PHOTO

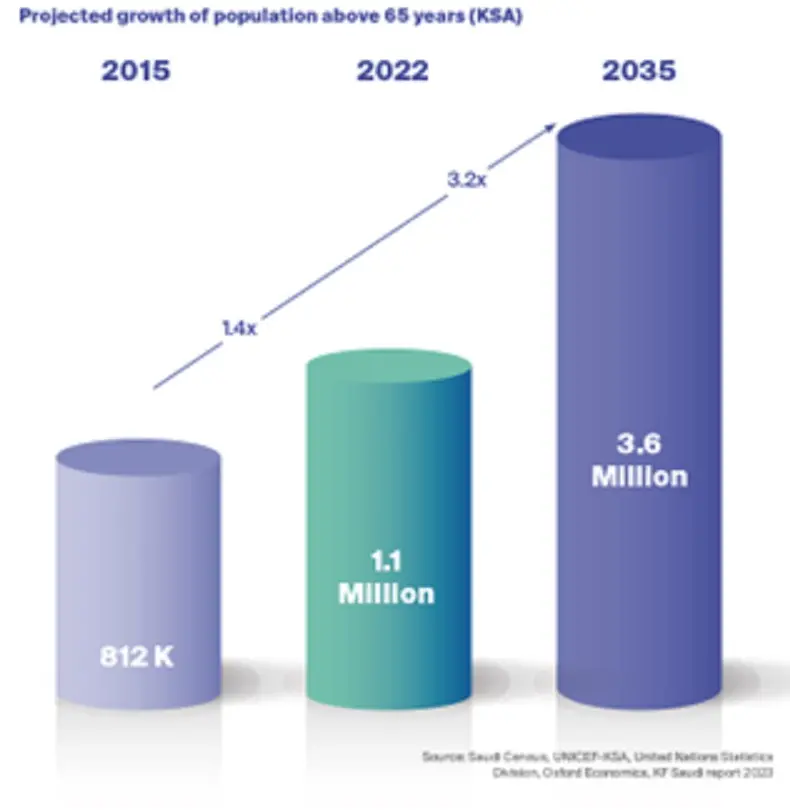

Saudi Arabia – The Kingdom is expected to witness a significant surge in its ageing population, projected to grow from 1.11 million in 2022 to 3.58 million by 2035 according to Knight Frank's latest publication by the Healthcare advisory, “Golden Years & Real Estate - The Untapped Senior Living Market, 2023.

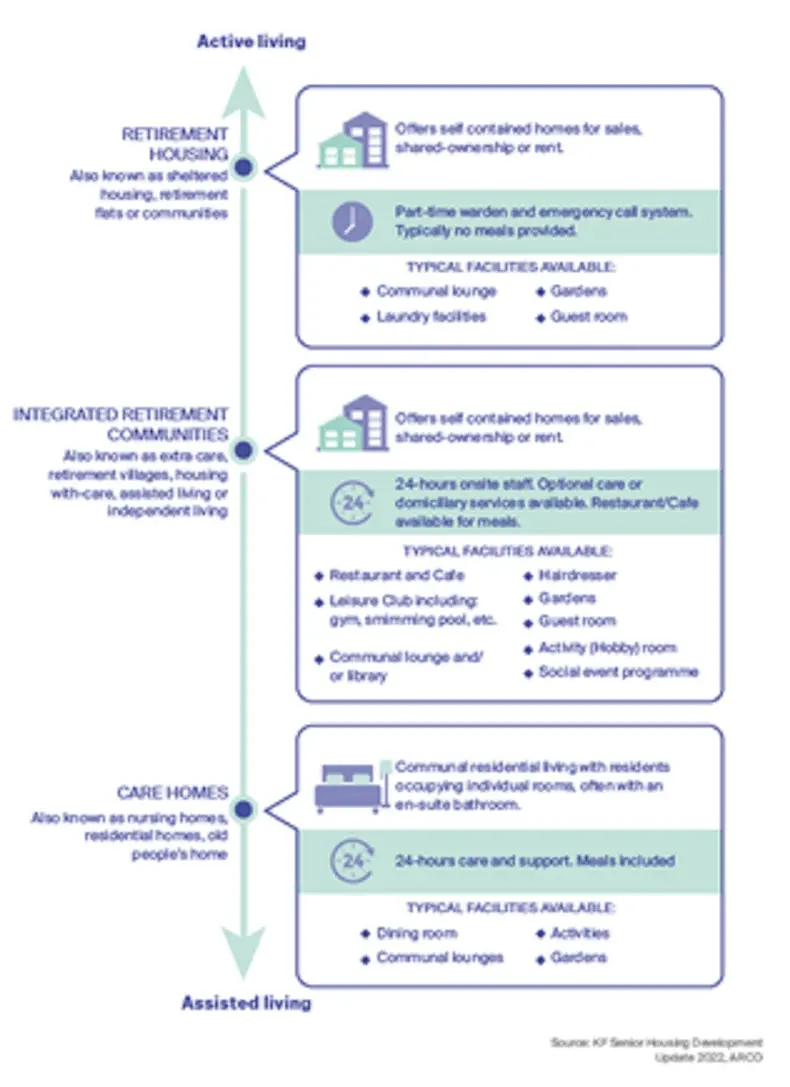

With senior individuals transitioning into their retirement years, there is a discernible shift in housing preferences, accompanied by lifestyle modifications. This emerging trend, known as retirement living, seeks to provide a comfortable and seamless transition for individuals aged 65 and above, moving from regular housing to facilities offering essential support.

A recent survey conducted by Knight Frank, involving 1,014 Saudi national households, reveals that approximately 43% of respondents currently reside outside their hometowns due to job-related migration to cities such as Riyadh and Jeddah. This would classify the parents who are left behind in their home cities as “empty nesters,” this highlights the growing demand for physical, mental, and social support as these individuals age.

Shehzad Jamal, Partner – Strategy & Consulting, MEA elaborates: "We are witnessing a global shift towards retirement living unfolding, offering a potential solution for Saudi Arabia’s ageing population as young professionals are being attracted to the key cities and new cities for improved economic prospects. However, education and awareness is required to highlight the benefits and convenience offered by such concepts for senior citizens.”

The publication underscores the importance of two primary retirement living offerings: Active Living and Assisted Living. Active Living encourages active engagement and includes specialized nursing centres with varying levels of care and services. Currently, the prevailing trend in Saudi Arabia leans predominantly toward long-term care facilities.

Dr. Gireesh Kumar, Associate Partner – Strategy & Consulting, Healthcare, MEA explains: "Assisted Living addresses the unique needs of senior citizens in Saudi Arabia, requiring support with day-to-day house chores or medical support in the form of continuous care or remote monitoring. This will also reduce the burden on an already overburdened healthcare system and reduce the demand for long term care beds in Saudi Arabia. Research suggests that such facilities in the United Kingdom have been instrumental in reducing the cost on the NHS by 38%.”

Shifting our focus to key demand drivers, the demand for retirement services and housing in Saudi Arabia is propelled by several critical factors. These include increasing life expectancy, a growing aging population, and shifts in social dynamics. According to Knight Frank's analysis, Saudi Arabia's demographic shift towards an aging population above the age of 65 is expected to grow by 3.2 times over the next decade, resulting in a dependency ratio of five seniors for every 100 persons in the workforce by 2050.

Additionally, the rise in Ultra High Net Worth Individuals (UHNWIs) and High Net Worth Individuals (HNWIs) contributes to the escalating demand, as they have the capacity to invest in retirement communities for their post-retirement years.

Echoing on this shift, Dr. Gireesh Kumar further states: “The population of HNWIs and UHNWIs in Saudi Arabia is anticipated to grow up to 185,000 HNWIs and 1,000 UHNWIs by 2027 according to the Wealth Report Series by Knight Frank, making this segment a significant contributor to the demand for senior living options. In addition, the number of households on Saudi Arabia with an annual income of USD 200,000 is also expected to increase from 141,000 to 175,000 between 2022 and 2035 respectively, which further bolsters this demand.”

The rising demand for retirement services and housing in Saudi Arabia has piqued the interest of significant investors, government authorities, and senior stakeholders. Collaborative ventures with established healthcare operators offer families a sense of assurance, as they can trust that their elderly family members are in capable hands and have access to essential services, such as healthcare and housekeeping. Residents benefit from this

necessary support without experiencing the clinical atmosphere of a medical facility, while developers also find advantages in bypassing the intricate approvals typically associated with healthcare facility operations.

Key Highlights:

Demand for retirement services and housing in KSA will be driven by:

- Demographic shift towards ageing population above the age of 65 years which is expected to grow by 3.2X over the next decade.

- This demographic shift is expected to create a dependency ratio of 5 seniors dependent on every 100 persons in the work force by 2050.

- Based on a residential survey of 1,000+ Saudi National Households 43% of the respondents reside outside of their hometowns due to their jobs in cities like Jeddah and Riyadh. This will create the need for various retirement housing and related services to support the parents of these migrants who are residing in their hometowns.

Opportunities:

- Such concepts should be integrated in larger communities.

- Locations that are tourist friendly (religious or otherwise) can be considered as spots for retirement, this would result in attracting an international audience as well.

Ties with established healthcare operators is a key to success:

- Reassurance for families, knowing their loved ones are in safe hands and have access to essential services including healthcare and housekeeping.

- Residents are ensured they have the necessary support and do not feel they are part of a medical setting.

- The developers do not have to invest and obtain approvals to be a healthcare facility as they will have the support through the collaboration.

About Knight Frank:

Knight Frank LLP is the leading independent global property consultancy. Headquartered in London, the Knight Frank network has 487 offices across 53 territories and more than 20,000 people The Group advises clients ranging from individual owners and buyers to major developers, investors, and corporate tenants. For further information about the Firm, please visit www.knightfrank.com.

In the MENA region, we have strategically positioned offices in key countries such as the United Arab Emirates, Saudi Arabia, Bahrain, Qatar, and Egypt. For the past 13 years, we have been offering integrated residential and commercial real estate services, including transactional support, consultancy, and management.

Understanding the unique intricacies of local markets is at the core of what we do, we blend this understanding with our global resources to provide you with tailored solutions that meet your specific needs. At Knight Frank, excellence, innovation, and a genuine focus on our clients drive everything we do. We are not just consultants; we are trusted partners in property ready to support you on your real estate journey, no matter the scale of your endeavour.

Let's connect socially - find us on LinkedIn, Instagram, and Twitter. For more information and to explore how we can be your partners in property, please visit our website at https://www.knightfrank.ae/property-development/healthcare-development-and-consultancy

For all Media and PR inquiries, please contact:

Roksar Kamal, Press Manager

Roksar.kamal@me.knightfrank.com