PHOTO

Kuwait: Brookfield Asset Management Limited (Brookfield) leads the top GCC M&A transactions during Q1 2024 as per a report recently issued by the Investment Banking Department at Kuwait Financial Centre “Markaz”. The report highlights the USD 2.0 billion transaction that was announced by the Canadian investment firm, highlighting that they are exploring the acquisition of a majority stake in UAE-based GEMS Education from CVC Capital Partners.

In the second position, LyondellBassell Industries Holding B.V. (LyondellBassell) secured the second-largest transaction by signing an agreement to acquire a 35% stake in Saudi-based National Petroleum Industrial Company (NATPET) from Alujain Corporation, valued at USD 498.2 million. National Corporation for Tourism & Hotels (NCTH) took on the following transaction, penning a proposal to Alpha Dhabi Holding expressing its interest in acquiring 100% of ADH Hospitality RSC Limited, Murban (BVI) Holding Inc and Hill View Resorts (Seychelles) Limited by way of a share swap, where NCTH will issue 1.3 billion shares at par value of AED 1.0 per share, implying a transaction value of USD 248.8 million. Moreover, following the successful acquisition of a 46% stake in Gulf Insurance Group, Fairfax (Barbados) International Corporation (Fairfax) has issued a mandatory tender offer to acquire the remaining 10% not owned by Fairfax or any related party for KD 1.9 per share, implying a transaction value of up to USD 179.2 million. Lastly, Gulf Islamic Investments aims to expand its footprint in the Saudi Arabian healthcare market by acquiring a majority stake in Abeer Medical Company for an estimated USD 159.8 million.

GCC M&A Decline

According to Markaz’s report, the GCC market sealed a total of 48 closed transactions throughout Q1 2024, which implies a decline of 13% year over year. United Arab Emirates claimed the lion’s share with 21 closed transactions, followed by Saudi Arabia, closing a total of 20 transactions. Apart from Saudi Arabia, all other markets in the region remained stable or saw a decline in their M&A activities.

Acquirers and Targets

Consistent with historical trends, the majority of transactions completed in Q1 of both 2024 and 2023 were carried out by acquirers from the GCC. Specifically, during the first quarter of 2024, GCC acquirers took the lead, being responsible for a substantial 65% of the total completed transactions, leaving foreign acquirers with a 33% share. Note, the remaining 2% represents transactions for which the buyer information was not available. GCC acquirers also dominated the market during the first quarter of 2023 as they accounted for 76% of the total number of closed transactions with foreign counterparts contributing a noteworthy 24%.

Furthermore, GCC acquirers primarily invested in companies within their local markets and in international markets, and targeted regional companies to a lesser extent. Throughout Q1 2024, GCC acquirers closed a total of 31 transactions within their local markets, compared to 42 transactions in Q1 2024. In addition, GCC acquirers sealed 23 cross-border transactions throughout Q1 2024, relative to 26 cross-border transactions in Q1 2023. It's noteworthy that UAE buyers spearheaded the cross-border activity, representing approximately 65% of the total number of closed cross-border transactions, while Bahrain and Kuwait followed, contributing 13% and 9%, respectively.

Foreign Buyers

Shifting focus, it is worth mentioning that GCC targets experienced an increase in foreign buyer interest during this period. They concluded a total of 16 transactions, which was higher than the 13 transactions in the preceding year, marking a 23% year-over-year increase. Notably, UAE targets continued to be the prime attraction for foreign buyers, who sealed 10 transactions involving Emirati targets in the first quarter of 2024.

Sectorial View

Moreover, the deals concluded in Q1 2024 were directed towards companies spanning diverse sectors, emphasizing a consistent trend observed in recent quarters. That said, the , Consumer Staples, Industrials and Information Technology sectors stood out as the most active, collectively accounting for 42% of the transactions completed during this period.

Deals in the Pipeline

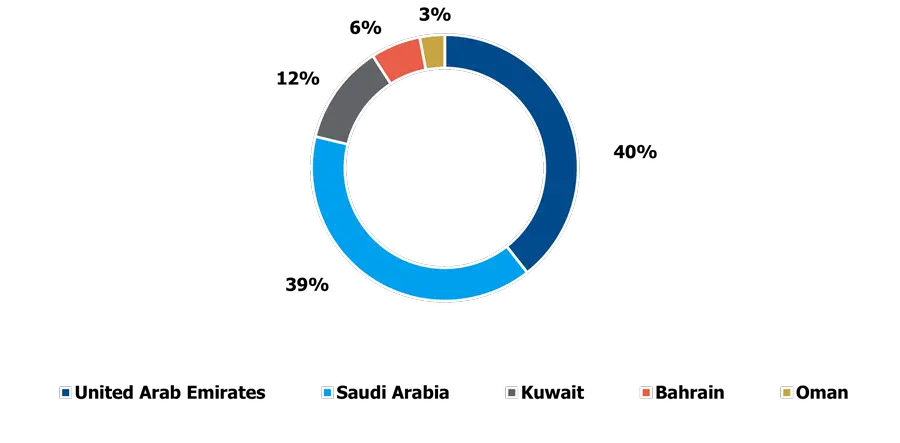

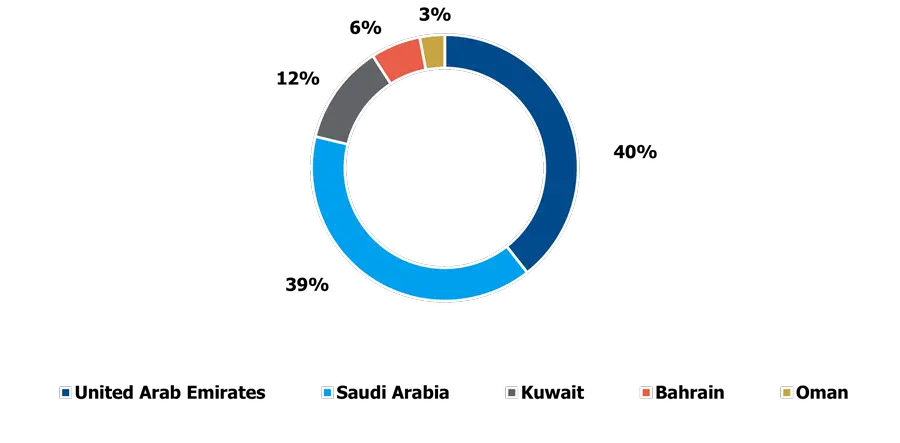

By the end of Q1 2024, there were a total of 33 announced transactions in the pipeline, marking a substantial increase compared to Q1 2023, which ended with 22 transactions in the pipeline. The majority of these transactions involved United Arab Emirates and Saudi Arabia targets, who each accounted for 39% of the total number of announced deals, followed by Kuwait, Bahrain, and Oman at 12%, 6%, and 3% respectively. Apart from Kuwait and Oman, all the other markets experienced an increase in activity compared to the same period in 2023, noting that Qatar had no announced transactions in the pipeline for both periods.

Top 5 M&A Deals by Reported Value* – Q1 2024

| Target Company | Target Country | Buyer | Buyer Country | Percent Sought | Deal Value (USDmn) | Status |

| GEMS Education | United Arab Emirates | Brookfield Asset Management Limited | Canada | - | 2,000 | Announced |

| National Petrochemical Industrial Company | Saudi Arabia | LyondellBassell Industries Holding B.V. | United States | 35 | 498 | Announced |

| ADH Hospitality RSC Limited; Hill View Resorts (Seychelles) Limited | United Arab Emirates | National Corporation for Tourism and Hotels | United Arab Emirates | 100 | 249* | Announced |

| Gulf Insurance Group K.S.C.P. | Kuwait | Fairfax (Barbados) International Corporation | Canada | 10 | 179 | Announced |

| Abeer Medical Company | Saudi Arabia | Gulf Islamic Investments | United Arab Emirates | - | 160 | Announced |

Source: S&P Capital IQ, GCC Stock Exchanges, Local Newspapers, Reuters, Markaz Analysis. These transactions were selected based on available information.

* The transaction value is an estimate and was calculated based on the following assumptions: (1) The buyer intends to issue 1.3 billion shares and (2) The shares are expected to be issued at a price of AED 1.0 per share.

Number of Closed GCC M&A Transactions*

| Country | Q1 2024 | Q1 2023 | % Change (YoY) |

| Bahrain | 1 | 1 | - |

| Kuwait | 4 | 4 | - |

| Oman | 1 | 4 | -75% |

| Qatar | 1 | 3 | -67% |

| Saudi Arabia | 20 | 10 | 100% |

| United Arab Emirates | 21 | 33 | -36% |

| Total | 48 | 55 | -13% |

Source: S&P Capital IQ, GCC Stock Exchanges, Local Newspapers, Markaz Analysis

Classification of Deals by Sector – Q1 2024

| Sector | Foreign | GCC | Other* | Total | %** |

| Information Technology | 2 | 5 | 1 | 8 | 17% |

| Consumer Staples | 1 | 5 | 0 | 6 | 13% |

| Industrials | 1 | 5 | 0 | 6 | 13% |

| Consumer Discretionary | 1 | 4 | 0 | 5 | 10% |

| Media & Entertainment | 3 | 2 | 0 | 5 | 10% |

| Materials | 0 | 3 | 0 | 3 | 6% |

| Financials | 1 | 1 | 0 | 2 | 4% |

| Insurance | 1 | 1 | 0 | 2 | 4% |

| Real Estate | 1 | 1 | 0 | 2 | 4% |

| Education | 1 | 1 | 0 | 2 | 4% |

| Energy | 2 | 0 | 0 | 2 | 4% |

| Professional Services | 1 | 1 | 0 | 2 | 4% |

| Logistics | 0 | 1 | 0 | 1 | 2% |

| Utilities | 0 | 1 | 0 | 1 | 2% |

| Hospitality | 1 | 0 | 0 | 1 | 2% |

| Total | 16 | 31 | 1 | 48 | 100% |

* Other refers to deals where buyer information is not available

**Totals may exceed 100% due to rounding.

Geographical Distribution by Number of Announced Pipeline Transaction

# END #

About Kuwait Financial Centre “Markaz”

Established in 1974, Kuwait Financial Centre K.P.S.C “Markaz” is one of the leading asset management and investment banking institutions in the MENA region with total assets under management of over KD 1.30 billion as of 31 March 2024. Over the years, Markaz has pioneered innovation through developing new concepts resulting in creation of new investment channels. These channels enjoy unique characteristics, and helped Markaz widen investors’ horizons. Examples include Mumtaz (the first domestic mutual fund), MREF (the first real estate investment fund) and Forsa Financial Fund (the first and only options market maker in the GCC since 2005), all conceptualized, established and managed by Markaz. Markaz was listed on the Boursa Kuwait in 1997.

For further information, please contact:

Sondos S. Saad

Media & Communications Department

Kuwait Financial Centre K.P.S.C. "Markaz"

Email: ssaad@markaz.com