PHOTO

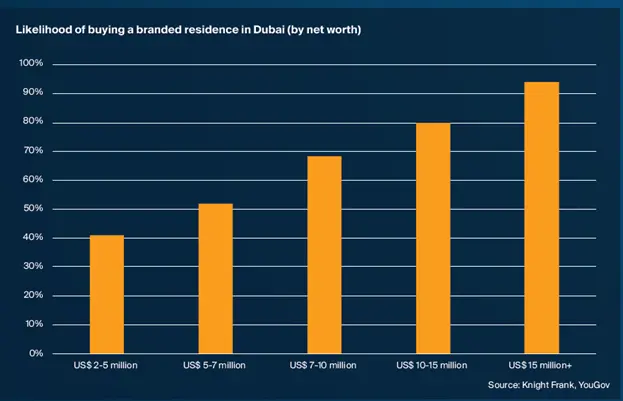

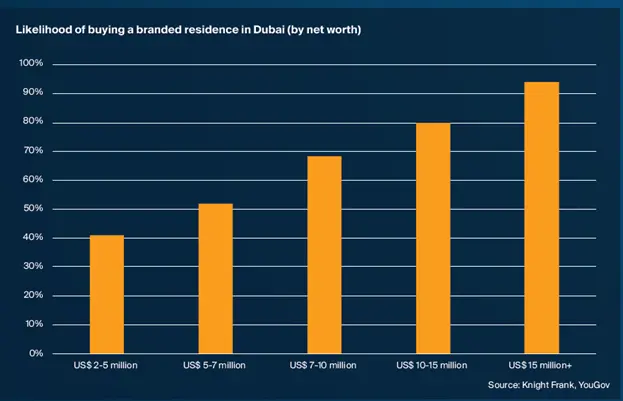

Dubai: 69% of global HNWI are interested in owning a branded residential property in Dubai, up from 59% in 2023, according to global property consultancy, Knight Frank’s second annual 2024 Destination Dubai report.

Knight Frank has surveyed 317 high-net-worth-individuals (HNWI) – 217 around the world and 100 GCC-based HNWI expats – to gain an understanding of their attitudes, appetite and aspirations when it comes to investing in real estate in Dubai. Collectively, the HNWI respondents have a net worth of US$ 5.4bn and own 1,149 homes around the world between them.

The desire to purchase a branded residence in the emirate is higher amongst non-GCC-based HNWI at 83%, compared to GCC-based HNWI expats (46%).

Lars Jung-Larsen, Partner – Luxury Brands, MENA said, “Branded residences offer access to a luxury lifestyle that is now synonymous with Dubai and luxury branded residential operators such as the Ritz Carlton, Bulgari, Dorchester Collection, and the Four Seasons are all moving to capitalise on the demand for high end homes in Dubai. The depth of demand for such homes is reflected in the achievement of a record AED 16,283 per square foot for a 6-bedroom Bulgari Ocean villa in the summer of 2022”.

NESTING

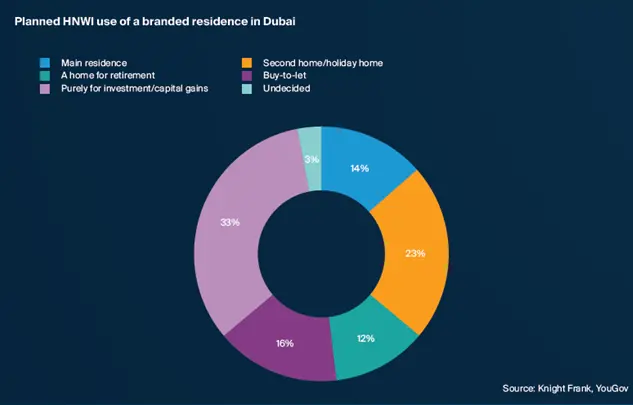

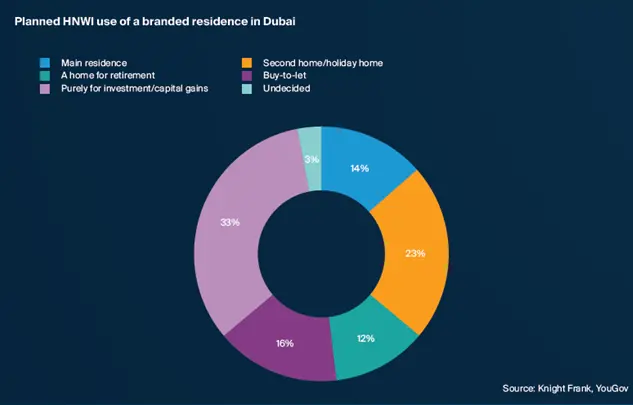

Knight Frank says one of the key defining features of the emirate’s third freehold residential market cycle has been the increase in the number of purchases by genuine end users, or those looking for a second home, or holiday home. And this trend is playing out in the city’s branded residential market as well.

Faisal Durrani, Partner – Head of Research, MENA, explained: “14% of HNWI would like to secure a branded residence as their main home and this figure rises to 22% amongst those with a net worth of over US$ 15 million would like a branded residence in Dubai to use as their primary home. This mirrors our findings amongst the ultra-high-net-worth-community who appear to have a particular penchant for purchasing Dubai’s most expensive homes and turning the city into one of their many global bases.

“Indeed, 23% of HNWI would use a branded residential purchase in Dubai as a holiday home, or second home, while 12% would treat it as a retirement home”.

HIGH EXPECTATIONS

According to Knight Frank, just over a third (36%) of HNWI believe that any branded residential purchase in Dubai will appreciate in value by 5-10% during the first year of acquisition. This expectation is highest amongst those with a net worth of US$ 10-15 million (50%). A further 30% of GCC-based HNWI expats and global HNWI expect prices for any branded residential purchase will rise by 10-15% within 12 months.

Durrani continued: “The expectation amongst the HNWI community for strong price appreciation of branded residences is likely linked to the fact that branded residences traded for a premium of 86% when compared to the rest of the market, compared to a global average of a 30% premium.”

Knight Frank says that this premium pricing is justified by the additional features that come with these properties: security; facilities; services; quality assurance provided by the brand; the ease of placing the property into a rental pool; and finally, the “lock up and leave” nature of a well-managed property. However, this premium is not guaranteed, and developers need to work hard to justify its existence, especially with the increasing competition in this segment.

Jung-Larsen added: “The feeling of “owning a part of a hotel” having full access to the amenities and hospitality of the hotel, but in your own private environment is what really sets branded residences apart for the ultra-rich. The next point of differentiation of a residential property could be the branding by a non-hospitality brand. This would typically be a brand from fashion, jewellery or automotive segments. The exciting thing about this format is that buyers of non-hospitality branded residences are able to ‘live the brand’ 24/7 with the furniture and decor designed by the brand, with exciting amenities and hospitality partnerships which would be in the same positioning of the brand, and also includes tailormade services and members-only benefits”.

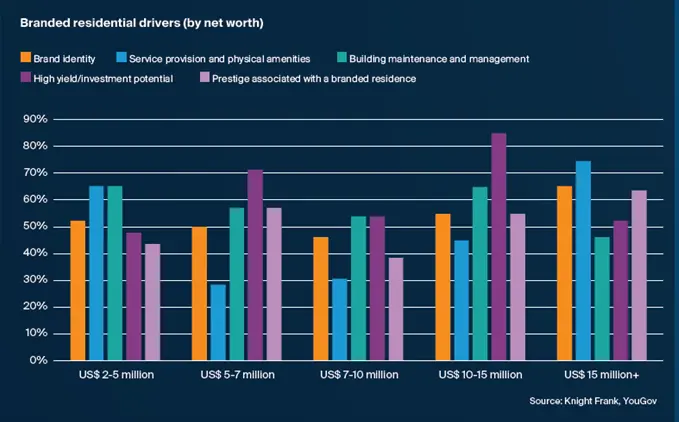

For those with a net worth of over US$ 15 million, ‘service provision and physical amenities’ (75%) is the most critical factor, closely followed by ‘brand identity’ (63%), according to Knight Frank’s analysis.

BIG SPENDERS

Shehzad Jamal, Partner – Strategy & Consultancy, MEA, explained: “Branded residences represent a relatively easy way to access the ‘Dubai Life’ and are more often than not accompanied by access to world-class facilities and amenities, usually courtesy of an adjoining luxe hotel. Owners also have the added benefit of being able to take advantage of world-class facilities and property management, which is crucial for those that do not reside in Dubai and want assurances that their asset is being treated with the utmost of care”.

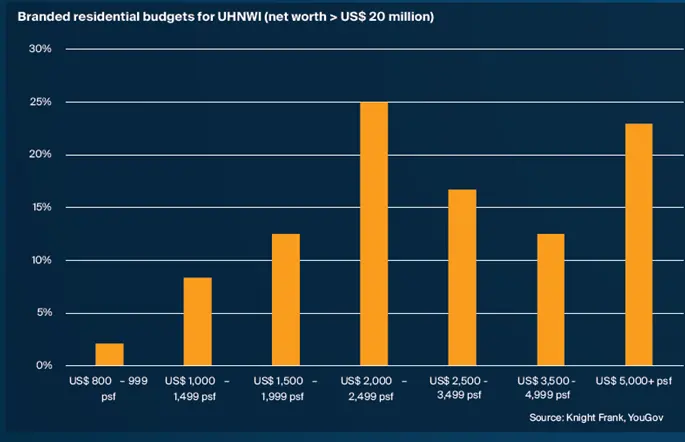

Knight Frank has found that the bulk of GCC-based expat HNWI appear to want to spend relatively low amounts on branded residential real estate in Dubai. In fact, 91% of this group want to spend between US$ 600-999 psf on a branded residential property in Dubai. The average budget for this group stands just shy of US$ 950 psf. In contrast, global HNWI are more likely to splash out on a branded home in the emirate, with nearly a fifth (17%) ready to spend over US$ 5,000 psf. This figure rises to 23% for those with a personal value of more than US$ 20 million.

-Ends-

About Knight Frank:

Knight Frank LLP is the leading independent global property consultancy. Headquartered in London, the Knight Frank network has 487 offices across 53 territories and more than 20,000 people The Group advises clients ranging from individual owners and buyers to major developers, investors, and corporate tenants. For further information about the Firm, please visit www.knightfrank.com.

In the MENA region, we have strategically positioned offices in key countries such as the United Arab Emirates, Saudi Arabia, Bahrain, Qatar, and Egypt. For the past 13 years, we have been offering integrated residential and commercial real estate services, including transactional support, consultancy, and management.

Understanding the unique intricacies of local markets is at the core of what we do, we blend this understanding with our global resources to provide you with tailored solutions that meet your specific needs. At Knight Frank, excellence, innovation, and a genuine focus on our clients drive everything we do. We are not just consultants; we are trusted partners in property ready to support you on your real estate journey, no matter the scale of your endeavour.

For all Media and PR inquiries, please contact:

Roksar Kamal, PR and Communications Manager

Roksar.kamal@me.knightfrank.com

Let's connect socially - find us on LinkedIn, Instagram, and Twitter. For more information and to explore how we can be your partners in property, please visit our website at https://www.knightfrank.ae.