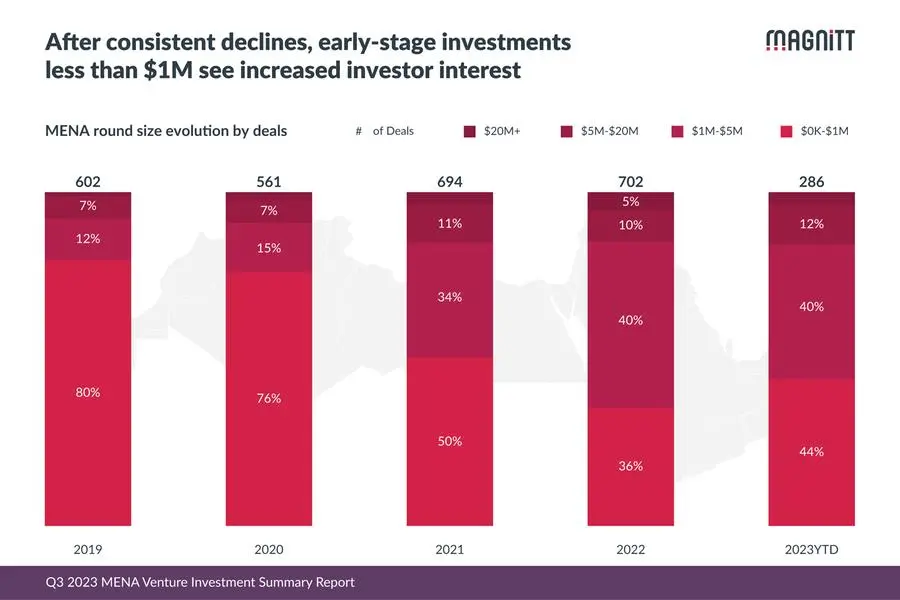

- After years of consistent declines, Early Stage investments of less than $1M saw an increased appetite from investors, up by 8p.p. compared to FY2022

Dubai, UAE — MAGNiTT, the leading venture capital data platform for emerging markets, releases its Q3 2023 MENA Venture Investment Summary. This report provides an update on how the latest investment trends have evolved across the Middle East and North Africa (MENA) in the first 9 months of 2023.

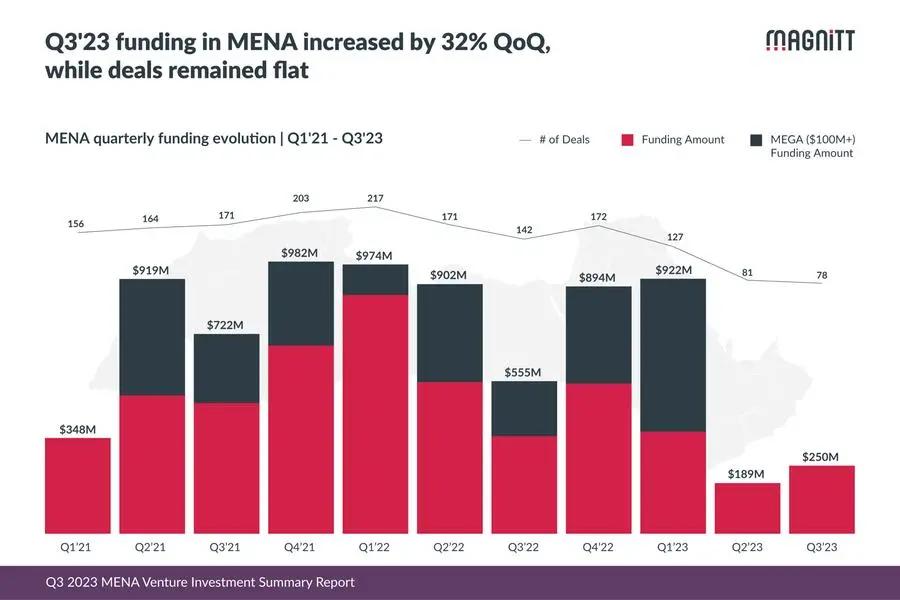

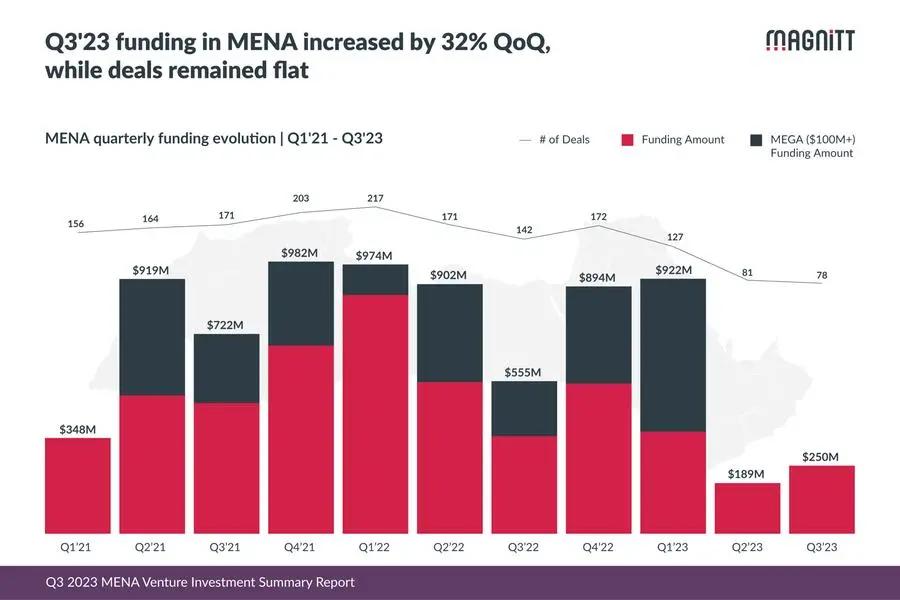

According to the latest release, MENA venture funding in Q3 saw $250M raised across 78 deals. The funding levels have seen an uptick of 32% when compared to Q2’23, while the number of deals has largely remained flat.

This contributed on aggregate to the first nine months of 2023 reaching $1.4BN, down by 44% from the first nine months of 2022. The $1.4BN was raised through 286 transactions, which was represented by a 46% decline from last year. These numbers are in line with the global figures, as global venture funding witnessed a 42% YoY decline*.

A trend highlighted in this report is after years of consistent declines, Early-Stage investments of less than $1M saw an increased appetite from investors. In 2023, 44% of all deals were attributed to investments between $0K-$1M round size bracket. To put this into perspective, in 2019, around 80% of all investments fell into this bracket, and this number shrunk to 36% in 2022. The 44% figure in 2023 has been driven by the cautious investor sentiment favoring a shift to smaller-sized deals in the first three quarters of this year.

This has also been reflected in valuation trends for the region. Early-stage SEED rounds in the MENA region have seen a 28% rise in average valuations in 2023YTD – the only stage to see growth in their mean and median valuations where activity has remained stable. This too is also in line with global trends where investors see a lower risk in early-stage investments versus late-stage counterparts.

Philip Bahoshy, CEO at MAGNiTT, comments: “While we saw a 32% QoQ incline in funding levels, this was against the backdrop of a record low figure in Q2 dating back to 2019. Investment activity has remained flat with investors focusing on early-stage bets. On the positive side, we have seen multiple fund announcements. In MENA, UAE’s Chimera Capital and Aliph Capital have launched new funds, and in KSA IMPACT46 and KAUST have raised funds to deploy in local startups. What we’ll be keenly tracking is the pace at which this dry powder translates into investments. In fact, investment activity in Q4’23 will be a good indicator of the strength of 2024's VC landscape.”

When comparing the funding activities across the countries in the region, Saudi Arabia has seen the most deployed capital, reporting a 172% QoQ incline, and UAE ranks second showcasing a 55% incline. By the number of transactions, UAE has seen the most activity capturing a third of all deals closed in MENA for the first nine months of 2023, despite a 30% YoY drop. Only Morocco, in the top 5 countries by transactions, could boast a YoY incline of 27% in the number of transactions closed. And the sharpest decline was observed in Egypt, which saw a 70% retreat in the number of transactions compared to last year.

While the report indicates a more positive shift in invested capital Bahoshy highlights that it is still early to predict when a recovery will take place. "Historically the summer has always been a slower-paced investment cycle in MENA. Q3 is the second quarter where no mega deal investments have taken place, which is a key indicator of late-stage activity and funding growth. Meanwhile, MAGNiTT continues to monitor investment activity and provides insights and predictions against the backdrop of global macroeconomic and regional market volatility."

MAGNiTT’s ‘Q3 2023 MENA Venture Investment Summary’ highlights many such figures and leading players from the Middle East and North Africa. The report is now available to download for free here.

*Global venture data sourced from Crunchbase.

For press inquiries please contact: press@magnitt.com

About MAGNiTT:

Headquartered in the Dubai International Financial Centre, MAGNiTT is the largest verified investment data platform for investors, entrepreneurs, corporations, governments, and the wider venture capital industry in the Middle East, Africa, Pakistan, and Turkey. Through its dynamic analytics platform delivering real-time information on over 25,000 private companies and 7,000 investment firms across 65 countries – including funding history – MAGNiTT enables investors, corporations, Big Tech companies, and government entities to make informed, data-driven decisions that help deliver real-world impact and better value for all sides of the investment equation.

For more information about MAGNiTT: https://magnitt.com

Sign up for our latest webinar on 26th Oct: The State of Venture Capital in Q3 2023